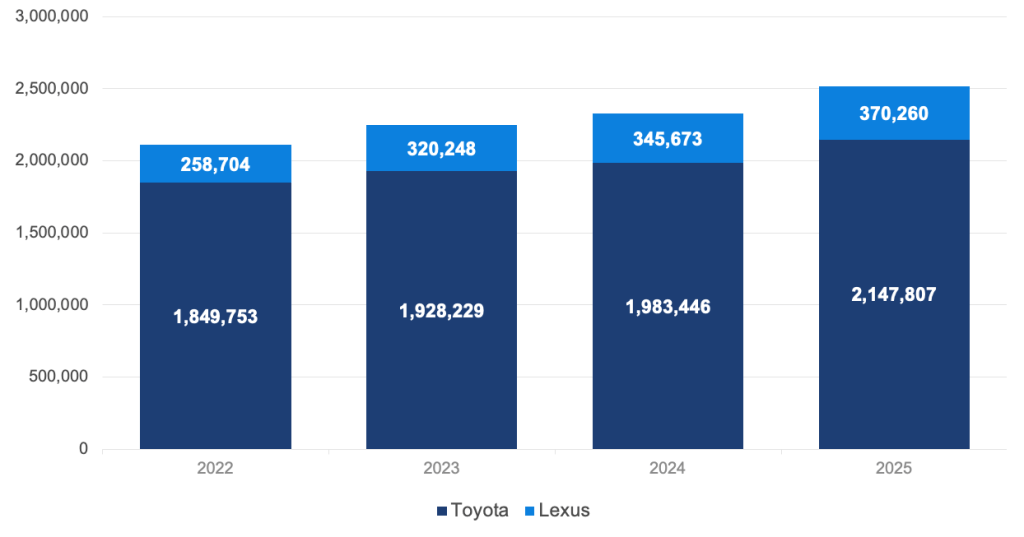

Toyota Motor North America reported 2025 U.S. sales of 2,518,071 vehicles, up 8.0% year over year, outpacing the broader market in a year marked by tariff volatility and shifting electric vehicle (EV) incentives. Electrified vehicle sales for the hybrid pioneer reached 1,183,248 units, up 17.6% year over year and representing nearly 50% of Toyota’s total sales. This performance stands out in a year when the industry finished at 16.3 million units, the best result since 2019 but still well below the 17.5 million high-water mark from a decade ago.

Six Toyota vehicles have MSRPs starting under $30,000, a critical advantage when affordability remains a top challenge for many consumers. According to Cox Automotive forecasts, the industry faces ongoing affordability constraints at the start of 2026, with average monthly finance payments hitting $767 in December 2025, the highest level in 18 months. New-vehicle affordability pressures are expected to keep total sales around 15.8 million in 2026. Still, in 2025, Toyota grew market share with standout new vehicles, including the Corolla Cross, which grew solidly in a crowded segment, up 7.3% despite strong competition.

This success isn’t accidental, nor is it captured in a single vehicle or segment. A quick trip to Sonoma Raceway in late September reminded me that in a K-shaped economy where only four automakers gained share in 2025, diversification in the product portfolio matters. At this iconic track in wine country, Toyota hosted a unique event to showcase the new 2026 Corolla Cross while highlighting the company’s performance lineup. Giggles ensued as the joys of a manual transmission reignited.

For mass-market brands, trying to stay relevant across a vast product spectrum while navigating the transition to electrification, times are challenging at best. Toyota’s answer: Challenge accepted! With a small but mighty portfolio of performance vehicles, Toyota continues to create an outsized impact on brand perception. But the performance models are only one reason that Toyota continues to be one of the most envied brands in the U.S. auto industry. In 2025, Toyota remained the most considered non-luxury and electrified brand according to Kelley Blue Book’s annual Brand Watch study, while its luxury sibling, Lexus, held on to the top spot.

