According to the Cox Automotive analysis of vAuto Live Market View data, used-vehicle inventory levels at the start of May have increased month over month but are down compared to early May 2024.

2.22M

Total Unsold

Used Vehicles

as of May 1, 2025

43

Days’ Supply

$25,547

Average Listing Price

71,423

Average Mileage

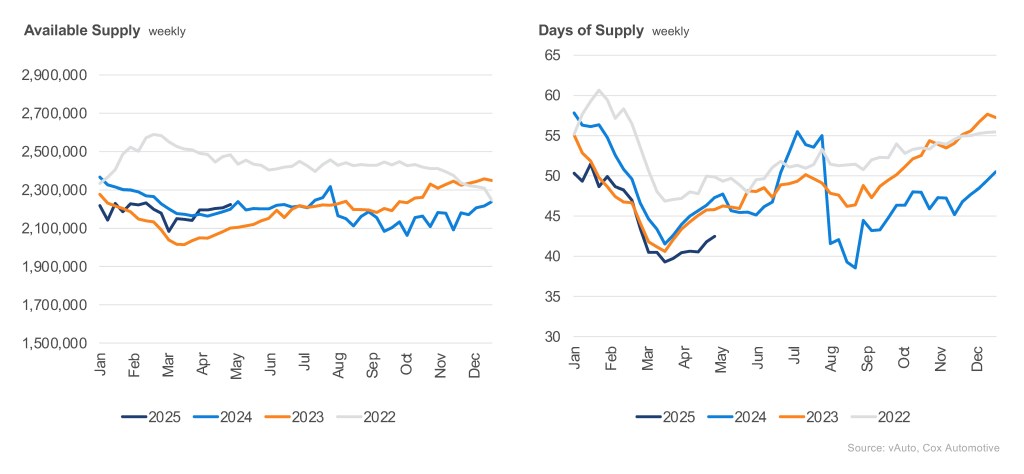

As May opened, the total supply of used vehicles on dealer lots – franchised and independent – across the U.S. was at 2.22 million units, up from the 2.20 million units at the start of April but down 1% from a year ago.

The retail used-vehicle sales pace decreased month over month in the most recent 30-day period. Used retail sales were at 1.57 million vehicles in April, a decrease of nearly 4% compared to the 1.63 million reported in March. As the effects of the “spring bounce” and initial pull ahead from tariffs diminished, sales saw a decrease in April. However, sales remain significantly higher than in recent years and are 12% higher compared to the previous year. As of May 2, tax refunds, which are a key driver of the seasonal increase the used-vehicle market often sees, averaged $2,947, up 3% year over year, with the total amount refunded up over 2%.

USED-VEHICLE INVENTORY VOLUME AND DAYS’ SUPPLY

The Cox Automotive days’ supply is based on the estimated daily retail sales rate for the most recent 30-day period. Used vehicles had 43 days’ supply at the start of May, up two days from the upwardly revised level at the beginning of April but down five days compared to the same time last year. Days’ supply is the tightest since 2021 for this time of year and remains down three days compared to 2019 levels.

Used retail prices rose for the second consecutive month in April. The average used-vehicle listing price rose to $25,547, up from the revised $25,483 at the beginning of April, matching the levels observed a year earlier.

AVERAGE USED-VEHICLE LISTING PRICE

Affordability remains challenging for consumers, and used-vehicle supply is more constrained at lower price points. Used cars below $15,000 continue to show low availability, with only 32 days’ supply, six days lower than the same time last year and 10 days below the overall industry average. The top five sellers of the month were listed at an average price of $23,926, more than 6% below the average listing price for all vehicles sold. Once again, Ford, Chevrolet, Toyota, Honda and Nissan were the top-selling brands, accounting for 51% of all used vehicles sold.