January marked a reset for the EV market, with new‑vehicle demand softening sharply and inventory building, while used EV sales strengthened and supply tightened further. Pricing edged lower across both segments, narrowing EV‑to‑ICE premiums.

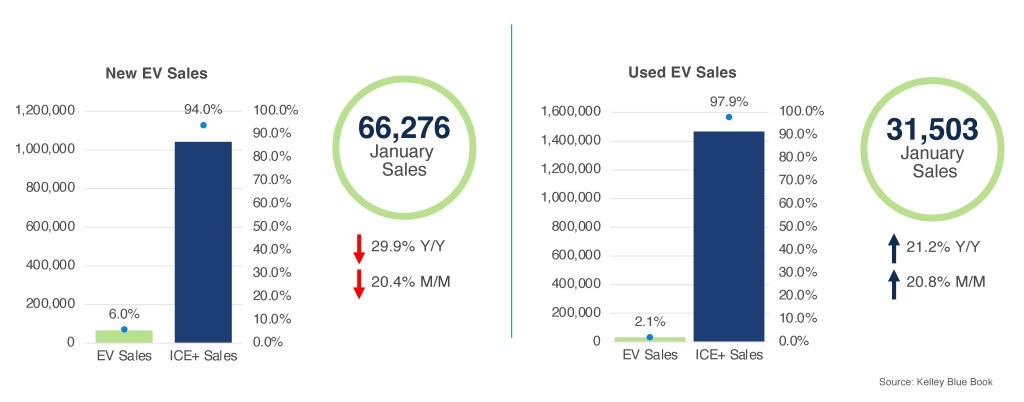

New and Used EV Sales – January

New EV Sales: January’s new EV sales totaled an estimated 66,276 units, down 29.9% from a year earlier and down 20.4% month over month. EV share of total new‑vehicle sales came in at 6.0%. The top five brands by unit volume were Tesla (40,100), Hyundai (3,074), Toyota (2,794), Cadillac (2,716), and Rivian (2,516). Tesla fell 17.0% month over month; however, its market share climbed to 60.5%, up from December’s 57.3%, as most competitors posted even steeper declines. Ford, which held the number‑two spot in December, saw volume drop 56.8% to 2,174 units and fell out of the top five, replaced by Toyota, which bucked the broader trend with a 34.5% gain. Nearly all brands recorded month-over-month losses, with Toyota, Lexus, Audi, and Subaru being the key exceptions.

Used EV Sales: In January, used EV sales reached 31,503 units, 21.2% higher than a year ago and up 20.8% from December. Market share rose to 2.1%. Tesla led the category with 12,416 units, followed by Audi (2,002), Ford (1,995), Chevrolet (1,959), and BMW (1,842). Most brands posted month‑over‑month increases, with Cadillac, Rivian, Porsche and GMC as the key exceptions – though most of those declines were modest, underscoring the broad‑based strength of the used EV market in January. Audi displaced Nissan from the top five, surging 63.4% month over month – the strongest gain among the leading brands.

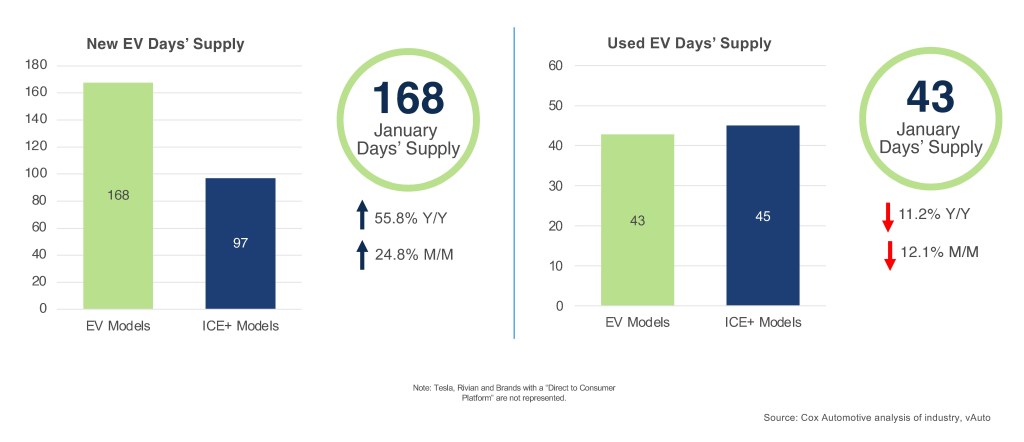

New and Used EV Days’ Supply – January

EV Days’ Supply: New EV days’ supply rose to 168 days in January, 55.8% higher than year‑earlier levels and up 24.8% month over month. The gap between EV and ICE+ days’ supply widened to 71 days, up from 59 days last month. At 168 days, new EV days’ supply is at its highest level since July 2024 and has nearly quadrupled from September’s near‑record low of 46 days. EV supply sat below ICE+ levels as recently as late October – that gap has since reversed by roughly 78 days.

