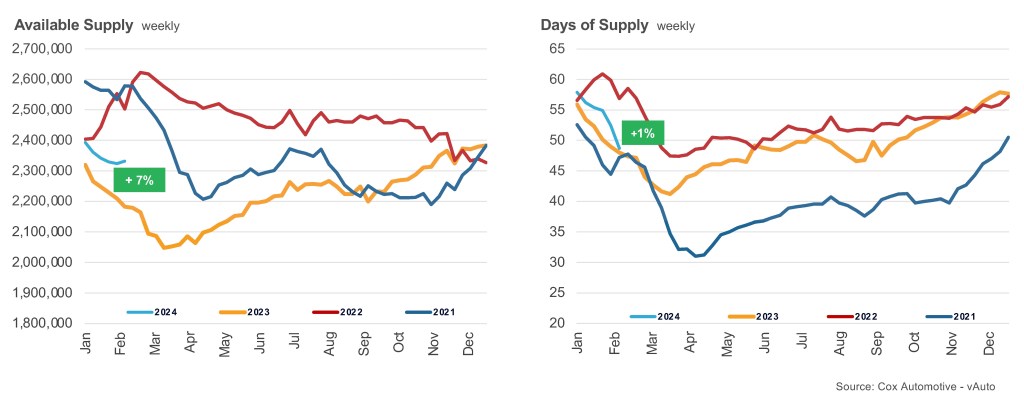

Used-vehicle inventory opened February at lower levels than it closed 2023, according to the Cox Automotive analysis of vAuto Available Inventory data.

2.33M

Total Unsold

Used Vehicles

as of Feb. 5, 2024

49

Days’ Supply

$25,638

Average Listing Price

69,240

Average Mileage

The total supply of unsold used vehicles on dealer lots – franchised and independent – across the U.S. stood at 2.33 million units as February opened, up 7% from a year ago but down from the revised 2.39 million units at the start of January.

Total days’ supply at the start of February fell to 49, compared with the revised 58 at the beginning of January. The days’ supply is down 16% compared to the start of the year, as sales of used-vehicles picked up in the month and inventory decreased. Days’ supply has been in the 50 to 58 range since the end of September 2023 and remained up 1% from year-ago levels.

USED-VEHICLE INVENTORY VOLUME AND DAYS’ SUPPLY

Available inventory volume was up 7% year over year, while days’ supply remained up 1% year over year.

“EV talk is everywhere, and now even in the used-vehicle days’ supply discussion,” said Jeremy Robb, senior director of Economic and Industry Insights at Cox Automotive. “Used EV sales increased enough in January to help drive days’ supply lower.”

The Cox Automotive days’ supply is based on the estimated daily retail sales rate for the most recent 30-day period, ending Feb. 5, when sales were 1.44 million units. Used-vehicle sales are about flat compared to a year ago but higher than the 1.30 million reported last month.

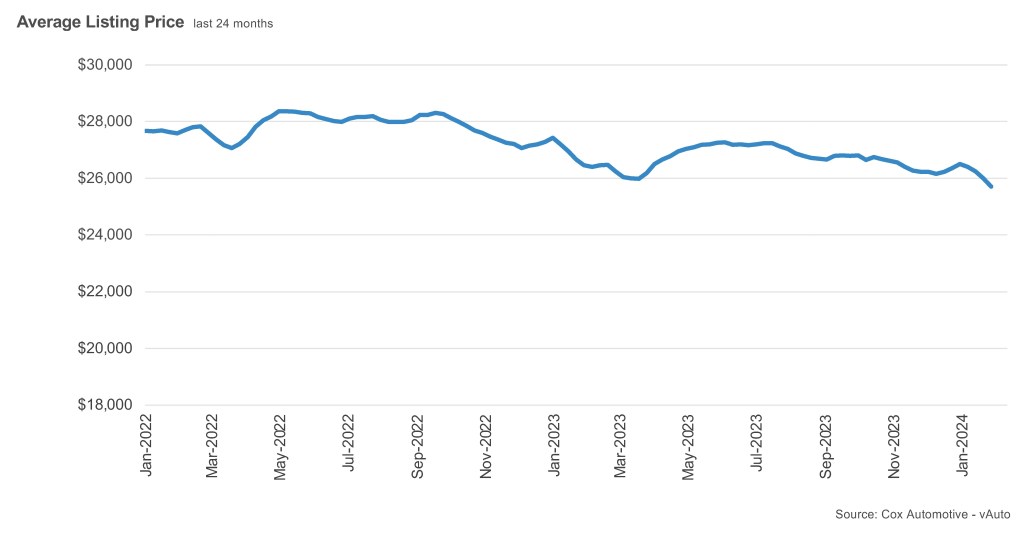

The average used-vehicle listing price was $25,328, down from a revised $26,505 at the start of January, down 4% from a year earlier. Though used-vehicle prices are lower now versus 2022 and 2023, they remain much higher than in 2019.

AVERAGE USED-VEHICLE LISTING PRICE

Used-vehicle prices are now declining more slowly each week.

As with new cars, and as has been the case for months, the lower the price segment, the tighter the inventory. Honda and Toyota were the non-luxury brands with the lowest inventory of used vehicles at the beginning of February. Lexus and Acura had the lowest supply among luxury brands.

“Fewer new vehicles produced in 2021 meant lower leasing, which equals fewer lease maturities starting this year,” noted Robb. “After being low for the last two years, used-vehicle supply is expected to improve later in 2024 – but that will be without much help from off-lease supply.”