August marked a second consecutive strong month for the electric vehicle (EV) market, with record sales and rising market share in both the new and used segments. As consumers acted quickly ahead of the Inflation Reduction Act’s tax credit expiration, Cox Automotive saw demand stay strong, inventory tighten, and incentives remain influential. These shifts signal a market on the verge of a change as government-backed sales incentives dry up at the end of September.

New and Used EV Sales – August

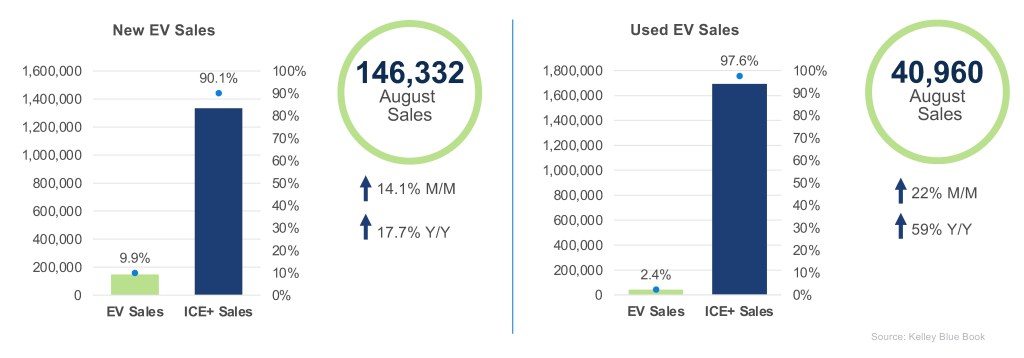

New EV Sales: August new EV sales climbed to a record 146,332 units, up 14.1% month over month and 17.7% year over year, lifting market share to an all-time high of 9.9%. Thirteen brands posted their best EV sales of the year. The top five by volume – Tesla (55,500 units), Chevrolet (12,191), Ford (10,414), Hyundai (10,186), and Honda (9,347) – continued to lead the market. While Tesla grew modestly (3.1%), its market share declined by 4 points to 37.9%. Honda, with only the Prologue in market, surged 47.9% month over month to reach 6.4% share. Among luxury brands, Audi posted the strongest growth, up 65.1% to 7,326 units, capturing 5% market share.

Used EV Sales: Used EV sales reached a record 40,960 units in August, up 22% month over month and 59% year over year, pushing market share to a new high of 2.4%. The top five makes by volume showed double-digit month-over-month growth: Tesla (17,164 units, 17.6%), Chevrolet (3,801 units, 17.3%), Ford (2,456 units, 39.6%), BMW (2,031 units, 38%) and Nissan (1,888 units, 21.6%). While Tesla remained dominant, its share of the used EV market dipped to 41.9%, down 1.6 percentage points from July. Ford and Volkswagen posted the largest share gains among major brands, each up 0.8 percentage points.

New and Used EV Days’ Supply – August

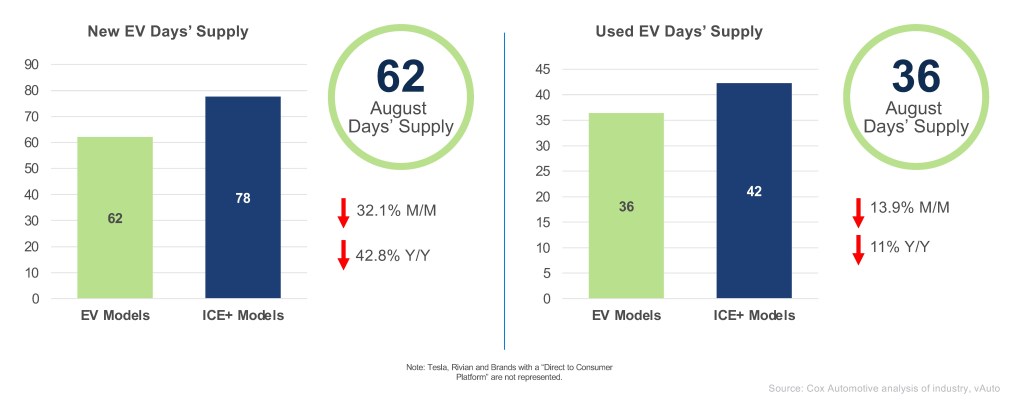

New EV Days’ Supply: In August, driven in part by strong sales, new EV days’ supply fell sharply to 62 days, down 32.1% month over month and 42.8% year over year, the lowest level recorded in 2025. Supply dropped 71 days from the June peak of 133 days. Most brands saw notable declines. GMC had the highest days’ supply at 139, while Toyota had the lowest at just 14 days. Audi posted the largest drop, falling 104 days to end the month at 67 days.

