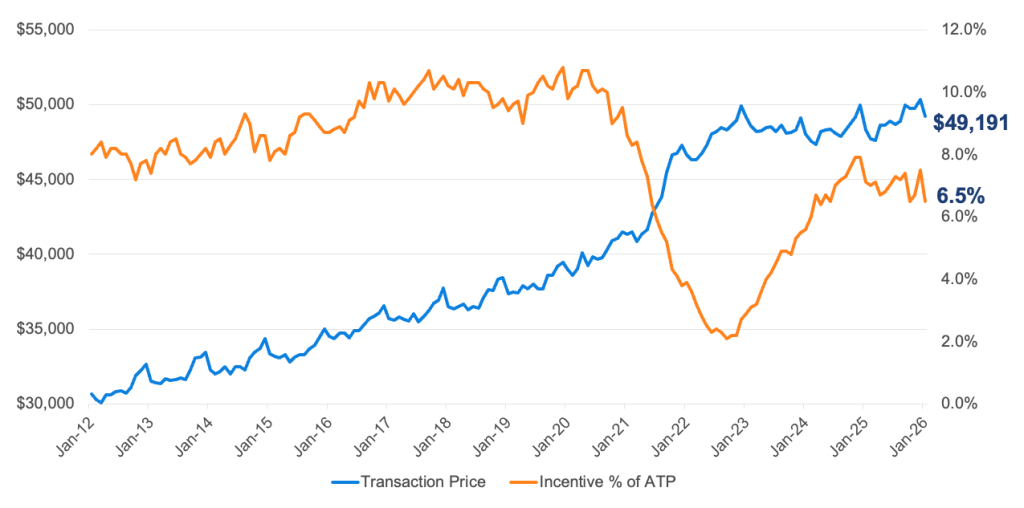

New-vehicle prices climbed to a new January record last month, according to estimates released today by Kelley Blue Book, a Cox Automotive brand, beating the previous high established in January 2023. New-vehicle prices last month fell from the record high set in December 2025. The monthly decline was seasonally normal, as prices typically decline as the market takes a breather after strong year-end results, when luxury vehicles account for a higher mix of total sales. Sales incentives were lower last month as well, as automakers pulled back to protect margins.

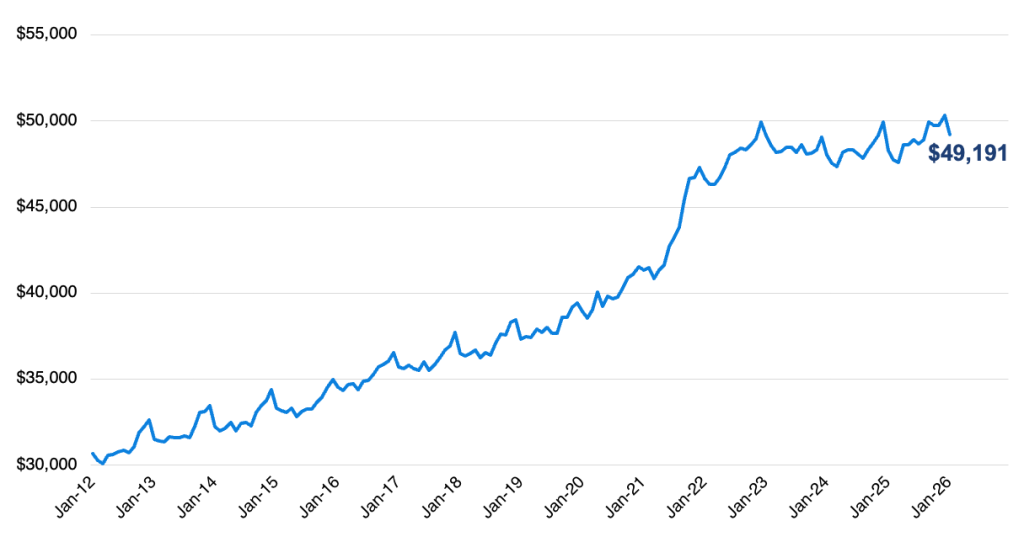

New-Vehicle Average Transaction Price

- In January, the ATP for a new vehicle was $49,191, a 1.9% increase from year-earlier levels and, according to Kelley Blue Book records, an all-time high for January. The ATP last month was down 2.2% from December, a seasonally normal decline. The December 2025 record ATP was revised down to $50,318.

