Data Point

CPO Sales Beat Year-Ago Levels Again in July, Remain Down 9% Overall

Monday August 17, 2020

Article Highlights

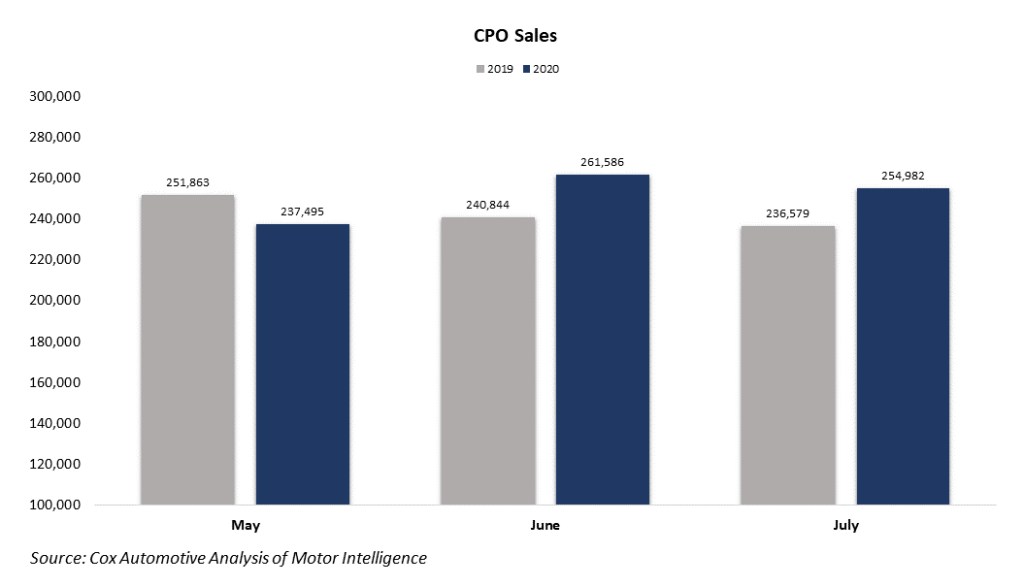

- Sales of certified pre-owned (CPO) vehicles increased 8% year over year in July and were down 3% month over month compared to June. For July, 254,982 CPO units were sold.

- For July, 254,982 CPO units were sold.

- Toyota, Honda and Chevy continue to be the biggest players in the CPO market, collectively representing a third of all CPO sales.

Sales of certified pre-owned (CPO) vehicles increased 8% year over year in July but were down 3% month over month compared to June. For July, 254,982 CPO units were sold.

CPO sales were on a record-setting pace the first two months of the year before COVID-19 put the brakes on auto sales. Reflecting huge decreases in March and April, CPO sales are down 9% year to date versus the same time in 2019. In the first seven months of 2020, the CPO market is more than 185,000 units below last year, which finished at 1,553,901 units sold. The 2020 Cox Automotive CPO sales forecast, which is subject to change, is 2.5 million units, down from 2.8 million sold in 2019.

For July, Toyota, Honda and Chevy continue to be the biggest players in the CPO market, collectively representing a third of all CPO sales. Those three plus Ford and Nissan account for 45% of CPO sales so far in 2020. Last year, Toyota, Honda and Chevy accounted for 32% of the total industry CPO sales reflecting that brands are maintaining consistent CPO sales share this year compared to 2019.

Relatively strong CPO sales in July were part of a larger recovery of the overall used-vehicle market. According to Cox Automotive estimates, total used vehicle sales volume was down 4% year over year in July. We estimate the July used SAAR to be 38.0 million, down from 39.7 million last July but up from June’s 36 million rate. The July used retail SAAR estimate is 20.4 million, down from 20.8 million last year but up month over month from June’s 18.9 million rate.