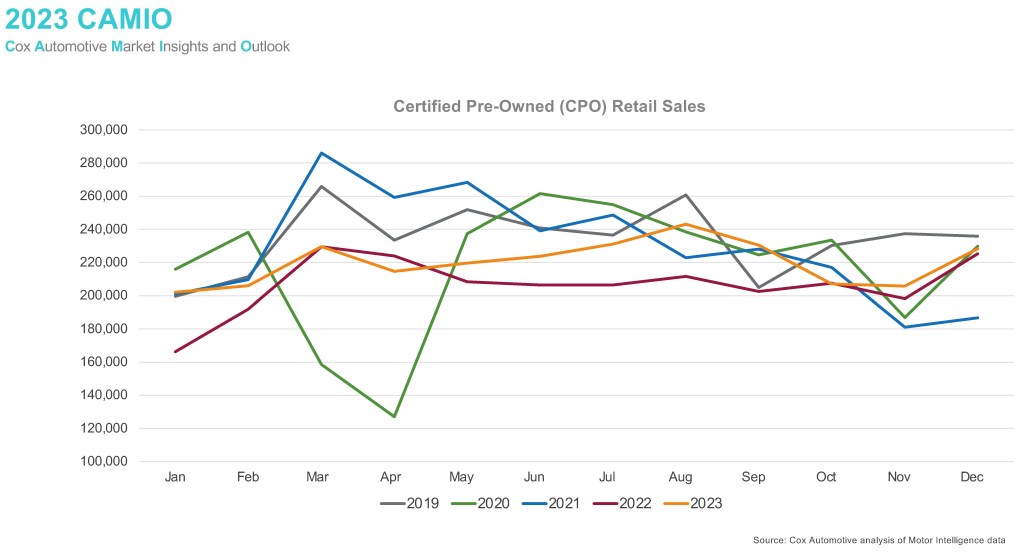

Takeaway: Certified pre-owned (CPO) outperformed the overall used-vehicle market. Full-year CPO sales in 2023 exceeded 2.6 million units, up 6.6% compared to 2022. Luxury helped move the needle, registering over 24% of all CPO sales (well above the new-vehicle luxury share of approximately 18%.)

What’s next: In 2024, CPO will likely remain strong despite being constrained by limited volumes of younger vehicles. The used-vehicle market is beginning a multi-year recovery from low new-vehicle sales following the pandemic but is still being held back by limited supply and affordability issues. CPO sales in 2024 are expected to reach 2.7 million units, up 3% from 2023. Limited production between 2020 and 2022 has led to a scarcity of prime, available CPO products despite relatively strong CPO demand.