According to Cox Automotive’s analysis of vAuto Live Market View data, February began with used-vehicle inventory levels down month over month but higher than in January 2025.

2.18M

Total Inventory

as of Jan. 30, 2026

48

Days’ Supply

$25,533

Average Listing Price

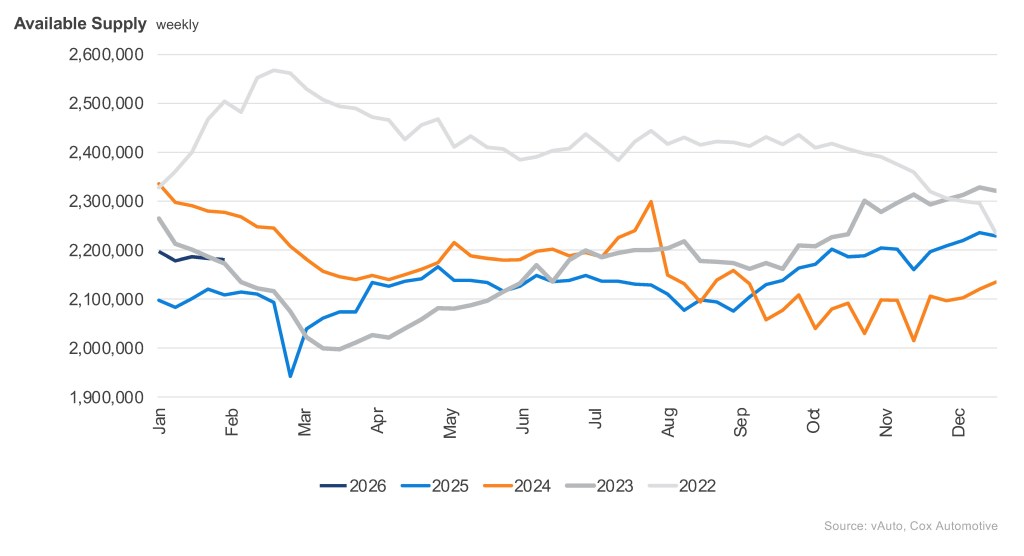

Nationwide, dealers – both franchised and independent – had a total supply of 2.18 million used vehicles on their lots at the beginning of February. That figure is 3% higher than the same time last year but down 1% compared to the 2.20 million a month earlier.

USED-VEHICLE INVENTORY VOLUME

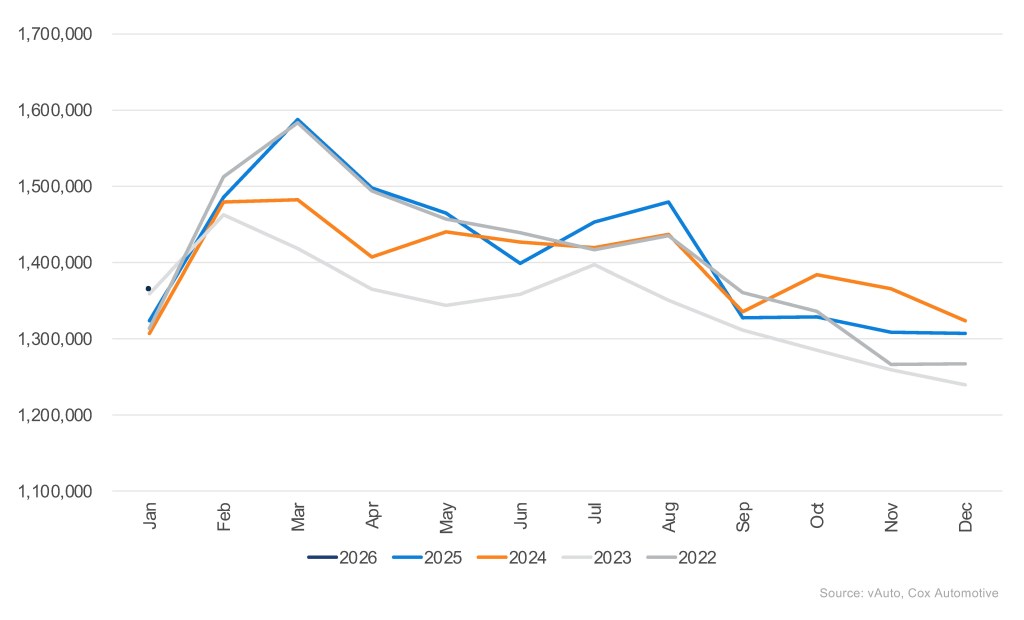

The retail used-vehicle sales pace remains strong, up 3.3% compared to the previous year and up 4.6% month over month in the most recent 30-day period. Used retail sales reached 1.37 million vehicles in January, up from the 1.31 million reported in December. Despite a slowdown in the final week due to winter weather across much of the eastern United States, the 2026 used-vehicle market started the year with strong momentum, most likely driven by factors such as credit availability holding at its strongest level since late 2022 and the used market’s affordability advantage over new vehicles.

