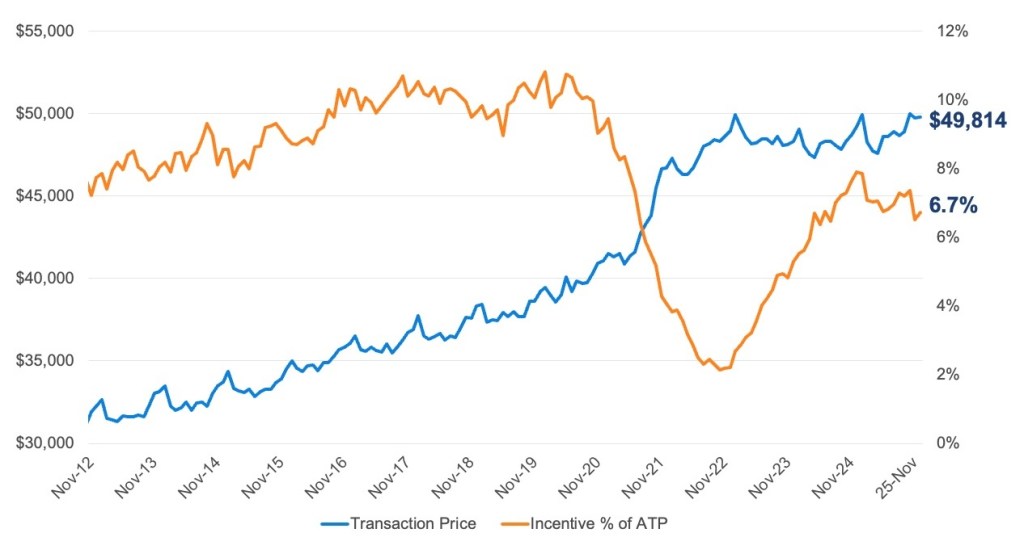

The average transaction price (ATP) of a new vehicle in the U.S. moved higher in November, according to estimates released today by Kelley Blue Book, a Cox Automotive brand. New-vehicle prices have been increasing steadily – albeit slowly – for more than a year now. After peaking in September, prices have remained mostly stable at just under $50,000. Prices are expected to move higher this month, as new-vehicle prices typically peak in the final month of the year, as a rich mix of expensive vehicles is sold.

New-Vehicle Average Transaction Price

- The new-vehicle ATP in November was $49,814, up 1.3% year over year and mostly unchanged from October ($49,760). The elevated ATP continues to reflect a market heavily influenced by affluent households.

- The average incentive package in November was equal to 6.7% of ATP ($3,347), down notably from one year ago when incentive spending was at a three-year high of 7.9% of ATP. Incentive spending in November was higher compared to October, when incentives averaged 6.5% of ATP. In 2025, incentive spending has averaged roughly 7.0% of ATP.

- The average new-vehicle manufacturer’s suggested retail price (MSRP) – commonly called “the asking price” – was higher by 1.7% year over year in November. The MSRP also increased month over month, gaining 0.3%. The average new-vehicle MSRP – at $51,986 – has been above $50,000 since April, as a rich mix of expensive vehicles sold each month continues to drive elevated pricing.

- In November, the average MSRP for a full-size pickup was above $70,000 for the third straight month. At $70,178, the average MSRP was 1.8% higher than in November 2024 and mostly unchanged from October. Incentives held steady as well, measured at 8.4% of ATP. Nearly 183,000 full-sized pickup trucks were sold last month, accounting for 14.2% of total sales.

- New vehicles sold in November with an MSRP below $30,000 accounted for 7.5% of total sales last month, down from 10.3% in November 2024, as lower-priced vehicles continue to struggle in the U.S. market. The most popular under-$30,000 vehicles last month were the Toyota Corolla, Chevrolet Trax and Hyundai Elantra. (Note: 10.8% of vehicles sold last month had MSRPs over $75,000.)

Industry Average Transaction Price Versus Industry Average Incentive Spend as % of ATP

Quote from Erin Keating, Executive Analyst, Cox Automotive

“The average price for a new vehicle in the U.S. remains near $50,000, with no indication of softening,” said Cox Automotive Executive Analyst Erin Keating. “It’s important to remember that the KBB ATP reflects what consumers choose to buy, not what’s available. Many new-car buyers today are in their peak earning years and are less price-sensitive, opting for vehicles at the higher end of the market to get the features and experiences they value most. In November, sales of vehicles priced above $75,000 outpaced those below $30,000, underscoring this preference for premium products.”

Electric Vehicle Prices Drop, Incentive Increase as EV Market Searches for New Normal

- The average price for a new electric vehicle (EV) in November was $58,638. The EV ATP climbed 3.7% year over year, but was down 0.8% from October. Incentives as a percentage of ATP were 13.3%, which is 4.1% lower than in November 2024 but 20.1% higher than in October.

- EV Sales were weak for the second straight month, according to initial estimates from Kelley Blue Book. At just over 70,000, sales were lower by more than 40% year over year and down roughly 5% from October. A full report on November EV sales will be released next week.

- Tesla’s ATP was $54,310 in November, down 1.7% from one year ago but up 1.5% from October. Sales declined for the second straight month and were down 22.7% year over year in November, beating the segment, mostly due to significant declines in the popular Model 3, which fell 42.1% year over year and 11.9% month over month. The Model Y, the most popular EV sold in the U.S., saw prices increase modestly in November, up 0.9% both year over year and month over month. Sales volume was 0.5% lower than in November 2024 but 2.5% higher than in October.

- Tesla Cybertruck, at one point the best-selling vehicle priced over $100,000, saw sales fall to 1,194 units in November, the lowest volume of 2025. Cybertruck prices in November, at $94,254, were higher year over year and compared to October.