Used EV Days’ Supply: In August 2025, the days’ supply of used electric vehicles fell to 36 days, the lowest level of the year, and remained below ICE+ levels for the sixth time this year. As with the new EV market, supply levels vary significantly by make. Tesla had the lowest days’ supply at 26 days, with Chevrolet (32 days) and Nissan (32 days) also showing low levels. In contrast, Rivian (65 days), Ford (62 days) and GMC (58 days) had the highest levels, each hovering around a two-month supply. (Note: Tesla and Rivian days’ supply measures reflect only vehicles available through traditional dealerships, NOT models offered directly by the company.)

New and Used EV Prices – August

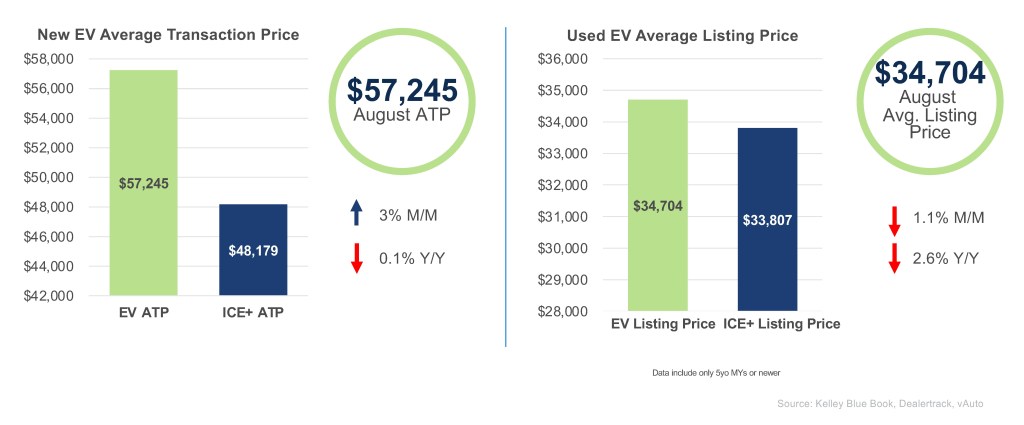

New EV ATP: In August, the average transaction price (ATP) for new electric vehicles rose to $57,245, up 3% from July and down by 0.1% year over year. The price premium over ICE+ vehicles increased to $9,066, reversing a three-month decline. EV incentives dipped to 16% of ATP, though this remained the second-highest level of the year. Among brands, Mercedes-Benz posted one of the largest ATP increases at 11.1%, followed by Nissan at 7.1%. While Tesla’s ATP rose 2.9%, its dominant sales volume played a key role in lifting the overall average. Of the top six selling EVs – Tesla Model Y, Tesla Model 3, Honda Prologue, Chevrolet Equinox EV, Hyundai Ioniq 5 and the Mustang Mach-E – nearly all saw strong incentives play a role in driving higher volume. Hyundai Ioniq 5 and Honda Prologue had the most aggressive incentives, while the Chevrolet Equinox EV had the lowest ATP among the group and very little incentive support, underscoring its price-driven appeal and competitive market positioning.

Used EV Listing Price: In August, the average listing price for used electric vehicles declined to $34,704, down 1.1% from July and 2.6% year over year. The price premium over used ICE+ vehicles narrowed to just $897, the lowest gap on record. Importantly, 14 makes had a lower average EV price than their ICE+ counterparts, highlighting the growing affordability and accessibility of used EVs. The top-selling models – Tesla Model 3, Tesla Model Y, Chevrolet Bolt EV, Tesla Model S and Ford Mustang Mach-E – were all priced below the market average, reinforcing their appeal to budget-conscious buyers. The Model 3, which led in volume, averaged $23,278, while the Chevrolet Bolt EV remained one of the most affordable options at $14,705. The Nissan Leaf, another high-volume model, was priced even lower at $12,890, further emphasizing the value proposition of used EVs.

Looking Ahead

As we approach the sunset of the IRA tax credit, we expect September to mirror August’s elevated sales activity, driven by time-sensitive purchase and lease offers. This final stretch of policy-driven urgency will likely sustain momentum across both the new and used EV segments. The market’s ability to respond to real-time demand and pricing dynamics will be crucial as incentives taper and inventory remains tight, shaping performance through the remainder of the year.

The EV Market Monitor gauges the health of the new and used electric vehicle (EV) markets by monitoring sales volume, days’ supply and average pricing. Each metric will be measured month over month and year over year. For a detailed new-EV sales report, see the Q2 Electric Vehicle Report, the official quarterly report of EV data.