The second full week of December was quiet except for the Federal Reserve’s last meeting of the year – and it delivered some drama. Last week, our team provided updates on credit availability and new- and used-vehicle inventory levels. This week, we will receive new information on jobs and unemployment early in the week, before the November CPI report is released on Thursday, Dec. 18.

Fed Makes Final 2025 Decision on Interest Rate Policy

The Federal Reserve delivered its third rate cut of 2025 this week, but growing resistance within the committee suggests the early phase of the easing cycle may be over—with the most internal dissent in over six years signaling deep uncertainty about the path ahead.

- The voting committee decided to lower the target range for the Fed Funds rate by 25 bps to 3.50% to 3.75% this week, as somewhat stale economic data clouds the view of the current situation.

- The market was expecting a rate cut and likely some dissent, but the level of disagreement was the highest since September 2019. While there are only 12 voting members on the FOMC that set interest rates, there are 7 more members in total. Those 7 individuals do not vote, but they do cast their views on the path of future interest rate policy.

- Interestingly, four of those seven members indicated they were not aligned with the current updated band for the Fed Funds rate, shown by the infamous ‘dot plot’ released. In the dot plot for year end 2025, 6 votes were cast in the range of 3.75% to 4.00%, meaning four additional non-voting members believe there should have been “no change” to the target range. This reveals even deeper division than the formal vote suggests.

- The dot plot was last updated after the September meeting (it is not released at each meeting). At that time, the future projection for interest rate policy was 3.30% in 2026 and 3.19% in 2027. After the meeting in December, future projections for rate policy in 2026 are now 3.36% and 3.21% for 2027. Altogether, this means the committee only sees roughly one rate cut in 2026 and perhaps only two through 2027.

Credit Availability Rose in November

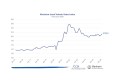

The Dealertrack Credit Availability Index is 4% higher than last year, marking three consecutive months of improvement.

- In November, approval rates were higher and helped expand access to credit, and the yield spread contracted meaningfully, driving the majority of the improvement in the index for the month.

- Credit access improved across all sales channels in the month, with the largest gains seen in the all new and all used segments.

- Compared to last November, the largest improvements in credit access were seen in used channels, with decent growth in the non-captive new segment also. In general, credit access has improved to levels last seen in 2022, reflecting the impact of the Fed’s easing cycle.

Used Sales and Inventory Increase in November

Used sales and days’ supply are higher than last year in November.

- Retail used-vehicle sales reached 1.39 million in November, 2% higher than last year and up from 1.36 million in October.

- Used-vehicle inventory had 50 days’ supply at the start of December, up two days compared to the same time last year, though flat to last month. While supply is higher than last year, it holds roughly flat versus 2019.

Bottom Line

The Fed is more divided than it’s been in years, as unusually high dissent at this month’s meeting revealed deep disagreement about the future for interest rates. The conflict stems from mixed signals: unemployment has been slowly ticking up, suggesting labor market softness, yet inflation progress has stalled and updates are stale. Chair Jerome Powell even suggested that reported jobs growth could be overstated, potentially indicating a much weaker employment picture.

Complicating matters further, the recent government shutdown curtailed data collection across various economic activity, leaving the Fed to make tough choices with limited data. This uncertainty has frozen the rate outlook: Futures markets now show nearly an 80% probability that the Fed will hold rates steady at their January meeting, pushing any potential further relief for housing and auto markets down the road.

This week brings updates on both metrics comprising the Fed’s dual mandate: jobs growth and inflation. We may see slightly lower rates of price increases, but consumers continue to feel pressured by five years of compounding price growth. Meanwhile, multiple data points suggest the jobs market is either stalling or slowing, leaving the Fed torn between competing objectives.