ATLANTA, Sept. 10, 2025 – New-vehicle prices moved higher in August as more model year 2026 vehicles hit dealer lots and automakers work to offset higher costs. According to estimates from Kelley Blue Book, price increases accelerated in August as both key measures – average transaction price (ATP) and manufacturer’s suggested retail prices (MSRPs) – increased month over month and year over year. Despite higher prices, retail sales in August climbed by 2.5% versus year-ago levels.

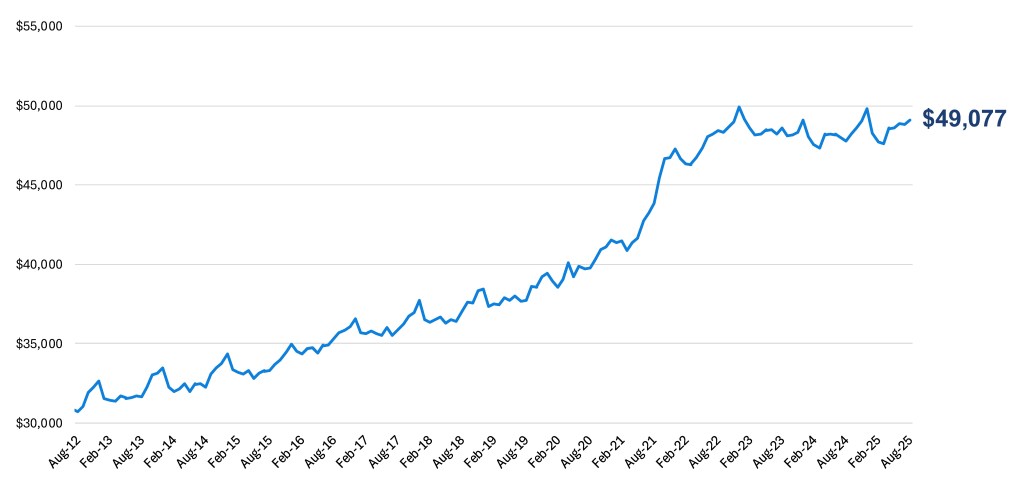

NEW-VEHICLE AVERAGE TRANSACTION PRICE

- The new-vehicle ATP was $49,077 in August, up 0.5% from July ($48,841) and higher year over year by 2.6%. The annual gain of 2.6% in August was the largest gain in more than two years, although it remains below long-term averages.

- The average new-vehicle MSRP – commonly called “the asking price” – in August was $51,099, an increase compared to July and higher year over year by 3.3%, a rate of increase very close to long-term averages and the largest gain in 2025.