USED-VEHICLE RETAIL SALES

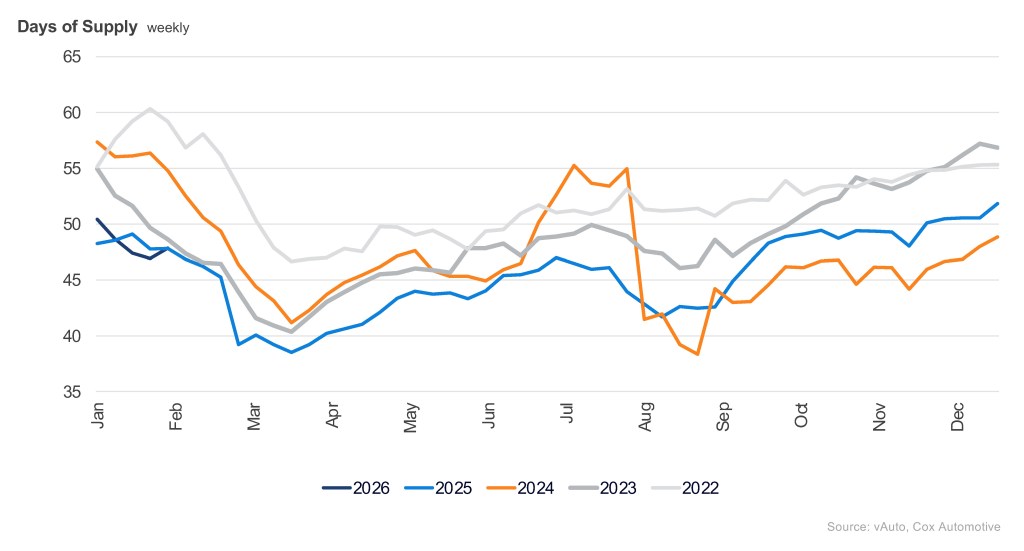

The Cox Automotive days’ supply is based on the estimated daily retail sales rate for the most recent 30-day period. Used vehicles had a 48-day supply in January, down nearly three days from the upwardly revised level in the December report but unchanged from the same time last year. Supply remains constrained compared to recent years and is down nine days compared to the same time in 2022.

USED-VEHICLE INVENTORY DAYS’ SUPPLY

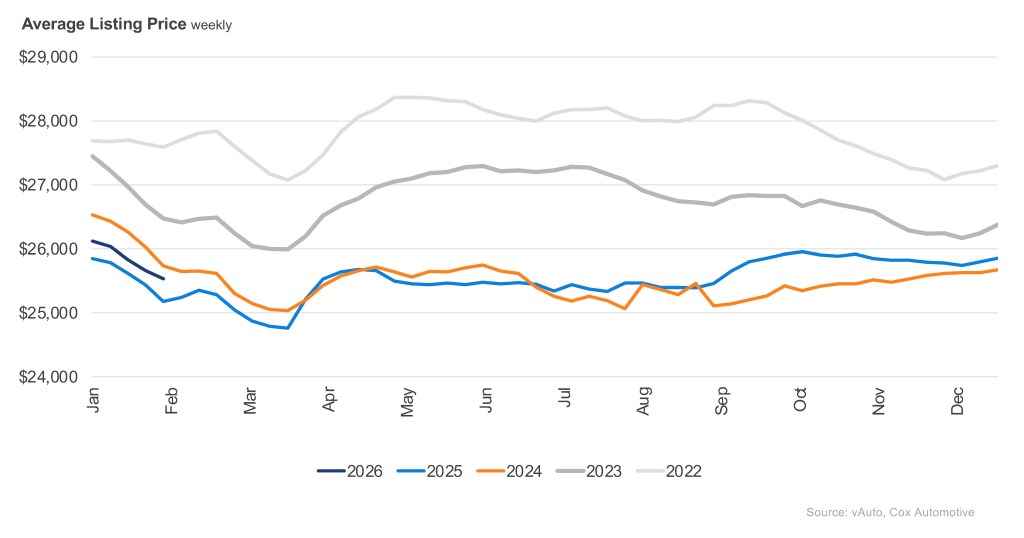

The average used-vehicle listing price was $25,533, up over 1% compared to the levels observed a year earlier but down more than 2% from the revised $26,120 in December. The month-over-month decline was most likely driven by price declines in the two largest segments, SUVs and pickups.

AVERAGE USED-VEHICLE LISTING PRICE

Price-conscious buyers have limited options for affordable used vehicles. Used cars priced below $15,000 continue to have low availability, with only 37 days’ supply, which is 11 days below the overall industry average. The top five sellers of the month had an average price of $23,668, nearly 7% below the average listing price for all used vehicles sold. Once again, Ford, Chevrolet, Toyota, Honda and Nissan were the top-selling brands, accounting for nearly 50% of all used vehicles sold.

CPO Sales Up in January

Certified pre-owned (CPO) sales increased 1% year over year in January, according to data reviewed by Cox Automotive. CPO sales in January were down 7.6% month over month but still outperforming the broader new-vehicle market, which was down 24%. January’s CPO sales are estimated at 204,649, down from 221,418 in December.