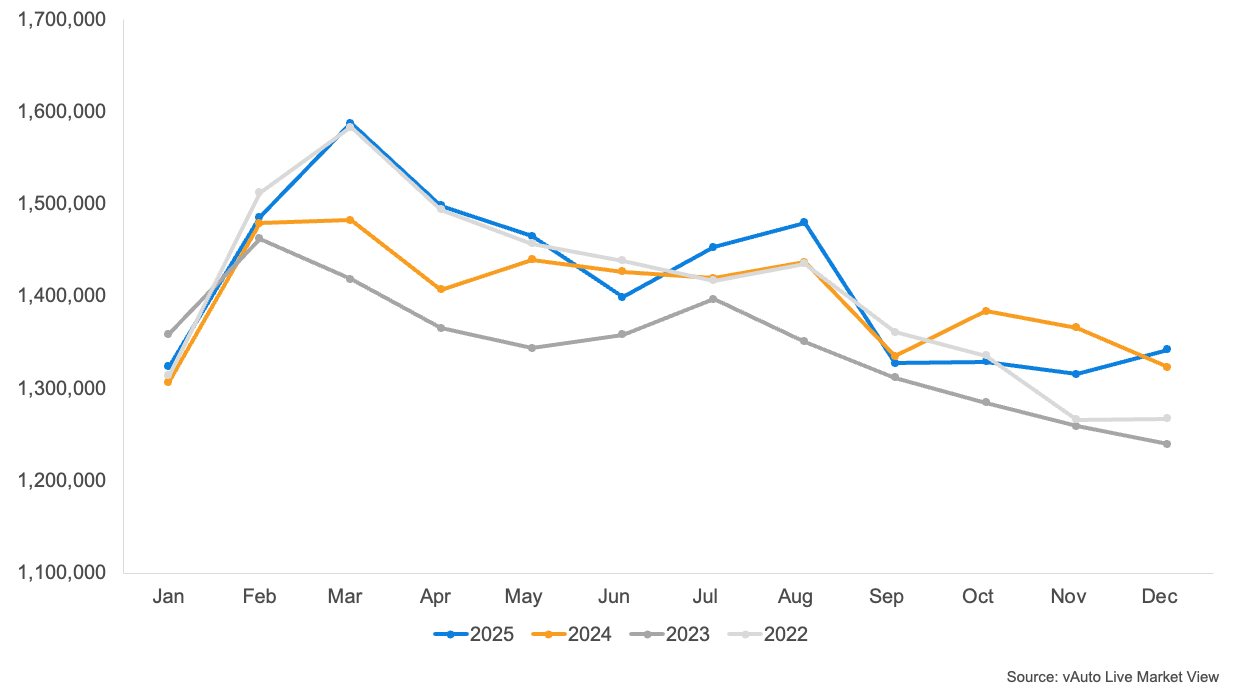

According to an analysis of Cox Automotive’s vAuto Live Market View data estimates, retail used-vehicle sales in December1 were higher than a year ago and outpaced November sales.

A total of 1.34 million used vehicles were sold at retail – from both franchised and independent dealers – during December, up 3% year over year and 2% month over month. Days’ supply of used vehicles in the most recent report was 49, up one day compared to the same time last year and down one day from November.

Monthly Used-Vehicle Retail Sales Volume

“December showed unusual growth during a month that typically sees a slowdown, capping off a used-vehicle market that exceeded expectations in 2025,” said Scott Vanner, manager of Economic and Industry Insights at Cox Automotive. “However, we anticipate a modest sales decline in 2026 as economic pressures and constrained supply from lower production volumes continue to weigh on the market. That said, Q1 could be a bright spot with strong sales driven by larger-than-expected tax refunds.”

The retail used-vehicle sales estimates are based on observed unit changes tracked by vAuto, a Cox Automotive brand specializing in inventory management. The vAuto Live Market View database provides guidance on sales pace and volume over time. Full-year sales volume, based on registrations and other sources, is updated annually.

CPO Sales Up in December

Certified pre-owned (CPO) sales increased 1.7% year over year in December, according to data reviewed by Cox Automotive. CPO sales in December were up 7.9% month over month, outperforming the broader new-vehicle market. December’s CPO sales are estimated at 220,803, up from 204,619 in November. Total CPO sales finished 2025 as expected at 2.61 million, up 2.1% from last year.

Used-Vehicle Market Forecast and Outlook for 2026

Cox Automotive forecasts retail used-vehicle sales in 2026 to reach 20.3 million, down 0.7% from 2025. Sales are expected to decline slightly compared to the stronger-than-expected 2025 performance. Retail and wholesale supply will remain constrained in the coming year, driven by lower production and fewer lease maturities returning to the market, though lease maturities will rise over the year.

The 2026 CPO forecast is for sales to decline mildly but still rounding to 2.6 million. Fewer new sales – leading to lower CPO inventory levels – and weaker buying conditions will be the key headwinds for CPO sales in 2026.

1The estimated monthly retail used-vehicle sales number is based on vAuto Live Market View data from the most recent 30-day period. This change aligns the sales data in the monthly estimated sales report with the monthly inventory report. The historical data in the downloadable file has been updated to reflect comparable 30-day sales data. The 2024 implied sold and days’ supply numbers affected by the CDK outage have been normalized.