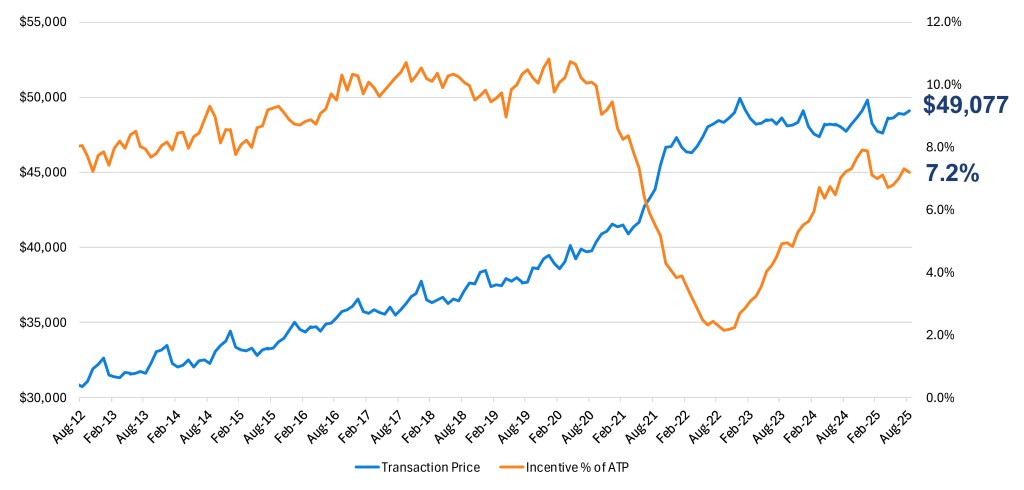

- Incentives spending softened, falling to 7.2% of ATP in August from 7.3% in July. Compared to a year ago, new-vehicle incentive spending is mostly unchanged. In fact, over the past year, incentive spending has held relatively steady, averaging 7.2% of ATP, with the highest incentive spending in the final months of 2024 and the lowest in April 2025.

- A vast majority of automakers posted price increases year over year in August. Of 31 major brands tracked by Kelley Blue Book, only five recorded transaction prices in August lower than year-ago levels. Acura (down 6.5%) and Tesla (down 5.5%) led the way, with three Stellantis brands all lower by less than 1%: Dodge, Ram and Chrysler. All other major brands saw prices increase in August. Seventeen brands saw price gains in excess of 3%.

- Full-size pickups, now commonly available with EV and hybrid powertrains, continue to push the industry’s ATP higher. Of the 10 best-selling vehicles in the U.S., four are full-sized pickup trucks, with the Ford F-Series ($66,934) and Chevrolet Silverado ($61,023) firmly in the top two spots. The GMC Sierra ($70,150) is No. 7 on the list. The Ram pickup ($65,849) is No. 9. (Note: The Kelley Blue Book ATP is an average of all vehicles sold each month, so big sellers influence the number more than low-volume vehicles.)

INDUSTRY AVERAGE TRANSACTION PRICE VERSUS INDUSTRY AVERAGE INCENTIVE SPEND AS % OF ATP

Quote from Erin Keating, Executive Analyst, Cox Automotive

“While new-vehicle prices continue their upward trajectory, the pace of change remains relatively measured, more a gradual correction than a seismic shift. Costs are clearly increasing, for automakers, dealers and buyers alike. This month’s increase aligns with our expectations, reflecting a market that’s adjusting to new production realities and consumer preferences without tipping into volatility.”

Electric Vehicle Sales Hit New Record in August; Tesla Loses Share Despite Lower Prices

- According to initial Cox Automotive estimates, sales of electric vehicles reached a record 146,332 in August. EV share last month was a record 9.9% of total sales and higher than the July share of 9.1%. With government-supported EV tax credits set to expire at the end of September, current sales trends suggest Q3 2025 will set an all-time record for EV sales in the U.S. (The current record is Q4 2024: 365,824.)

- The initial estimate of the EV average transaction price in August was $57,245, up 3.1% from the revised lower EV ATP of $55,562 in July. Year over year, EV prices were mostly unchanged, lower by 0.1%. The higher volume of EV sales helped push the overall industry ATP higher as well.

- EV incentives in August were down from the July record, but at 16% of ATP, EV incentives remain more than twice as high as the overall market. The average incentive package on a new EV was more than $9,000 in August. A year ago, incentive packages for EVs averaged 13.6% of ATP.

- Tesla, the leading EV seller in the U.S. by far, saw ATPs climb 2.9% in August to $54,468. Compared to a year ago, ATPs in August were lower by 5.5%. Tesla’s sales last month were lower year over year by 6.7% and the EV leader’s share of all EV sales in the U.S. fell to 38% last month, the lowest point in the modern EV era.

Quote from Stephanie Valdez Streaty, Senior Analyst, Cox Automotive

“The one constant in the automotive business is that fresh product sells well. While Tesla’s Model Y update has slowed the company’s sales decline, it’s not getting easier for the EV pioneer because the market is now flooded with all-new, fresh EVs from mainstream competitors — consumers have more choice than ever. The current surge in EV sales is being driven by product innovation, motivated dealers, and an urgency ahead of the IRA tax credit phase-out.”