Toyota Motor Company U.S. Sales Volume

Performance Credibility Drives Brand Value

Toyota’s GR lineup – GR86, GR Corolla and GR Supra – accounts for less than 1% of U.S. volume, but its influence extends far beyond the volume. These vehicles validate engineering at the highest level, with lessons from racing and track durability informing mainstream product development. This isn’t promotional theater; it’s genuine R&D driven from the top. Company scion Akio Toyoda, master driver “Morizo” himself, instills a “push, break, learn, repeat” mantra. Engineers rotate through GR assignments, learning split-second decision-making under pressure before returning to mainstream products. When Toyoda delayed the GR Corolla launch a year to ensure it had sufficient “untamed energy,” he signaled that performance credentials must be earned, not marketed.

This authenticity shifts brand perception across the portfolio. Even buyers of mainstream models like the Camry Nightshade, which attracts customers nine years younger on average than the typical Camry buyer, are influenced by Toyota’s reputation for building track-capable vehicles. In a bifurcating market where consumers increasingly choose either affordable transportation or premium experiences, this halo effect provides crucial differentiation.

Strategic Electrification

Toyota’s “1:6:90” philosophy reflects strategic pragmatism: The rare materials needed to create one battery-electric vehicle (BEV) could produce six plug-in hybrids or 90 hybrids. Rather than betting solely on BEVs, Toyota maintains multiple powertrain pathways to meet consumers wherever they are on the adoption curve.

This approach proved prescient in 2025. After federal EV tax credits expired on Sept. 30, EV retail share fell to 5.8% in Q4 2025, down 2.9 percentage points from the prior year. Meanwhile, conventional hybrid sales climbed 27.6% to 2.05 million units for the full year. Toyota’s electrified portfolio – spanning gas, hybrid, plug-in hybrid, and the forthcoming Lexus LFA Concept BEV – positions them to serve customers across the spectrum as the market adjusts to a post-incentive landscape.

Affordability and Manufacturing Advantage

Entry-level listing prices have climbed significantly, with average new-vehicle listing prices reaching $50,465 in December 2025, according to Cox Automotive’s vAuto Live Market View data. Toyota clocked in with an average listing price of $43,208, over 14% less than the national average. Toyota’s domestic manufacturing footprint provides tariff protection that competitors importing complete vehicles don’t enjoy. In early November, Toyota began production at its first U.S. battery plant in North Carolina. Toyota reported that this represents a nearly $14 billion investment, creating up to 5,100 jobs. At the opening, it announced another $912 million investment across five manufacturing plants.

Platform sharing and manufacturing efficiency through Toyota New Global Architecture (TNGA) allow R&D costs to be spread across multiple vehicles while maintaining segment-specific tuning. These structural advantages help Toyota keep prices accessible, maintaining “among the lowest incentives among full-line manufacturers” per their 2025 year-end results, even as industry-wide affordability pressures intensify.

Managing Complexity, Simplifying Choice

Operating 24 nameplates with multiple powertrains creates complexity. Toyota manages this through 12 regional offices analyzing local demand monthly, ensuring full complexity doesn’t overwhelm any single market. They also simplify strategically, the 2026 GR Corolla, for example, drops from three grades to two, making it easier for enthusiasts to find their ideal configuration.

Beyond managing operational complexity, Toyota builds brand relevance across generations through non-traditional channels. The “Grip” anime series features GR vehicles as heroes, while “The Pitch” video series generated 16 million views. Partnerships with LEGO and Hot Wheels ensure GR vehicles inhabit aspirational cultural spaces. For Gen Z, engaging with “Grip” today may translate into purchase consideration years later, a long-term brand investment that complements short-term sales strategies.

Looking Forward

Toyota’s strategy of maintaining broad accessibility while building performance credibility through focused investments positions the brand uniquely as the industry transforms. The company is not abandoning enthusiast products, recognizing the outsized brand impact these vehicles deliver. Nor is it narrowly betting on the timing of electrification. Instead, Toyota is maintaining multiple powertrain pathways to reach a maximum customer base.

Cox Automotive data suggests this approach is working. Strong overall sales growth, combined with outsized performance in enthusiast segments, indicates Toyota is successfully threading the needle between accessible and aspirational. In a market increasingly defined by affordability constraints and electrification uncertainty, Toyota’s unique positioning looks increasingly valuable.

For a detailed review of the 2026 Toyota GR86 features and driving experience, see this Kelley Blue Book review.