The average transaction price (ATP) for a new vehicle hit an all-time high in December, according to estimates released today by Kelley Blue Book, a Cox Automotive brand. A strong mix of midsize SUVs and full-size pickup trucks pushed the average higher, as both segments outperformed in the final month of 2025. New-vehicle prices typically peak in December.

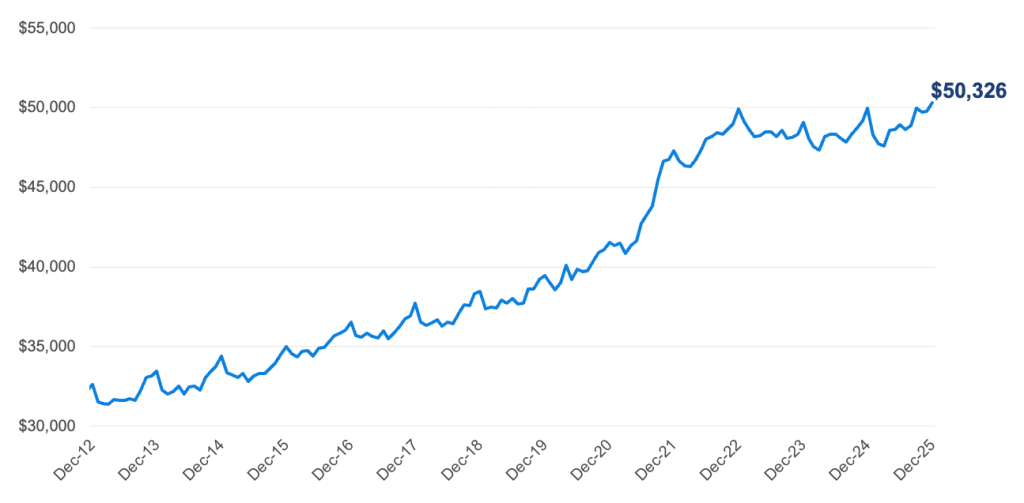

New-Vehicle Average Transaction Price

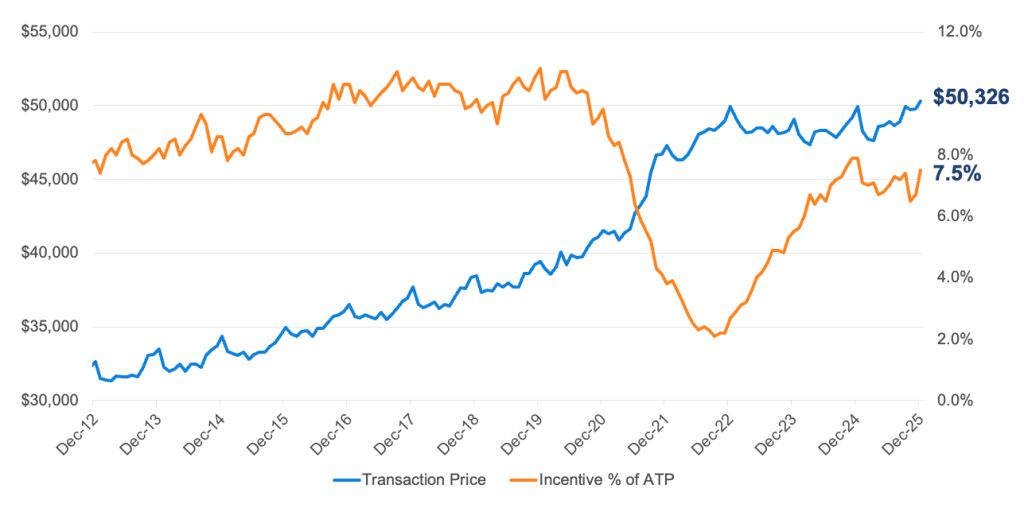

- The average price paid for a new vehicle in December was $50,326, an all-time high according to initial Kelley Blue Book estimates. The ATP last month was up 0.8% year over year and up 1.1% from November.

- The average new-vehicle manufacturer’s suggested retail price (MSRP) – commonly called “the asking price” – also set a record in December, at $52,627. The average MSRP was 1.2% higher year over year, below the long-term average increase. The average MSRP has been above $50,000 for eight straight months.

- Incentives increased in December to 7.5% of ATP, the highest point in 2025. The incentive level in December increased 10.7% compared to November (6.7% of ATP) but was lower year over year. In December 2024, the average incentive was equal to 7.9% of ATP.

- Strong sales of full-size pickup trucks also pushed the ATP higher last month. With more than 233,000 full-size pickups sold, December was the best month for the segment in five years and the sixth best in the past decade. The average price paid for a full-size pickup in December was $66,386, slightly below the record set in October 2025. In December, combined revenue from retail and fleet sales of full-size pickups surpassed $15 billion for the first time, according to Cox Automotive estimates.

Industry Average Transaction Price Versus Industry Average Incentive Spend as % of ATP

Quote from Erin Keating, Executive Analyst, Cox Automotive

“We typically see elevated prices in December, as the market delivers a strong mix of high-end and luxury vehicle sales,” said Cox Automotive Executive Analyst Erin Keating. “It’s important to remember, the Kelley Blue Book ATP is a reflection of what was sold in a given month, not what is available. Last month, nearly 20% of shoppers bought luxury, a peak for 2025 – and that doesn’t include the volume of high-end pickups that were snapped up by affluent shoppers.”

Electric Vehicle Prices Decline, Incentive Increase in December, As Sales Gain From November

- New electric-vehicle (EV) prices were higher year over year by 2.4% in December but were modestly lower compared to November. The average price paid for a new EV last month was $58,034, up from $56,691 in December 2024.

- Incentives jumped higher in December, both year over year and month over month. At 18% of ATPs last month, sales incentives for EVs were in record territory, helping push sales over 84,000 units for the month, the best result since the government-backed sales incentives were revoked.

- The average price paid for a new Tesla last month was $53,680, lower by 2.9% year over year, according to Kelley Blue Book estimates. Tesla ATPs were also lower month over month in December, while incentives jumped higher. According to initial estimates, sales incentives on new Tesla models (19.5%) in December were more than double year-earlier levels.

- Total EV sales in 2025 were approximately 1.28 million units, lower than 2024 by 2%, according to estimates from Cox Automotive’s Kelley Blue Book. Sales in the year ahead are expected to be mostly flat, thanks in part to new model launches and continued improvements in the U.S. charging infrastructure.