New-vehicle inventory increased in September as the sales pace slowed in the final two weeks of the month. Days’ supply increased as well. The volume of model-year-2026 vehicles continues to grow, pushing the average listing price higher as expected. At the start of October, roughly 41% of available new vehicles were MY2026 units, up from 25% at the start of September.

2.87M

Total Inventory

as of Oct. 6, 2025

84

Days’ Supply

$49,394

Average Listing Price

There were 2.87 million new vehicles available on dealer lots at the start of October, according to vAuto Live Market View data, an increase of 4.8% increase month over month. A year earlier, inventory volume was lower, at 2.71 million. Inventory at the start of the month was similar to the levels seen in the first quarter and has been generally increasing since late spring, when volume fell to 2.47 million at the end of May.

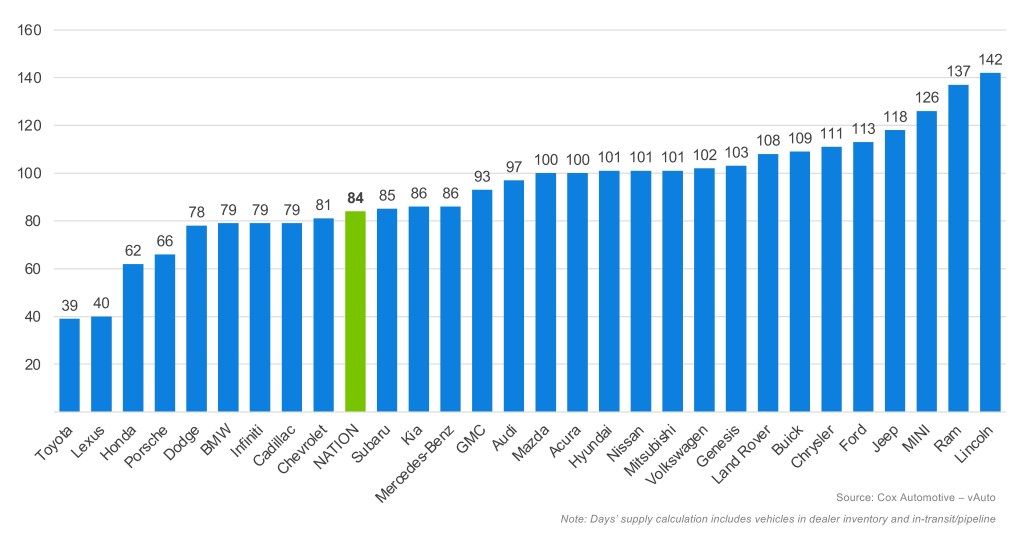

A slowing sales pace in the latter part of September helped push the days’ supply measure higher to 84 at the end of the month, up from an upwardly revised 78 days a month earlier. Days’ supply at the end of September was up 7.2% month over month and higher year over year by 1.6%. At 84 days, the supply measure is now at the highest point since Q1.

September Days’ Supply of Inventory by Brand

Days’ Supply Measures Increase for Most Automakers

The increase in inventory was mostly uniform across the industry, with a majority of brands starting October with more inventory compared to the previous month. Nearly half of the brands measured in the vAuto Live Market View data had days’ supply in excess of 100 as the fourth quarter began, suggesting an industry-wide softening of sales. More than two-thirds saw general increases. Toyota and Honda, two brands that typically operate with tight inventory, saw sales slow in September and inventory increase. Toyota’s days’ supply increased more than 10% month over month, and Honda jumped by nearly 18%. Automakers bucking the trend with lower month-over-month days’ supply include Cadillac, Porsche, Mercedes-Benz and Infiniti.

Due to a recent fire at an important supplier, inventory for key Ford and Lincoln products, including the best-selling Ford F-150 pickup and the profitable and popular Expedition and Lincoln Navigator full-size SUVs, could be under pressure in the coming months. At the start of October, Ford’s popular F-150 model had a days’ supply measure of 105, a typical level for a full-size pickup truck. Expedition days’ supply across the two models was close to 80 days, while Lincoln Navigator days’ supply was elevated at 113 across the two models. Ford brand’s days’ supply has been increasing in recent months. At the end of September, Ford’s days’ supply stood at 113, up 12% from the previous month. Lincoln days’ supply at the start of the month was 142, close to the highest level all year.

Average Listing Prices Trend Higher as MY2026 Vehicles Arrive

With a stronger mix of MY2026 vehicles on dealer lots, the average listing price of a new vehicle climbed further to $49,394, up 1.6% month over month and higher year over year by 3.6%. The average listing price peaked in December of 2024, at $49,853. Vehicle prices typically peak in the final months of the year, as a higher mix of luxury and high-end vehicles is sold. In September, the average transaction price of the new vehicles sold hit a record high and was above $50,000 for the first time ever. Read more here.

Looking Ahead

Cox Automotive has been expecting vehicle sales to cool somewhat in Q4, as higher prices begin to trickle through to the retail level and sales slow from a relatively strong pace in Q3. Sales of electric vehicles are also expected to slow in the months ahead, after setting a record in Q3 ahead of government-backed sales incentives being terminated. With slower sales, days’ supply is expected to increase further, which will likely lead to higher incentive levels. In September, as vehicle prices marked an all-time high, the average incentive package peaked for 2025 at 7.4% of ATP.