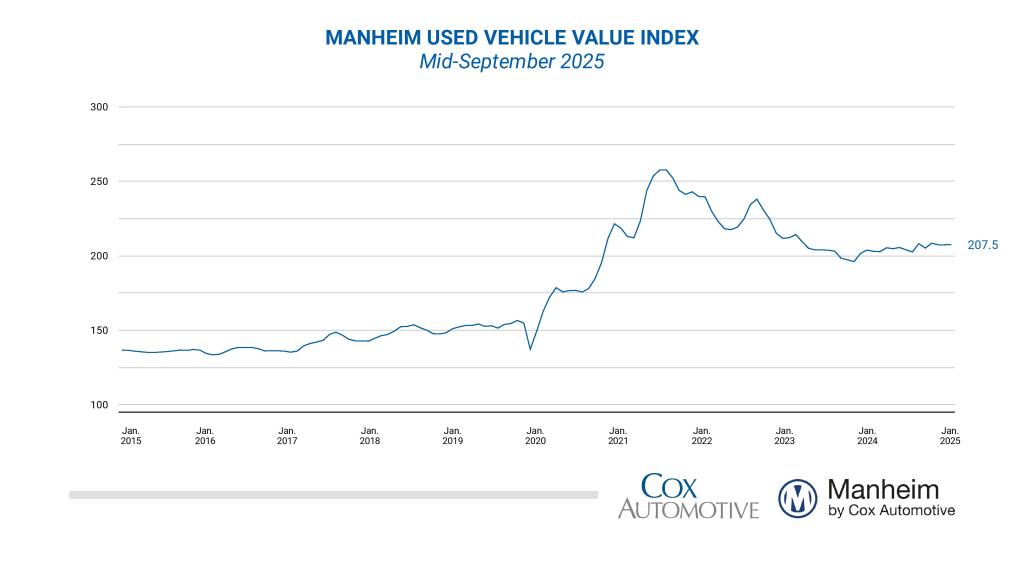

Wholesale used-vehicle prices (on a mix-, mileage-, and seasonally adjusted basis) increased slightly from August in the first 15 days of September. The mid-month Manheim Used Vehicle Value Index increased from 207.4 to 207.5—a negligible month-over-month change of 0.0%—but was 2.2% higher than the full month of September 2024. The seasonal adjustment reduced the results, as it was higher than typical. The non-adjusted price change in the first half of September rose 0.3% compared to August, and the unadjusted price is higher by 2.3% year-over-year. The average move for the full month of September is a decline of 0.3 percentage points for non-adjusted values, indicating the pricing moves observed so far in September are quite a bit stronger than normally seen for the full month.

“Wholesale values are continuing to buck traditional trends as they have for most of 2025, as prices have yet to return to normal depreciation levels,” said Jeremy Robb, Deputy Chief Economist for Cox Automotive. “We are continuing to see elevated new and used retail sales trends in the first part of September, and that is keeping retail days’ supply relatively tighter, pushing buyers through the doors at Manheim. As we approach the end of September, when tax incentives on EVs end, we are seeing demand trends that are keeping used EV sales strong and values even stronger, even as EVs rise in sales mix at Manheim. The automotive market continues to show resiliency overall, both at the retail and wholesale level, as they are tied so closely to each other.”

Over the last two weeks, the Manheim Market Report (MMR) prices for the Three-Year-Old Index declined by 0.5% in aggregate, falling in both weeks of September. The long-term average decline for 3-year-old values in the first two weeks of September is a decline of 0.6%, so MMR values fell at a slightly lower pace than normal. Over the first 15 days of September, MMR Retention, the average difference in price relative to current MMR, averaged 99.4%, showing that prices moved a bit below valuation models over the first half of the month, with a decline of 0.3 points from late August. MMR retention was up by 0.1% compared to the first half of September 2024, another period when demand was elevated at Manheim. The average daily sales conversion rate of 60.3% in the first half of the month was almost half a point higher than last year’s level of 59.9%, but down by one point from the end of August.

