Our Brands

Power your business forward with the #1 marketplace for better leads and higher profits. Sell more vehicles and expand your reach with Autotrader’s personalized car-shopping experience.

Related Solutions:

Take control with the country’s largest self-managed auto transportation marketplace. So you can confidently find the ideal partner for any job, and run your business the way you need to.

Related Solutions:

When trucks stop, business stops. Fleets can’t afford downtime — yet every day, trucks are sidelined by breakdowns, delays, and inefficiencies that ripple across supply chains nationwide. By uniting the proven strengths of FleetNet and Fleet Services, Cox Fleet creates a single, nationwide force dedicated to one mission: keeping fleets moving—every mile.

Related Solutions:

Quality leads & higher profits start with better websites. Get proven results with the automotive industry’s most comprehensive digital marketing agency.

Related Solutions:

Dealertrack provides a suite of connected solutions for managing your dealership and your F&I and titling processes to help improve profitability and customer satisfaction—all backed by the power of Cox Automotive.

Related Solutions:

EV Battery Solutions delivers end-to-end EV battery support—from management to valuation—backed by Cox Automotive’s full spectrum of car buying, ownership, and service solutions. Together, we’re your complete partner in driving the electric future.

Related Solutions:

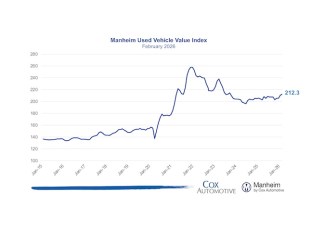

For over 80 years, we’ve had one goal: making you more successful.

That’s why everything we do empowers you to max your potential with options to wholesale your way and make decisions confidently without surprises. From end-to-end, we’ve got everything you’ll ever need along the way. Because at Manheim, our mission is yours.

Related Solutions:

NextGear Capital is powering more possibilities for independent dealers with flexible floor plan financing. As the industry’s leading comprehensive finance provider, we work hard to give dealers the buying power they want with the flexible terms they need.

Related Solutions:

vAuto delivers a suite of solutions for the complete life cycle of new and used inventory, powered by superior data and insights that optimize each car’s unique ROI and your process. No matter how well your business runs today, vAuto’s end-to-end inventory management solutions help the best dealers run better.

Related Solutions:

Make the most of every connection to identify opportunities sooner and sell more cars. Our intelligent CRM is built to connect dealerships with customers. Leveraging customizable processes and robust integrations, VinSolutions meets your evolving needs.

Related Solutions:

Service more cars in less time. Enhance customer satisfaction and drive fixed operations growth with Xtime. Make it easy for your service customers to say “yes” to recommended repairs through transparent communication while you boost productivity.

Related Solutions:

What We Offer

Make profitable wholesale inventory buying and selling decisions—in-person or online.

Vast physical infrastructure, unrivaled experience, and cutting-edge technology.

Free up cash with flexible financing for independent dealers.

Take the risk out of wholesale buying and selling.

Take control of your transport.

We manage all the complexities of transporting vehicles for you.

Featured Solutions

Cox Automotive solutions bring together the best of our brands—powered by data, technology, and deep industry expertise—to deliver outcomes that matter.

Get to a yes faster with every deal

No matter the path to purchase, Deal Central enables a modern deal-making experience for both your customers and employees that helps you stay competitive and protect your profits. Deal Central delivers the car buying experience your customers demand while keeping you in control of every deal.

Innovative vehicle service solutions at scale.

When the future of automotive hits you with big questions, Cox Automotive is there to give you the answers. Tackle any challenge in vehicle lifecycle management with a vast physical infrastructure, unrivaled expertise, and cutting-edge solutions built to help your business grow as the industry grows.

Auto

Market Pulse

pricing

sales & service

sales & service