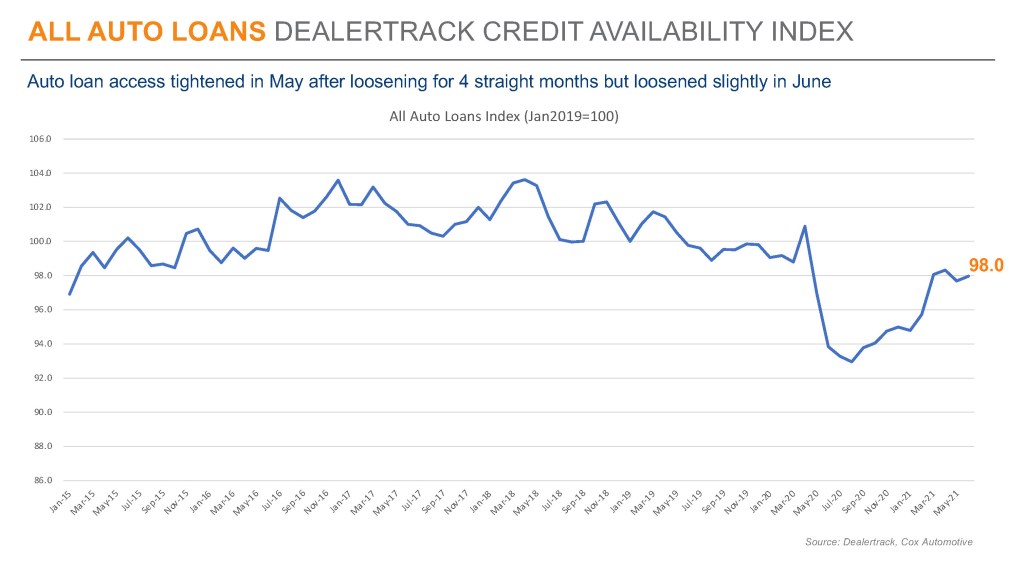

Access to auto credit improved modestly in June after tightening in May, according to the Dealertrack Credit Availability Index for all types of auto loans. The All Loans Index increased 0.3% to 98.0 in June, reflecting that auto credit was easier to get in the month compared to May. Access was looser by 4.4% year over year, but compared to February 2020, access was tighter by 1.2%.

All loan types loosened in June. Used CPO loans loosened the most, while New Loans loosened the least. On a year-over-year basis, all loan types were easier to get with non-captive new loans having loosened the most.

Credit standards movement was more varied across lender types in June. Credit accessed was unchanged at captives, loosened only slightly at banks and credit unions, and loosened the most at auto-focused finance companies. On a year-over-year basis, all lenders had looser standards. Auto-focused finance companies have loosened credit access the most year over year. Compared to February 2020, only auto-focused finance companies were looser in June, and credit unions had tightened the most.

The Dealertrack Credit Availability Index is a new monthly index based on Dealertrack credit application data and will indicate whether access to auto loan credit is improving or worsening. The index will be published around the 10th of each month.