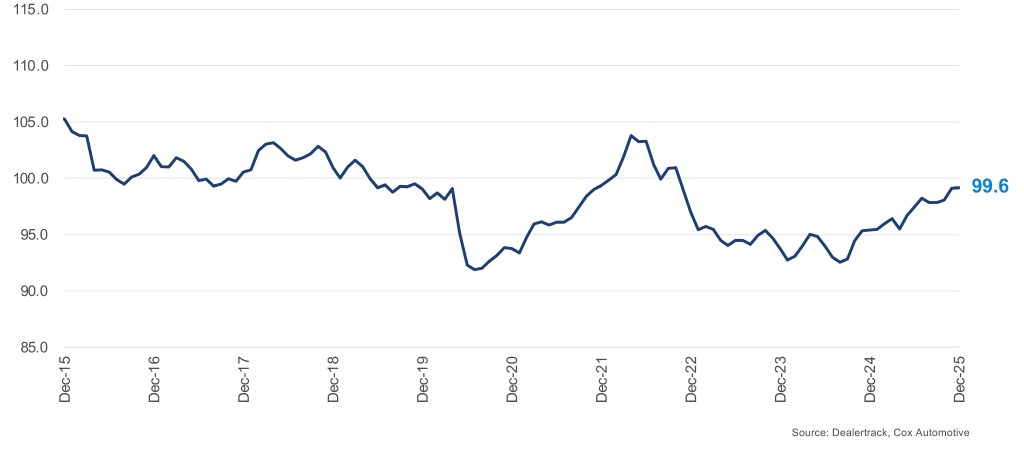

In December, the Dealertrack Credit Availability Index reached its highest point of 2025, climbing to 99.6 and marking the best level since October 2022 as credit access continued to improve. The All-Loans Index rose 90 basis points (bps) from November’s 98.7 and is up 4% from December 2024. While individual metrics showed mixed movement, this continues the broader trend of easing credit conditions that began in late summer 2024.

Dealertrack Credit Availability Index

Key Metrics

- Approval Rates: The approval rate for auto loans rose to 73.7% in December, up 90 bps from November, and up 80 bps from December 2024 (72.9%). Approval rates increased for the second month in a row after two consecutive months of declines.

- Subprime Share: The share of loans to subprime borrowers decreased by 20 bps month over month (from 14.3% to 14.1%) but is up 230 bps year over year. This continues the pullback from November’s 80 bps decline, suggesting lenders are tightening access for higher-risk borrowers even as overall credit conditions loosen. Despite the recent moderation, subprime lending remains significantly elevated compared to a year ago.

- Yield Spread: The yield spread shrank by 18 bps (from 6.81 to 6.63), while the average contract rate fell by 16 bps (from 10.5% to 10.3%). The 5-year Treasury yield increased by 2 bps (from 3.68% to 3.70%). This spread compression was again the largest driver of the overall index improvement, offering consumers more favorable pricing.

- Loan Term Length: The share of loans with terms greater than 72 months increased by 20 bps (from 27.1% to 27.3%) and is up 380 bps year over year, reversing November’s decline. This may reflect ongoing affordability pressures as consumers opt for longer terms to manage monthly payments, with lenders appearing willing to accommodate these requests.

- Negative Equity Share: The proportion of borrowers with negative equity increased by 10 bps month over month (from 52.8% to 52.9%) and is up 250 bps year over year. While the modest monthly increase partially reverses November’s 140 bps improvement, the share remains near the lowest levels seen in 2025, signaling relatively contained risk levels despite the uptick.

- Down Payment Percentage: The average down payment percentage decreased by 10 bps (from 13.4% to 13.3%) and is down 100 bps year over year, reversing November’s uptick. This may reflect increased consumer demand or lenders’ greater flexibility as credit conditions ease.

Channel and Lender Trends

- Channels: Credit access improved across most sales channels in December. The largest gains were seen in the independent used segment, followed by the all used segment. The franchised used, all new and non-captive new segments also saw slight increases, while certified pre-owned (CPO) dropped 0.4%, representing the only channel decline and contrasting with the broad-based gains seen elsewhere.

- Lender Types: Lender performance was all positive in December. Captives led the improvement again, with credit availability rising 1.0%, reflecting a strong appetite for growth and a greater willingness to extend credit. Banks and finance companies also showed notable loosening, up 0.8%, while credit unions posted a 0.7% increase. Overall, lenders are showing more willingness to extend credit, with captives driving the month-over-month improvement.

Year-Over-Year Comparison

Compared to December 2024, credit access was looser across most channels and all lender types:

- Channels: The most notable year-over-year improvements were in franchised used and non-captive new, indicating stronger credit availability in both the new and used vehicle segments. The all used channel also saw solid improvement, followed by independent used, all new and CPO.

- Lender Types: Banks and auto-focused finance companies led the year-over-year loosening, while captives also improved. Credit unions showed a more cautious but still positive stance compared to a year ago.

Implications for Consumers and Lenders

- Consumers: Ongoing improvement in credit access, especially in both the new and used markets, continues to offer financing opportunities. While approval rates increased, the slight decline in down payments combined with longer loan terms may indicate stretched affordability. Consumers should remain mindful of the total cost of ownership when evaluating loan offers.

- Lenders: The performance across lender types reflects a shift in strategic priorities. Finance companies, captives, banks and credit unions all appear to be expanding access but are more cautious about risk. As credit conditions evolve, lenders must balance growth with prudent risk management, especially amid shifting rate environments and consumer behavior.

Overall, the December Dealertrack Credit Availability Index continued to reflect a loosening of auto credit conditions. The improvement was driven primarily by more favorable pricing through lower yield spreads and higher approval rates. However, lenders showed increased caution toward risk, with a continued pullback in subprime lending and a modest uptick in negative equity.

Full-Year 2025 Credit Availability Index Trends

For full-year 2025, the Dealertrack Credit Availability Index averaged 97.3, a 3.4-point improvement from 2024’s average of 93.9, representing a 3.6% year-over-year gain. This marks a notable reversal from 2024, which saw the index decline slightly from 2023 levels as lenders remained cautious amid elevated rates and affordability pressures. The improvement accelerated through the year, with the second half of 2025 averaging 98.4 compared to 96.3 in the first half. December’s reading of 99.6 brought the index back near its January 2019 baseline of 100 for the first time in over two years, signaling that credit conditions have largely normalized following the tightening cycle that began in late 2022.

The full-year improvement was driven primarily by increased subprime lending, which accounted for over half of the index gain as lenders expanded their risk appetite after a cautious 2024. Greater accommodation of longer loan terms – with the share of loans exceeding 72 months rising nearly 2 percentage points – contributed roughly a quarter of the improvement, reflecting lender flexibility in addressing ongoing affordability pressures. Yield spread compression added another 18% of the gain through more favorable consumer pricing. Notably, overall approval rates edged slightly lower year over year, a modest headwind that was more than offset by the loosening in other components.

The Dealertrack Credit Availability Index tracks six factors that affect auto credit access: loan approval rates, subprime share, yield spreads, loan term length, negative equity and down payments. Reported monthly, the index indicates whether access to auto credit is improving or declining. This typically means that it is cheaper and easier for consumers to obtain a loan or more expensive and harder. The index is published around the tenth of each month.