Filter By:

Cox Automotive Auto Market Report: November 7th

The video below is part of a biweekly Auto Market Report series focusing on data and insights that provide a holistic view of the auto industry. Chief Economist Jonathan Smoke leads our effort to translate data and trends into actionable insights. Download this week’s presentation

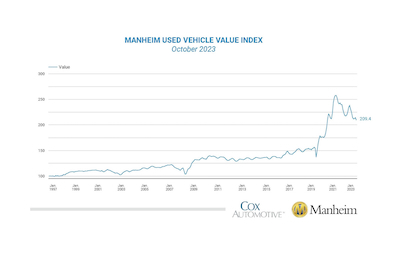

Wholesale Used-Vehicle Prices Decrease in October

Wholesale used-vehicle prices (on a mix, mileage, and seasonally adjusted basis) decreased 2.3% in October from September. The Manheim Used Vehicle Value Index (MUVVI) dropped to 209.4, down 4.0% from a year ago. “October revealed some not-so-spooky price moves, namely a reversal of the gains that were seen during the prior two months,” said Chris …

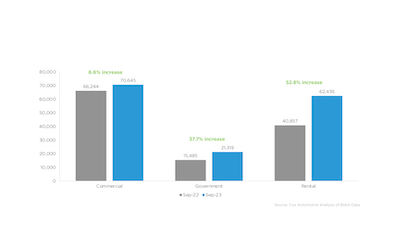

Fleet Sales Drop in October for First Time This Year

In October, sales into large rental, commercial, and government fleets declined compared to the previous year. An analysis of Bobit’s data by Cox Automotive revealed that there was a 10.4% drop in sales to large fleets (excluding dealer and manufacturer fleets) in October, with 162,590 units sold. In addition, sales to commercial fleets decreased by …

Auto Market Weekly Summary

Job growth in October slowed and was weaker than expected. Prior job numbers were revised down, and the unemployment rate increased to the highest level since the beginning of 2022 while wage inflation moderated slightly. The labor market is showing the impact of the Fed’s efforts to slow the economy. Financial markets cheered the result …

Fed Actions Speak Louder Than Words About Rate Policy; Those Actions Portend Higher Rates Ahead

As expected, the Fed left interest rates unchanged today, at least as it relates to official short-term rate policy. We have now had two meetings with no change in rate policy, yet rates keep rising. The Fed is getting more restrictive higher rates while pretending to be patient. Despite no change in their policy, the …

The Power of Data in an Evolving Automotive Market

As we navigate the fourth quarter, risks remain across the auto industry caused by the fallout from the United Auto Workers strike, a possible economic slowdown, and political uncertainty that’s putting downward pressure on consumer sentiment. In times like these, following the data is even more important—for us and our clients. If you’ve followed the …

Cox Automotive Analysis: Toyota Motor Corporation’s Quarterly U.S. Market Performance

Toyota reported improved U.S. sales in the latest quarter, with most models showing gains despite having among the lowest inventory levels in the industry. In Japan, Toyota Motor Corp. posts financial results Oct. 31 for the July-to-September quarter, the automaker’s second quarter of its 2024 fiscal year. Toyota’s U.S. sales for the quarter rose 12%, …

Cox Automotive Analysis: Stellantis’ Q3 2023 Market Performance

Stellantis reports global deliveries and revenues on Oct. 31 and will be grilled by analysts about the impact the UAW strike had on its operating profit, which will take the biggest hit in the fourth quarter. The UAW went on strike against GM, Ford and Stellantis on Sept. 15, taking down one assembly plant for …

Auto Market Weekly Summary

Economic growth for the third quarter accelerated and was much stronger than expected at 4.9%. Most factors moved to positive, with accelerating growth in consumer spending being a major driver of the growth in the quarter. Consistent with the quarter’s performance, consumer spending growth accelerated in September, but income growth slowed. Personal Consumption Expenditure Index …

Cox Automotive Analysis: Ford Motor Company’s Q3 2023 U.S. Market Performance

Editor’s note: On the evening of Wednesday, Oct. 25, after this post was published, Ford and the UAW reached a tentative agreement on a new four-year contract. The contract has not been ratified by the UAW membership, but striking Ford workers will be going back to work, ending the production stoppages in Michigan, Kentucky and …