Updated, Oct. 2, 2025 – The new-vehicle sales pace in September remained above 16 million and was better than year-ago results, boosted by record electric vehicle (EV) sales and continued strong commercial demand. Initial September results show the seasonally adjusted annual rate (SAAR) of sales likely finished at 16.4 million, just above the Cox Automotive forecast of 16.2 million. (Below)

New-vehicle sales volume was 1.25 million, very close to the Cox Automotive forecast of 1.26 million in September. Overall, new-vehicle sales were higher by 3.5% year over year. According to Bobit, traditional fleet sales in September increased by nearly 12% compared to the same month last year. Retail sales showed a gain of 6.8% compared to September 2024, and the retail share of sales in September was unchanged year over year.

Cox Automotive expects September and Q3 to deliver record-breaking EV sales results for the U.S. auto market, driven in large part by the end of the tax credits. So far, Ford, Hyundai and Kia have all reported record EV sales for September. Ford alone posted an 85% increase in EV sales for the month and confirmed that Q3 was its best quarter ever for electrified vehicles – outpacing the estimated combined electrified sales of GM and Stellantis. Hyundai and Kia also set new benchmarks, underscoring the momentum in the EV segment. Tesla also posted a record quarter globally, delivering nearly 500,000 vehicles. Although U.S. figures are not yet available, Tesla’s volume is expected to bolster Q3 EV sales. Cox Automotive’s official Q3 EV Sales Report is scheduled for release on Friday, Oct. 10.

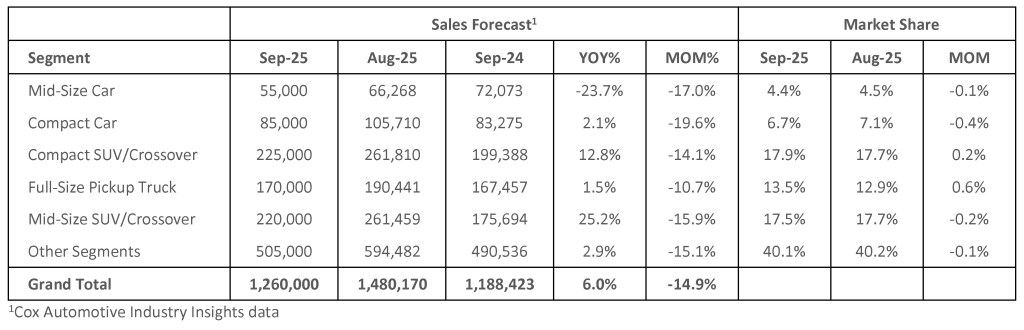

ATLANTA, Sept. 25, 2025 – September new-vehicle sales are expected to show a resilient market that continues to shake off significant policy changes and economic uncertainty. The September new-vehicle SAAR, or seasonally adjusted selling rate, is expected to finish near 16.2 million, an increase from last year’s 15.8 level and a slight uptick from last month’s 16.1 million pace. Sales volume is expected to rise 6.0% from last year but decline 14.9% from the previous month due to three fewer selling days.

“The new-vehicle sales pace has been surprisingly strong this summer and through the third quarter as uncertainty around tariff policy has decreased,” said Charlie Chesbrough, senior economist at Cox Automotive. “Continued low inflation and unemployment rates, coupled with a strong stock market, have kept consumers in a buying mood. A key contributor to sales in recent months has been an increase in EV sales, as buyers rush to market before the $7,500 tax credits expire at the end of September.”

September 2025 New-Vehicle Sales Forecast

Q3 Electric Vehicle Sales Poised to Set Record

With a surge of EV buyers in market before the end of government-supported tax incentives, Cox Automotive is forecasting that a record 410,000 EVs will be sold in the third quarter, a significant increase (21.1%) year over year and a jump of more than 30% compared to Q2. The share of EV sales in the third quarter will likely be close to 10% of total sales, a record. The previous EV sales peak in the U.S. was Q4 2024, when 365,824 EVs were sold, accounting for 8.7% of total new-vehicle sales.

“The federal tax credit was a key catalyst for EV adoption, and its expiration marks a pivotal moment,” said Stephanie Valdez Streaty, director of Industry Insights at Cox Automotive. “This shift will test whether the electric vehicle market is mature enough to thrive on its own fundamentals or still needs support to expand further.” Cox Automotive expects EV sales to slow notably in Q4, but long-term sales growth will continue. For more on what’s next, read Valdez Streaty’s latest post: After the Credits: How EV Adoption Advances When Incentives Fade.

