When Hyundai executives presented the 2026 Palisade Hybrid at a recent media drive event, they opened with a statistic that’s easy to overlook: Hyundai is now a top-five brand in 26 global markets and ranks in the top three in 12 of those markets. For an automaker that spent decades fighting for respectability in the shadow of Japanese and German competitors, Hyundai’s success – and the new Palisades specifically – marks a fundamental shift in the industry hierarchy.

The numbers back this up. Since the pandemic, Hyundai Motor Group – combined sales of Hyundai, Kia and Genesis – has climbed from seventh to fourth place in U.S. sales. The group first surpassed Honda in 2021, a historic milestone in its 35 years in the U.S. market and then leapfrogged Stellantis in 2023, selling 1.65 million vehicles. This steady climb can be attributed to a combination of product quality, strategic pricing, and powertrain diversity. The Palisade Hybrid isn’t just another powertrain variant. It’s a signal of how Hyundai plans to defend and extend that hard-won position during what might be the most uncertain period in automotive history.

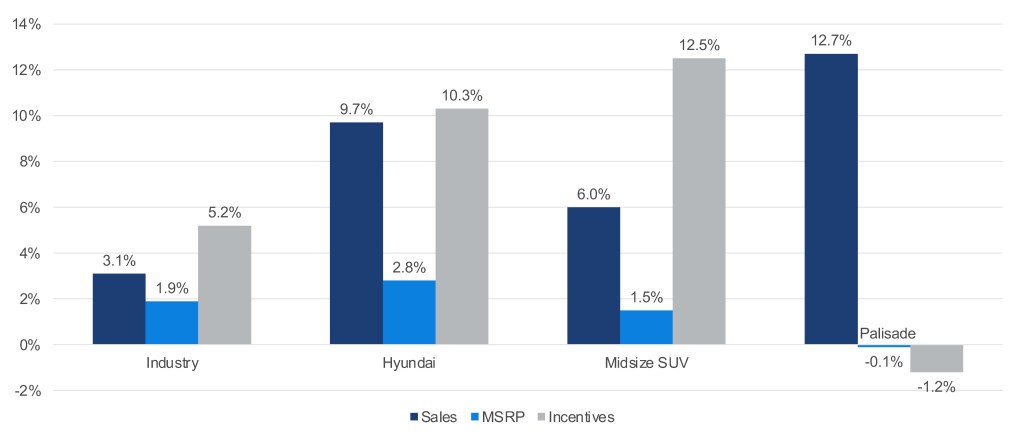

Key Stats: Year-Over-Year Comparison Year to Date

A Strategy Built on Options, Not Ideology

While some automakers push hard for full electrification as others pull back, Hyundai is taking a more flexible approach. The company plans to launch 18+ hybrid models by 2030, running parallel to its aggressive electric vehicle (EV) investments through the IONIQ brand.

With EV adoption plateauing and federal incentives expired, families are looking for electrification benefits without having to embrace the complexities of owning full EVs. The Palisade Hybrid delivers exactly that: 329 horsepower, up to 35 MPG, and a 630+ mile driving range. That extra $2,220 isn’t just about fuel savings; it’s about a better drive. The Hybrid delivers a smoother, more responsive experience, and over time, fuel savings will cover the premium.

Hyundai’s approach mirrors Toyota’s long-successful playbook to offer quality products across multiple powertrains, let customers decide what works for their lives, and avoid betting the entire company on a single technology pathway. It’s pragmatic, unsexy and increasingly vindicated by market reality. While every brand is saying it, Hyundai is following through.

Premium Positioning Becomes Permanent

The Palisade Hybrid also signals something more fundamental: Hyundai’s upmarket journey is permanent, not temporary. The Calligraphy trim commands over $54,000 today, and the Hybrid, produced in Korea with features like Nappa leather, integrated dashcams, 64-color ambient lighting, and “Stay Mode” that runs climate control off the battery without idling, pushes even higher into near-luxury territory.

This “accessible premium” positioning is smart in a market where consumers increasingly question why they’re paying badge premiums. Hyundai is offering luxury execution without luxury pricing, and its global rankings suggest buyers are responding. By bundling premium features with the hybrid powertrain, Hyundai justifies the price increase while protecting margins. In an era of steadily rising average transaction prices, Hyundai seems ready to answer the question: Why?

Reading the Signals

The Palisade Hybrid’s launch reveals three strategic priorities that will define Hyundai’s approach through 2030:

Signal 1: Flexibility over dogmatism. The 18+ hybrids by 2030 commitment, alongside continued EV development, confirms Hyundai isn’t betting everything on one electrification pathway. This portfolio diversity is expensive but provides insurance against market and regulatory uncertainty, especially given the flux in Corporate Average Fuel Economy (CAFE) standards depending on administration priorities and ongoing lawsuits.

Signal 2: Premium positioning is here to stay. Hyundai’s top-three ranking in 12 global markets wasn’t achieved by accident. It came from consistently delivering value while gradually raising quality and pricing. The Palisade Hybrid’s feature content confirms the brand believes its equity can support near-luxury pricing in key segments.

Signal 3: Customer choice over coercion. Rather than eliminating popular gas models or forcing customers toward EVs, Hyundai offers genuine options: gas Palisade, hybrid Palisade, and the IONIQ 9 EV. This acknowledges that consumers are diverse, their needs vary, and their willingness to adopt modern technologies moves at different speeds.

What This Means for the Industry

The industry has signaled that, for now, hybrid is the rightful next step towards electrification, and sales are already up 3.4% year to date over 2024. Palisade Hybrid’s launch helps Hyundai put a stake in the ground. The questions remain: Will mainstream buyers embrace hybrids as a long-term solution, or is this a transitional moment? Can “accessible premium” features reset consumer expectations about value and luxury?

As automakers reconsider all-in bets on EVs and instead hedge with hybrids and diversified lineups, all eyes will be on this shift in share for mainstream brands. However, the real impact will be seen in how automakers, suppliers and policymakers respond, balancing ambition with resilience as market and regulatory conditions continue to shift.

For a detailed review of the Palisade Hybrid’s features and driving experience, see this Kelley Blue Book review.