- The average new-vehicle manufacturer’s suggested retail price (MSRP) – commonly called “the asking price” – in January also climbed higher compared to year-earlier estimates. At $51,288, the average MSRP was 2.1% higher year over year, an increase below long-term averages. Typically, MSRPs show an annual increase of approximately 3% in January. The average MSRP has been above $50,000 for 10 straight months, according to Kelley Blue Book estimates.

- Automakers reduced sales incentives in January. Last month, the average incentive package was equal to 6.5% of ATP, or roughly $3,200. A year ago, incentives averaged 7.1%; in December, incentives averaged 7.5% of ATP, the highest point in 2025. Last month, sales incentives were strongest for luxury vehicles and full-size pickup trucks; full-size SUVs, compact cars, and midsize cars had among the lowest incentive levels.

- In January, the best-selling vehicle segment was again the compact SUV segment (e.g., Toyota RAV4, Honda CR-V, Nissan Rogue and Chevrolet Equinox), where ATPs were $36,414, down 0.4% year over year in an industry that recorded a 1.9% gain. The popular compact SUV segment is a reminder that many excellent vehicles are available at more than 25% below the industry average.

- In January, with the subcompact Mitsubishi Mirage all but gone, the U.S. market no longer has a new vehicle with an average MSRP below $20,000. Last month, the Nissan Versa, with an average MSRP of $22,315, took up the mantle as America’s most affordable vehicle, but the role will be short-lived as reports suggest production of the Nissan Versa ended in December.

- Popular full-size pickup trucks continue to pull the industry average higher. The average MSRP in January for a full-size pickup was above $70,000 for the fifth consecutive month; despite sky-high prices, more than 150,000 were sold. For comparison, the subcompact car segment, where the average MSRP was less than $26,000 in January, fails to attract buyers. Less than 4,000 subcompact cars were sold last month.

Industry Average Transaction Price Versus Industry Average Incentive Spend as % of ATP

Quote from Erin Keating, Executive Analyst, Cox Automotive

“January’s pricing story is really a reminder of how much mix still matters in this market,” said Erin Keating, executive analyst at Cox Automotive. “We hit a new January high even as prices naturally pulled back from December’s luxury-heavy finish. Consumers are still finding plenty of options below the industry average, especially in core segments like best-selling compact SUVs, but the disappearance of true entry-level vehicles continues to lift the floor higher. At the same time, strong sales of full-size pickups and large, luxury SUVs keep pulling the averages up, proving that demand for high-priced models remains incredibly resilient.”

Led by Tesla, Electric Vehicle Prices Fall in January, as Sales Continue to Slow

- New electric-vehicle (EV) prices declined to $55,715 in January. Average transaction prices were lower by 0.6% compared to year-earlier levels and down 3.1% from December.

- Incentives for EVs fell notably in January, to an average of 12.4% of ATP, down from an upwardly revised 18.3% in December and below the 12-month average of 13.7% in 2025. Still, at 12.4% of ATP, EV sales incentives continue to be well above industry averages.

- Tesla, which accounted for approximately 60% of total EV sales in January, had an ATP of $52,628 in January according to Kelley Blue Book estimates, down from $53,678 in December. Compared to January 2025, Tesla prices were lower by 2.2%, in an industry that saw ATPs rise by 1.9%.

- EV sales in January are now being estimated by Kelley Blue Book at just over 66,000 and were lower year over year by nearly 30%. Compared to December, EV sales were down by approximately 20%, slightly better than the industry’s monthly decline of 25.4%.