Press Releases

Cox Automotive October Forecast: New-Vehicle Inventory Levels Are Improving, But Sales Remain Low

Tuesday October 25, 2022

Article Highlights

- Sales volume in October is expected to hit 1.11 million units, an increase of 4.4% from one year ago but a decline of 1.3% from last month.

- October’s new-vehicle sales pace is forecast to finish near 14.3 million, up 0.8 million from last month’s 13.5 million pace and up from last year’s 13.2 million level.

- New-vehicle inventory levels are improving, but gains are uneven across the industry.

UPDATED, Nov. 2, 2022 – Spurred in part by improving inventory, early indications of new-vehicle sales in October suggest sales volumes will come in above the Cox Automotive forecast. Gains from October 2021 were all but guaranteed, as last October was a historically bad month for new-vehicle sales. But reports from Hyundai, Kia, Toyota and other Asian brands indicate total industry sales volumes may be higher than the 1.11 million – a 4% year-over-year gain – forecast last week by our Industry Insights team. Even Honda, which reported yesterday a year-over-year sales decline of 16% in October, may chalk it up as a partial success: A drop of 16% is Honda’s best monthly sales performance in 2022 by far.

Our team’s full report will be out by the end of the week, but initial estimates suggest two trends. First, while inventory is still historically tight, improving product availability is helping support higher sales volumes at some brands. Many of the October “sales” were likely deals made in August and September and delivered in October, but clearly, some of the sales backlog is being fulfilled. Results are still wildly uneven – big gains at some brands, large drops at others – but the overall trend is positive.

Secondly, despite elevated prices, demand remains relatively healthy. Higher interest rates – with more hikes to come this week – are pushing some buyers out of the market, particularly those with lower credit scores; subprime and deep subprime buyers have mostly been eliminated from the new-vehicle market. But the market at this point seems to have sufficient high-net-worth, high-credit-score buyers flush with cash to support growing product availability.

Inventory, as measured by days’ supply, continues to increase slowly. And some segments – full-size pickups, for one – are mostly back to “normal.” But demand, as measured by transaction prices and incentives, is NOT collapsing. Some brands are upping incentives and lowering prices as inventory builds, but they are the minority, not the majority. Overall, it now appears the new-vehicle sales pace in October was the strongest since January. That’s good news for the auto industry. We’ve been expecting some softening in overall demand but not a full collapse. Looking at the initial October new-vehicle sales results, that’s exactly what we see.

ATLANTA, Oct. 25, 2022 – October U.S. auto sales, when confirmed next week, are expected to show an increased selling pace compared to last month and last year. According to the Cox Automotive forecast released today, October’s U.S. new-vehicle sales volume is expected to rise over 4% from last year and finish with 1.11 million units sold, delivering a sales pace, or seasonally adjusted annual rate (SAAR), for October of 14.3 million.

A sales pace of 14.3 million would be the fastest pace since April and a nice uptick from September’s 13.5 million level.

“This gain may sound like a treat, but it is more likely a statistical trick,” said Charlie Chesbrough, senior economist at Cox Automotive. “It seems more likely that the statistical adjustments made to reflect an additional selling day are lifting the SAAR rather than a noticeable uptick in sales across the marketplace.”

Sales Pace Likely Reflecting Improved New-Vehicle Inventory Levels

In terms of volume, October is expected to be very similar to every other month since August 2021 – and that is to finish with a final sales volume close to 1.11 million units. However, the new-vehicle market in October 2022 is in a better place than it was one year ago. Last October, the market suffered from a severe lack of product, with national new-vehicle inventory levels hovering close to 1 million units, and the sales pace was only 13.2 million. Inventories have improved since then, particularly over the last three months, and the recent sales pace is likely a reflection of greater product availability at some dealers.

Chesbrough notes: “The vehicle market is being supported by improving inventories and product selection for some, but not all, brands. However, rising interest rates are pushing monthly payments higher for everyone, and many potential buyers are being knocked out of the market.”

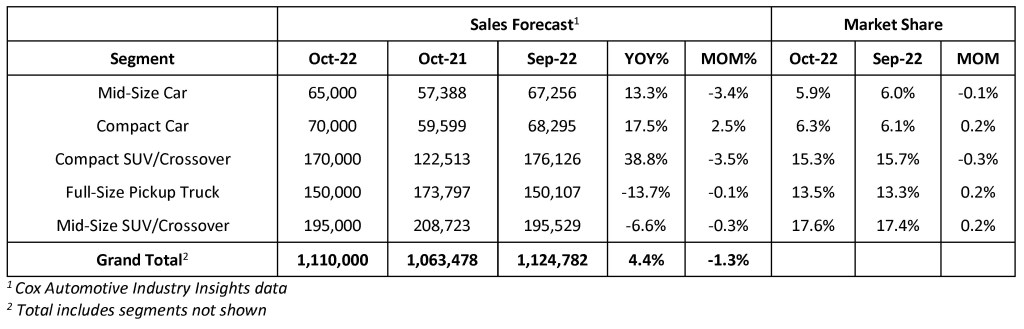

October 2022 U.S. New-Vehicle Sales Forecast Highlights

- Volume is expected to rise 4.4% from October 2021 but decline 1.3% from last month.

- The October 2022 SAAR is forecast at 14.3 million, above last year’s 13.2 million level and up from last month’s 13.5 million pace.

- October 2022 had 26 selling days, one more than September, one less than October 2021.

October 2022 U.S. New-Vehicle Sales Forecast

All percentages are based on raw volume, not daily selling rate.

About Cox Automotive

Cox Automotive Inc. makes buying, selling, owning and using vehicles easier for everyone. The global company’s more than 27,000 team members and family of brands, including Autotrader®, Dealer.com®, Dealertrack®, Kelley Blue Book®, Manheim®, NextGear Capital®, VinSolutions®, vAuto® and Xtime®, are passionate about helping millions of car shoppers, 40,000 auto dealer clients across five continents and many others throughout the automotive industry thrive for generations to come. Cox Automotive is a subsidiary of Cox Enterprises Inc., a privately-owned, Atlanta-based company with annual revenues of nearly $20 billion. www.coxautoinc.com

Media Contacts:

Mark Schirmer

734 883 6346

mark.schirmer@coxautoinc.com

Dara Hailes

470 658 0656

dara.hailes@coxautoinc.com