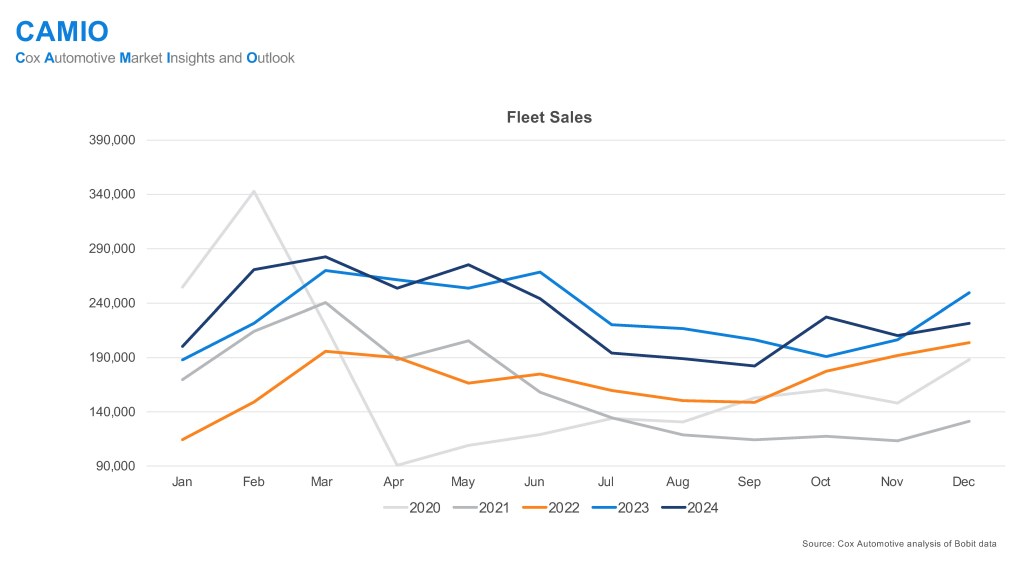

Takeaway: After an impressive rebound in 2023, fleet sales in 2024 retreated slightly. Fleet ended the year with 2.6 million units sold, down less than 1% from 2023. Fleet sales in 2024 were the second highest since 2019 and more in line with the long-term averages recorded from 2012 to 2019. As new-vehicle inventory levels returned to normal in 2024, so too did fleet sales. The total fleet share of new-vehicle sales in 2024 was 17.3%, a level typically seen before the pandemic and well ahead of 2021 and 2022, when fleet sales averaged just 13.5% of total sales.

What’s next: Fleet sales are expected to increase to 3.0 million units in 2025, a 7.7% increase year over year. The key question for 2025 is how much growth can be achieved following the significant increase in 2023. Pent-up demand for fleet, particularly rental and commercial fleets, has likely already been satisfied, so further growth will likely be more challenging.