October marked a sharp reversal for the electric vehicle (EV) market as the expiration of the federal EV tax credit cooled demand after three months of accelerated sales. Buyers rushed to secure incentives before the deadline, but once it passed, momentum slowed. Inventories climbed quickly, and pricing shifted upward for both new and used EVs, reflecting a market in transition.

New and Used EV Sales – October

New EV Sales: Estimated October new EV sales totaled 74,835 units, plummeting 48.9% from September’s record high and down 30.3% from a year earlier. EV share of total sales dropped sharply to 5.8%, falling nearly 6 percentage points from September’s record of 11.6%. The decline was broad-based, with luxury down 39% and non-luxury down 65%. The top five market leaders by unit volume were Tesla (40,650), Chevrolet (5,910), Ford (4,912), Cadillac (4,344), and Hyundai (2,429). Tesla dropped 35.3% month over month but gained 2.2 percentage points of market share to reach 54.3%, as competitors faced even steeper declines. Rivian demonstrated relative resilience with the smallest decline among major manufacturers at just 14.7%.

Used EV Sales: In October, used EV sales reached 31,610 units, representing a 20.4% decline from September but still showing strong growth at 36.2% year over year. Market share fell to 1.9%, down 1 percentage point compared to the previous month. Tesla led the segment with 11,927 units sold, followed by Ford with 2,273, Chevrolet with 1,919, Audi with 1,754, and BMW with 1,708.

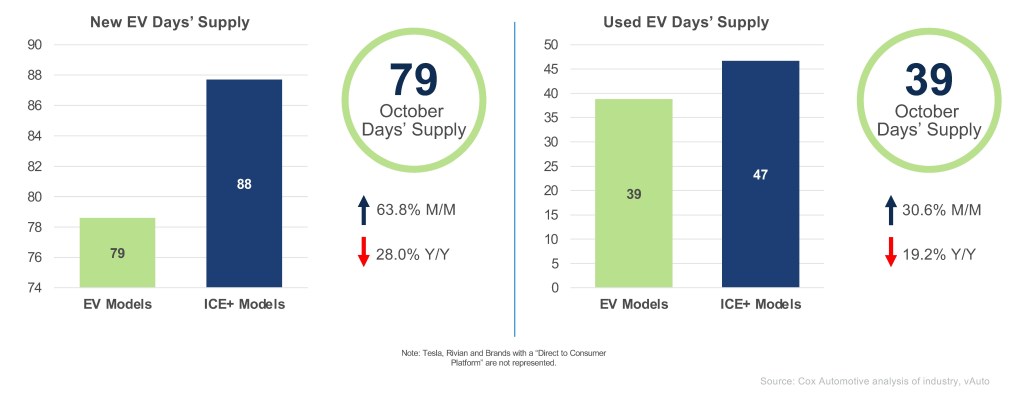

New and Used EV Days’ Supply – October

New EV Days’ Supply: In October, EV days’ supply rose sharply to 79 days – up 63.8% month over month and down 28% year over year – as sales momentum cooled and manufacturers continued adjusting production levels. This marks a significant reversal from September’s three-year low of 48 days. GMC maintained the highest days’ supply at 91 days, followed by Cadillac at 89 days and Ford at 71 days. On the opposite end, Subaru had the leanest inventory at just 8 days, while Toyota posted the largest month-over-month increase of 33 days, ending the month at 43 days of supply.

Used EV Days’ Supply: In October, used EV days’ supply rose to 39 days, up 30.6% from September’s 30-day low, though still below ICE+ levels for the eighth time this year. Supply varied widely by brand: Tesla had the tightest supply at 29 days’ supply, while Genesis led with 56, and GMC and Honda both had 55 days’ supply. Volkswagen posted the sharpest month-over-month gain, climbing 19 days’ supply to reach 40. Despite October’s improvement, overall supply was still 19.2% lower than a year ago, underscoring persistent inventory constraints in the used EV market. Note: Tesla figures reflect only vehicles available through traditional dealerships, excluding direct-to-consumer models.

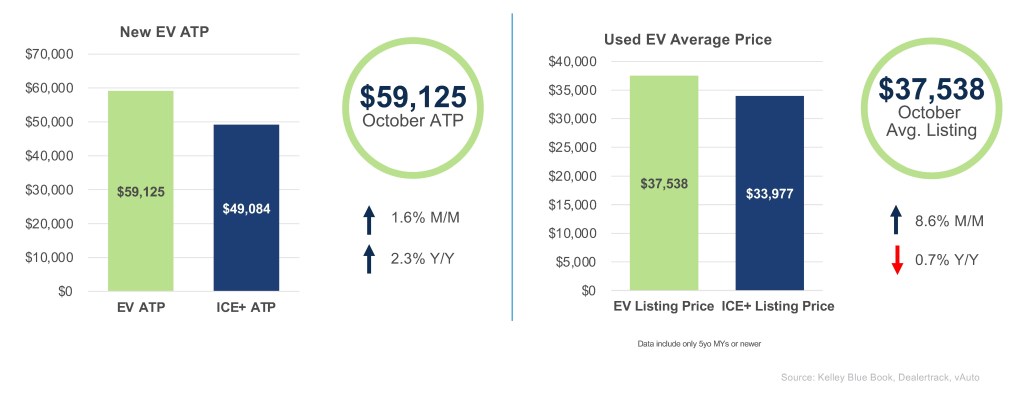

New and Used EV Prices – October

New EV ATP: In October, the average transaction price (ATP) for new electric vehicles climbed to $59,125, up 1.6% from September and 2.3% year over year. The price premium over internal combustion engine (ICE+) vehicles widened to $9,359, while incentives dropped to their lowest level of the year at 11.1% of ATP, or roughly $6,546. Porsche led all brands in month-over-month ATP gains with a dramatic 29.5% increase to $145,761, driven by the Taycan’s 35% jump and the Macan’s 1.3% rise. Higher-volume brands that led price increases included Chevrolet, up 5.4%, and Cadillac, up 5.1%. Tesla’s ATP declined 1.1% to $53,526, as its dominant sales volume continued to anchor the lower end of the EV price spectrum even as the overall market shifted upward.

Used EV Listing Price: The average listing price of used EVs surged 8.6% month over month in October to $37,538, though prices still sit 0.7% below year-ago levels. The October spike opened a $3,561 gap between EVs and ICE+ models, reversing September’s near parity between the segments. Thirteen makes posted price increases, led by Audi (12.2%), Tesla (9.5%), Subaru (9.5%), Chevrolet (7.8%), and Kia (4.8%). Despite the broad-based increases, 42 models remained priced under $30,000, with the Leaf remaining one of the most affordable at $12,166.

Looking Ahead

October’s sharp reversal marks the beginning of a necessary adjustment period as the EV market adapts to post-incentive realities. This correction will separate manufacturers with genuine cost advantages from those dependent on subsidies. Success will hinge on production discipline, pricing realism, and focus on the fundamentals: cost, confidence and convenience. The market isn’t retreating; it’s recalibrating to its natural pace.

The EV Market Monitor gauges the health of the new and used electric vehicle (EV) markets by monitoring sales volume, days’ supply and average pricing. Each metric will be measured month over month and year over year. For the latest detailed new-EV sales report, see the Q3 Electric Vehicle Report, the official quarterly report of EV data.