Heading into 2026, the U.S. auto industry faces a stable yet uneasy environment. Affordability will go down as one of the most-used buzzwords of the year, yet in new-vehicle sales and pricing, the story remains one of a slow, sustained upward trajectory. Even with talks of bringing more “affordable” subcompact cars to market, sales and inventory data show that it’s the large SUVs and trucks that continue to win the day.

3.01M

Total Inventory

as of Dec. 1, 2025

90

Days’ Supply

$49,422

Average Listing Price

According to Cox Automotive’s vAuto Live Market View data, new-vehicle inventory levels began December at about 3 million units, down 6% from the same timeframe of 2024 and a 90-day supply, down from 91 last year. Meanwhile, the new-vehicle sales pace over the past 30 days was 4.3% below 2024 levels. The narrative: Softer demand, but stable supply. Automakers are cautious, keeping inventory in check rather than flooding dealer lots, and monitoring demand signals closely.

The Inventory Holding Pattern: Stability or Stalemate?

Month over month, inventory levels have been consistent, increasing only slightly from the revised 2.97 million in early November to 3.01 million at the start of December. The sales pace in November improved slightly compared to October as well, suggesting good inventory management, as days’ supply held steady month over month at 90 days, as automakers balanced production with consumer demand. This reflects a mature approach, moving away from overproduction of past cycles and setting the stage for new pricing and incentive strategies in 2026.

Brand Divergence: The Gap Widens

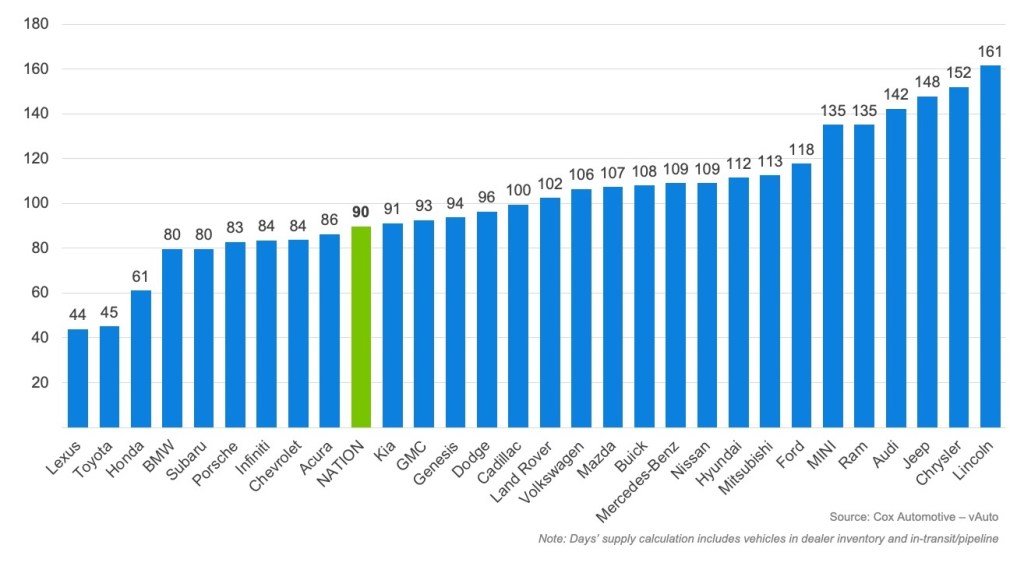

Beneath the national averages, individual brands face starkly different realities. The usual suspects, Toyota and Lexus, move inventory quickly, 45- and 44-days’ supply, respectively. Others, such as the Stellantis brands Chrysler, Jeep and Ram, as well as the luxury brand Audi, lag far behind, with a supply of 130 days or more. Brands with a balanced approach to inventory, including Honda, BMW, Subaru and Chevrolet, highlight the importance of product-market fit.

November Days’ Supply of Inventory by Brand

The Affordability Paradox: Prices Hold as Volume Softens

Due perhaps to weaker year-over-year demand, automakers have worked to keep average listing prices steady at $49,422, up 1.4% year over year and 0.6% above the start-of-November level. The $40,000 to $50,000 segment, crucial for volume, shows the highest days’ supply at nearly 100 days, signaling strong price resistance among mainstream buyers. Vehicles under $40,000 move faster, and luxury models over $80,000 maintain robust turnover, with dealers confident in selling newer models at premium prices. The industry prioritizes price discipline over volume, a strategy that may be a challenge to maintain if demand weakens in the luxury segments moving forward.

Model-Year Turnover Normalizes

Across all makes, inventory is now dominated by 2026 models, which make up 60.3% of the mix of available vehicles, while just 0.5% are prior-year (MY 2024) vehicles, a sign of healthy turnover. Automakers appear poised to strategically deploy incentives this holiday season, offering discounts on harder-to-move metal while protecting margins in segments that typically sell to affluent buyers.

What This Means for Year-End and Beyond

As the year ends, automakers are likely to offer more aggressive incentives on remaining 2025 models, especially in the hyper-competitive $40,000 to $50,000 range. Luxury vehicles should finish strong, as they historically do in December, while mainstream brands must choose between deeper discounts or carrying older inventory into 2026. The affordability crisis persists for lower-income households, even as inventory remains available in models selling well below the industry average transaction price.

Current inventory levels are manageable, but underlying demand appears soft. Strong sales earlier in the year will likely carry industry sales volume above 2024 levels by year-end. The good news is that the industry appears more disciplined than in past boom-bust cycles, but challenges like affordability, higher costs, and the EV transition remain unresolved. The first quarter of 2026 will be critical in determining whether current strategies can hold or if more significant changes are needed.