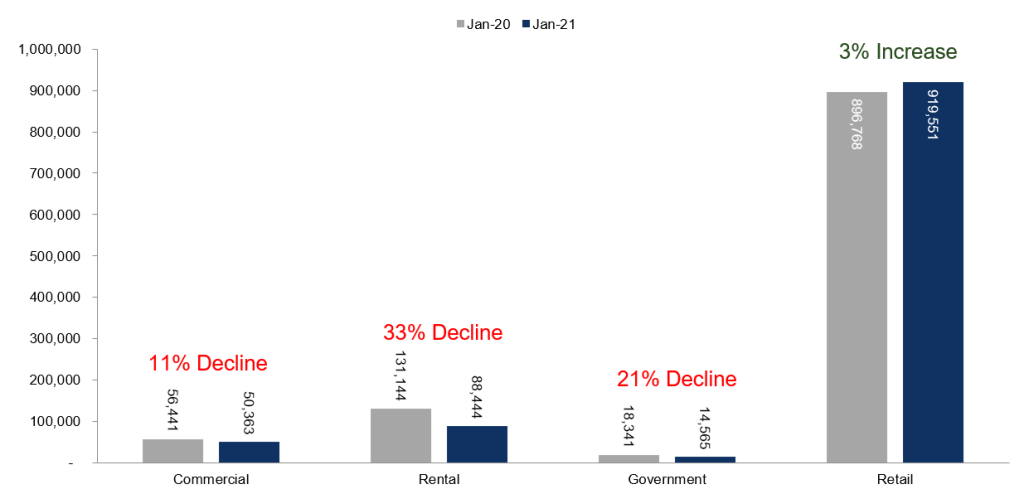

In January, 153,372 total fleet units were sold, compared to 165,713 in December. Combined sales into large rental, commercial, and government buyers were down 26% year over year in January.

Government units were down 21% year over year, on a small base, while rental units were down 33% year over year in January, an improvement over the 54% year over year drop in 2020. New-vehicle sales into the commercial channel declined 11% year over year in January. We estimate that the remaining retail sales were up 3% year over year in January, leading to an estimated retail SAAR of 14.0 million, up from 13.3 million last January but down from December’s 14.1 million rate.

January total new-vehicle sales were down 3.7% year over year, with one fewer selling day compared to January 2020. The January SAAR came in at 16.6 million, a decrease from last year’s 16.9 million but up from December’s 16.2 million rate.

Looking at automakers, year-over-year changes in fleet sales ranged from declines of 17% to 37%. Toyota showed the most resilience with a 17% year over year decline for January. Ford saw the largest decrease in fleet sales in January, according to a Cox Automotive analysis.