Used EV Days’ Supply: Used EV days’ supply fell to 43 days in January, down 11.2% year over year and 12.1% lower month over month, remaining below ICE+ levels for the tenth consecutive month. Supply tightened across most brands, ranging from 35 days (Audi and Tesla, tied) to 62 days (Porsche). Audi saw the sharpest decline, dropping 23 days month over month as sales surged. Note: Tesla figures reflect only vehicles available through traditional dealerships, excluding vehicles at Tesla-owned outlets.

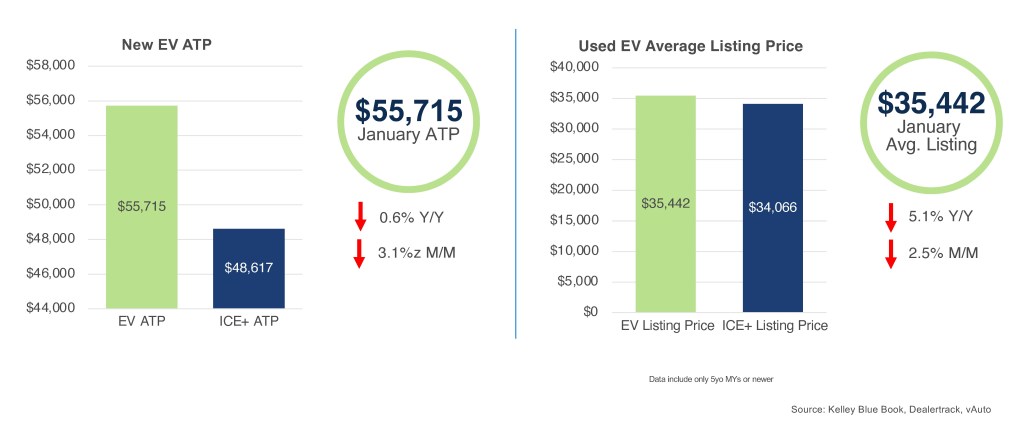

New and Used EV Prices – January

New EV ATP: The average transaction price (ATP) for new EVs in January was $55,715, down 0.6% year over year and 3.1% lower month over month. The EV premium over ICE+ narrowed to $7,098, the slimmest gap since July 2025. Incentives fell sharply from December’s record levels, averaging $6,918 or 12.4% of ATP, down from an upwardly revised 18.3% in December and below the 2025 full‑year average of 13.7%. Tesla saw its ATP decline 2.0% to $52,628, continuing to exert downward pressure on the overall EV average. Among other high‑volume brands, Mercedes-Benz (+7.9%) and Ford (+6.6%) recorded the largest month-over-month ATP increases, while Volvo (-23.5%) and Audi (-3.8%) posted the steepest declines.

Used EV Listing Price: The average listing price for used EVs was $35,442 in January, down 5.1% year over year and 2.5% month over month. The price premium over ICE+ vehicles narrowed further to $1,376, down from $2,591 in December, as used EVs continue to approach price parity with their ICE+ counterparts. Among high‑volume brands, Nissan (-3.2%), Kia (-2.8%), and Mercedes‑Benz (-2.3%) posted the steepest month‑over‑month declines. Audi bucked the trend, rising 4.8% to $39,502 even as sales surged 63.4%. Tesla edged up 0.6% to $31,760.

Looking Ahead

As the year progresses, the EV market is likely to remain uneven, with elevated new‑vehicle inventory and cautious consumer demand continuing to pressure volumes and pricing. Used EVs should remain a relative bright spot, supported by improving affordability and narrowing price gaps versus ICE+ vehicles. Near‑term momentum will hinge on disciplined production, more targeted incentive strategies, and the ability of more affordable EV models to sustain consumer interest without reigniting excess inventory.

The EV Market Monitor gauges the health of the new and used electric vehicle (EV) markets by monitoring sales volume, days’ supply and average pricing. Each metric will be measured month over month and year over year. For the official quarterly report of EV data, see the Q4 Electric Vehicle Sales Report.