Editor’s note: Jeremy Robb, interim chief economist at Cox Automotive, will keep the Auto Market Weekly Summary rolling as Jonathan Smoke transitions to his new role as chief strategy officer.

Last week saw the end of the longest government shutdown in history come to a stop on Wednesday evening after a record 43 days. Over the coming weeks, we expect to receive more updates on economic data and will cover that moving forward. Goldman Sachs expects the Bureau of Labor Statistics to publish a new data release schedule sometime next week.

Detailed below, we have new updates on mortgages, consumer credit, auto credit availability, auto loan performance, and the Fed’s household debt and credit report. Visit our Insights hub to see the October release of new-vehicle affordability, which will be available later today.

Mortgage Rates and Housing Concerns

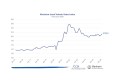

Mortgage rates remain elevated but have shown some improvement compared to last year.

- The 10-year treasury rose this week to 4.15% as the 30-year mortgage rate was higher by 2 bps to 6.24%.

- Mortgage rates have fallen by 54 basis points (bps) year-over-year, while home prices are 1.9% higher over the same period. This saves consumers 3.6% on their monthly mortgage payment and $33,900 over the life of the loan in interest, assuming 20% down.

- While 6.24% mortgage rates are still quite high for most consumers, they have fallen more than Treasury yields so far this year and are back to levels last seen in early 2023.

- Affordability continues to be a major concern in the housing market, just as a new report from ATTOM was released this week showing foreclosure filings rose 19% from last year and went up 3% against last month.

Consumer Credit Growth Increased Notably in September

Consumer credit growth accelerated significantly in September, according to the latest report from the Federal Reserve.

- Consumer credit increased by $13.1 billion following an upwardly revised increase of $3.1 billion in August.

- Revolving credit increased only $1.65 billion after a downwardly revised increase of $11.01 billion in August.

- Nonrevolving credit, which includes auto loans, increased by $11.44 billion following an upwardly revised increase of $9.20 billion in August.

Auto Credit Access Improved in October

Access to auto credit improved in October, and trends were positive by lender type according to our Dealertrack Credit Indices.

- The subprime share increased, terms lengthened, the negative equity share increased, and downpayments declined, and those factors improved credit access for consumers.

- However, the yield spread widened by 12 bps, and the approval rate was down 1.4 percentage points from September, factors that moved against consumers.

- Credit access improved across most sales channels in October, which was driven by gains in non-captive new, all new and franchised used segments.

- Credit access in October was looser than a year ago across most channels, with the most improvement in franchised used and non-captive new segments. The independent used group improved more modestly, and all used, all new, and certified pre-owned (CPO) also saw gains.

- Lender performance was all positive in October, with captives loosening the most, and banks also showing notable improvement. Compared to a year ago, banks and auto-focused finance companies led the improvement, while credit unions also showed loosening tendencies. Captives showed a more cautious but still positive stance compared to a year ago.

Auto Loan Performance Declined in October

Auto loan performance was lower in October, with slightly higher month-over-month delinquencies, while defaults increased, according to Cox Automotive analysis of Equifax loan performance data. While the month-over-month trend in defaults was positive, defaults have declined 1.9% YTD, and the loan base was lower by 1.6%.

- 60-day+ delinquencies were higher by 0.1% but were down 1.1% year over year, the third month in a row of year-over-year declines. In October, 2.05% of auto loans were severely delinquent, which is slightly higher than the 2.04% rate in September and up from 1.98% a year ago.

- The subprime severe delinquency rate was 13 bps higher year over year, while the aggregate was 7 bps higher. 7.55% of subprime loans were severely delinquent, which was a small decline from 7.56% in September and up from 7.42% a year ago.

- Defaults increased 1.3% in total for the second month but were down 13.2% year over year. Defaults of subprime auto loans increased 4.4% but were down 14.5% year over year. The annualized default rate was 3.17%, which was 7 bps higher than September, 32 bps lower than last year, and 7 bps higher than October 2019.

- The default rate year to date is 3.11%, which is flat against the full-year default rate in 2024 of 3.11% and rose 1 basis point from September.

Key Findings from NY Fed Q3 2025 Household Debt Report

- Total household debt reached $18.59 trillion (up $197 billion or 1% in Q3), growing $4.44 trillion since pre-pandemic levels.

- Mortgage debt grew $137 billion to $13.07 trillion, with new originations rising to $512 billion (up from $458 billion in Q2).

- HELOCs rose $11 billion to $422 billion, marking the 14th consecutive quarterly increase and now $105 billion above 2022 lows.

- Credit card balances increased $24 billion to $1.23 trillion (5.75% year-over-year growth), with credit limits expanding $350 billion against last year.

- Auto loan balances were steady at $1.66 trillion as originations fell to $184 billion in Q3, showing no growth against last year as tightening lending standards caused subprime originations to decline 12% year over year.

- Student loan debt rose $15 billion to $1.65 trillion, with elevated delinquency at 9.4% as previously unreported 2020-2024 missed payments now appear on credit reports, though student loan delinquency was down from 10.2% in Q2.

- Overall delinquency remains elevated at 4.5% with 141,000 new bankruptcies and 55,000 new foreclosures, though transition rates into serious delinquency are largely stable.

Bottom Line

We may not have much government data to digest, and that’s causing the Fed to fly a bit blind as they weigh what could be a slowing economy, coupled with sticky inflation. However, that’s going to change in the coming weeks, and we should start to get data on figures like unemployment and inflation. Even with all the information we have from our businesses at Cox Automotive, the picture of consumer health is muddy. Consumer spending has slowed, auto transactions for both new and used are fairly stable, and Manheim metrics are demonstrating seasonal trends. Long-term impacts from multiple years of inflation have forced consumer debt levels to all-time highs, with delinquency rates holding at high levels. The growth in tax refunds consumers will see next spring comes at a much-needed time, but we will see how much of those funds are used for purchasing rather than the retirement of existing debt.