The U.S. automotive industry is rolling into the year-end, holiday-sales season with a steady hand, think “confident, but not overzealous.” Inventory is slowly climbing, yet both measures of total volume and days’ supply haven’t reached last year’s levels, so it’s clear this market isn’t getting ahead of itself. Cox Automotive’s read on vAuto Live Market View data suggests a sense of equilibrium, showing things are settling in rather than speeding up.

2.97M

Total Inventory

as of Nov. 3, 2025

88

Days’ Supply

$49,143

Average Listing Price

In early November, the number of available new vehicles in the U.S. hit 2.97 million units, up 4.2% from last month, but still trailing last year’s count by 5.7%. Automakers seem to be walking a line between refilling lots and keeping incentives on a tight leash. The fact that they’re holding this balance, especially after a strong third quarter, really speaks to the industry’s discipline and strategic mindset.

Brands Facing Rising Supply and Shifting Demand

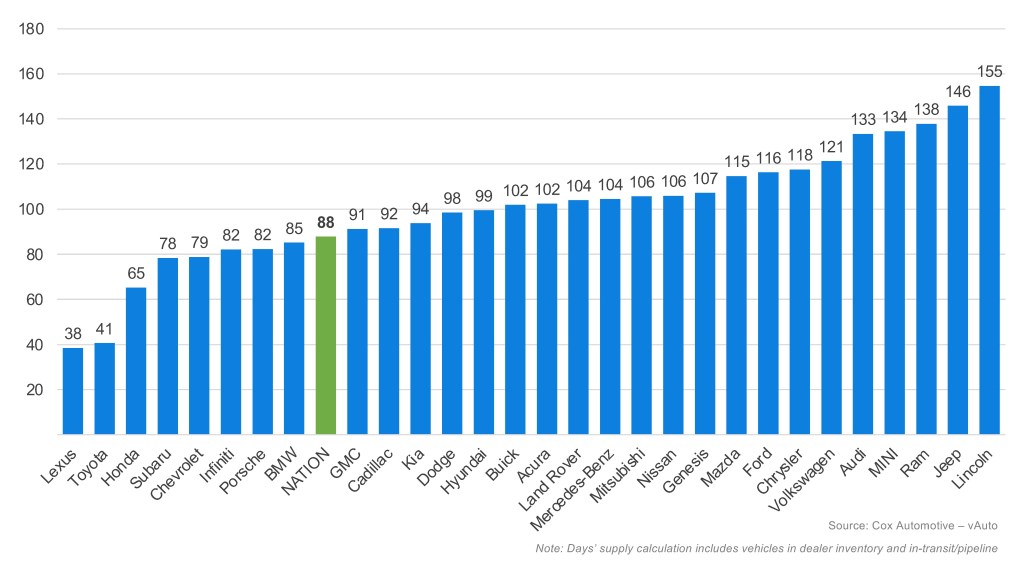

Looking at mainstream brands, recent inventory trends reveal that some manufacturers may be edging toward overstocked territory as consumer demand shifts. Cadillac’s days’ supply surged by 15% from a month earlier, signaling a potentially risky buildup if sales don’t keep up. Jeep’s situation is even more pronounced, with a 24% jump in days’ supply and a 13% increase in inventory, driven by models like the Cherokee, Compass and Wrangler, putting the brand at a high-water mark for 2025 and close to having more vehicles than the market might absorb.

For low-volume brands, Porsche’s inventory level rose 12%, a substantial increase that could lead to excess supply if demand softens. Even Mazda and Mercedes-Benz, with slower sales, are accumulating more vehicles on their lots, which may force them to rethink their strategies if these trends continue. Bottom line? Automakers are walking a fine line, and rising inventories could quickly shift from strategic flexibility to a liability if stock outpaces sales momentum.

October Days’ Supply of Inventory by Brand

Balancing Days’ Supply and Demand

In early November, industry-wide days’ supply ticked up to 88, a modest 2.9% rise since the end of September but still 3.8% below last year. The 30-day sales pace increased modestly in the latest data, but overall inventory is increasing faster. This signals a changing balance between supply and demand, with automakers needing to play it smart to keep the market humming. Days’ supply has been steadily increasing since August, with certain brands being more exposed to higher volumes and higher risks.

Average Listing Price Sees a Slight Dip

The average listing price clocks in at $49,143, a slight 0.4% dip from September but a 2.2% bump from October 2024. Even with rising production costs, prices are holding their ground. The big SUVs and pickups are still winning over buyers, and while most brands saw prices ease, Cadillac, Chrysler and Porsche all posted gains of 5% or more. Cadillac’s CT4 and CT5 models actually saw simultaneous jumps in price and sales, with the Escalade still leading the charge. Chrysler’s Voyager, meanwhile, got pricier but saw a minor drop in sales. Notably, minivans across the board are down with one exception: the forever-reliable Toyota Sienna. Despite rising inventory, Porsche’s lineup remains strong regardless of higher price tags.

Evolving Sales Patterns Amid Industry Shifts

October brought steady momentum, with new-vehicle sales nudging up 1.2% from the previous month but dipping 2% year over year. The standout shift was a sharp drop in electric vehicle (EV) sales after September’s big spike, but that was balanced by healthy demand for SUVs, performance cars and full-size pickups. At Hyundai, gas models flew off the lot, even as EVs took a breather. This back-and-forth highlights how the industry can pivot quickly, with traditional segments still holding plenty of sway.

Some top brands felt more pressure than others, as consumer tastes and segment strengths kept shifting. Jeep’s 30-day sales slipped 9.2%; Cherokee, Wrangler and Wagoneer all played a part. Volkswagen’s 14.7% slide was mostly thanks to its EV lineup. Porsche dropped 11.3%, yet its core models are still going strong.

What to Expect

As we gear up for a season of holiday sales, the U.S. auto industry finds itself at an intriguing crossroads. Manufacturers are fine-tuning their playbooks, but one thing’s clear: American buyers still love their SUVs, especially the big ones, and pickups. Luxury and other high-priced vehicles are typically hot commodities during year-end sales. With the market already favoring higher-end models, expensive cars could finish the year strong, but they don’t account for big volume. With affordability on everyone’s mind, expect more folks to lean toward smaller SUVs and crossovers rather than abandoning these segments altogether.

Looking ahead, price hikes are likely in 2026 as tariff costs continue to weigh on automakers, and that’s bound to influence both buying habits and industry strategy. On the EV front, sales may keep cooling off after Q3’s record run, but the surge has opened more eyes to electric options. If pricing and incentives are just right, demand could bounce back. Automakers are clearly recalibrating their EV output, pullbacks seem to be the current trend, but it’s a storyline to follow into next year.

Smart inventory management and savvy pricing will be crucial for keeping dealer lots on an even keel. If automakers stay flexible – ready to respond to affordability challenges, tariff shifts, and changes in production – they’re set up to weather near-term bumps and grab future opportunities. Heading into 2026, cautious optimism is the name of the game.