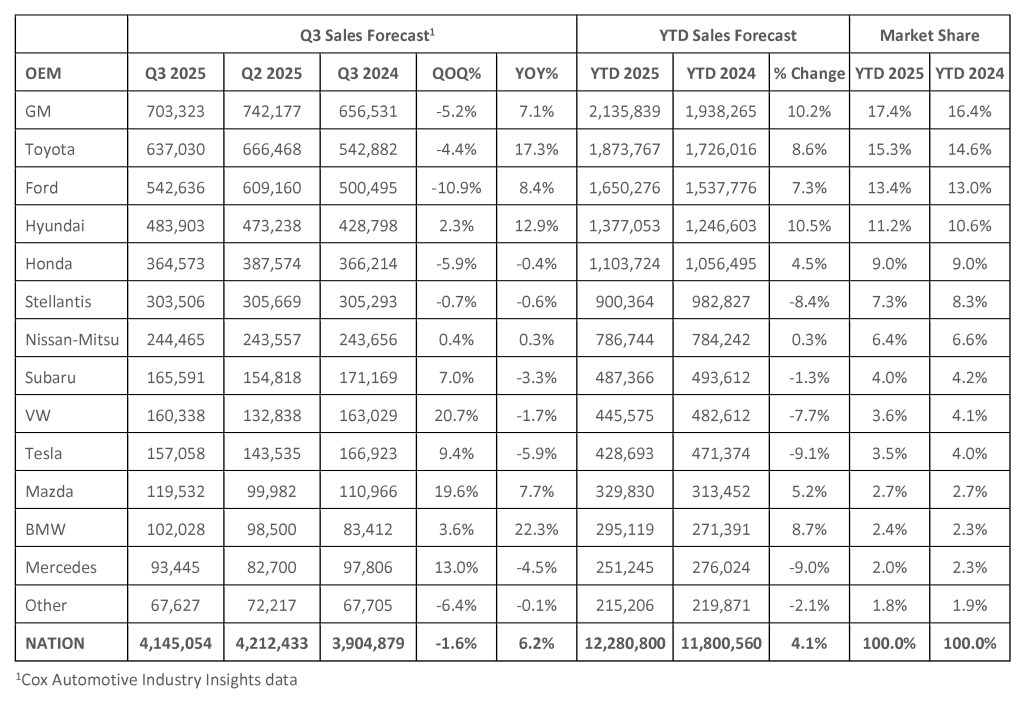

Q3 and Year-to-Date 2025 New-Vehicle Sales Forecast

Cox Automotive is forecasting Q3 2025 new-vehicle sales to climb year over year by 6.2%, although they are projected to finish lower compared to Q2 by 1.6%. The year-over-year volume gains in the market are expected to be driven almost entirely by the four biggest automakers – General Motors, Toyota Motor Corporation, Ford Motor Company, and Hyundai Motor Company. Cox Automotive forecasts the “Big Four” in Q3 to post combined sales gains of 11.2% year over year. The rest of the industry is expected to be higher by 0.1%. Year to date, the story remains the same, with the Big Four forecasted to gain 9.1 % while the other automakers decline by 2.0%.

Q3 2025 New-Vehicle Sales Forecast

Chesbrough added, “The sales pace in the new-vehicle market is expected to wane in the coming months, as more headwinds gather. Sales of EVs are likely to decline significantly, and market conditions for other vehicles will become more challenging in the near future. More tariffed products are replacing existing inventory, and prices are expected to be pushed higher as automakers pass along higher import costs. Still, the market’s strength in Q3 has improved our overall outlook.”

Cox Automotive is raising its full-year forecast range to between 15.8 and 16.4 million, while increasing the baseline number to 16.1 million, the likely outcome for full-year sales. At the end of Q2, Cox Automotive had adjusted its baseline forecast to 15.7 million, but healthy sales and the large surge in EV volume during Q3 have led the Cox Automotive team to shift its outlook. Forecasts for both fleet sales and new retail sales have been adjusted higher. With an expected decline in EV leasing in Q4, the lease penetration forecast was moved lower, from 25% to 24% for the Q3 forecast. Used retail sales and sales of CPO vehicles were also adjusted higher.

About Cox Automotive

Cox Automotive is the world’s largest automotive services and technology provider. Fueled by the largest breadth of first-party data fed by 2.3 billion online interactions a year, Cox Automotive tailors leading solutions for car shoppers, auto manufacturers, dealers, lenders and fleets. The company has 29,000+ employees on five continents and a portfolio of industry-leading brands that include Autotrader®, Kelley Blue Book®, Manheim®, vAuto®, Dealertrack®, NextGear Capital™, CentralDispatch® and FleetNet America®. Cox Automotive is a subsidiary of Cox Enterprises Inc., a privately owned, Atlanta-based company with $23 billion in annual revenue. Visit coxautoinc.com or connect via @CoxAutomotive on X, CoxAutoInc on Facebook or Cox-Automotive-Inc on LinkedIn.

Media Contacts:

Mark Schirmer

734 883 6346

mark.schirmer@coxautoinc.com

Dara Hailes

470 658 0656

dara.hailes@coxautoinc.com