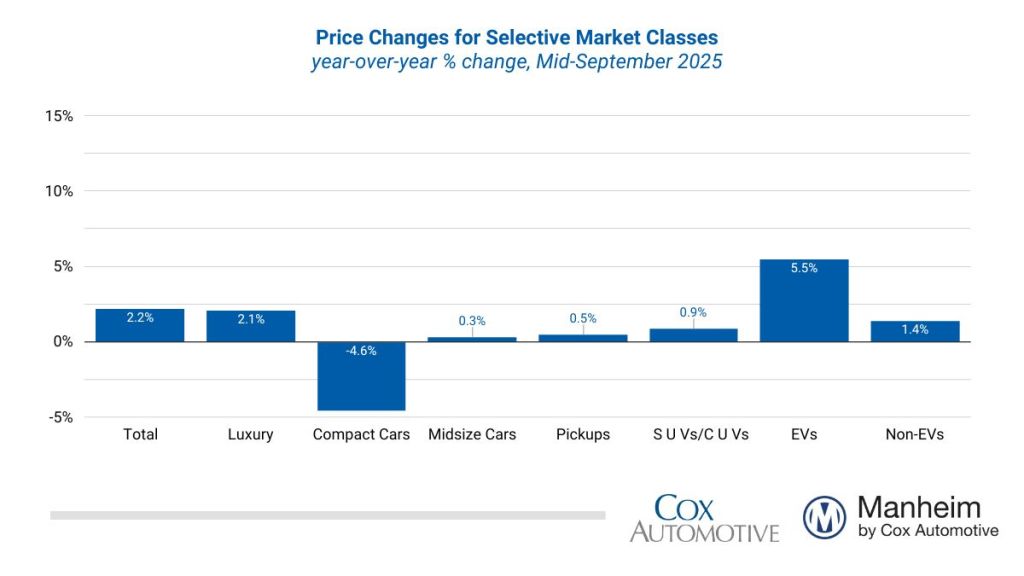

Results by segment for seasonally adjusted prices year-over-year in the first half of September were somewhat mixed. Compared to the industry’s year-over-year increase of 2.2%, the luxury segment performed best, rising by 2.1%, followed by SUVs, which were higher by 0.9%, with the truck segment rising 0.5%. Mid-size cars were higher by just 0.3% and the compact car segment declined the most, lower by 4.6% against last year. Against the full month of August, we observed the overall industry showed no change against the prior month, with mid-size cars outperforming with a 1.0% increase, while trucks rose 0.3%. The compact car segment was flat against August results, and SUVs were down 0.7%. Luxury fell the most, down 1.2% since the end of last month.

Electric vehicles (EVs) continue to show strongest year-over-year gains currently, as demand continues to be robust for these units. EVs showed a year-over-year increase of 5.5% in early September, while the non-EV segment increased by 1.4%. Against August values, EVs were on par with the industry, showing no change in the first half of September, while non-EVs were lower by 0.7% against August in the first half of the month.

Wholesale supply is unchanged in mid-September.

Leveraging Manheim sales and inventory data, wholesale supply ended August at an estimated 25 days, down one day against the end of July and down one day compared to August 2024 (at 26 days). Wholesale supply remains tight for this time of the year, running roughly two days lower than the longer-term levels for this week. As of September 15th, wholesale supply has not changed since the end of August, at 25 days, and was 5% (1 day) lower versus last year.

Consumer sentiment lower in first half of September.

The initial reading in September of the sentiment index from the University of Michigan decreased 4.8% and was worse than expected. With the decline, the index was down 21% year over year. Views of current conditions and expectations both declined, but current conditions declined the most. Expectations for inflation in one year remained at 4.8%, but expectations for inflation in five years increased to 3.9% from 3.5%. Consumers’ views of buying conditions for vehicles declined modestly and were worse than one year ago as views of car prices deteriorated but views of interest rates were unchanged. The daily index of consumer sentiment from Morning Consult shows a similar downward trend with data through September 15. After increasing in July and August, the index has reversed course and is down 2.9% so far in September. Views of current conditions and future expectations both declined in the first half of September, but views of future expectations declined the most. The average price of unleaded gasoline is little changed midway through September, registering a decline of 0.1% for the month as of September 15th to $3.19 per gallon, which was down just 1% year over year but up 4% year to date.