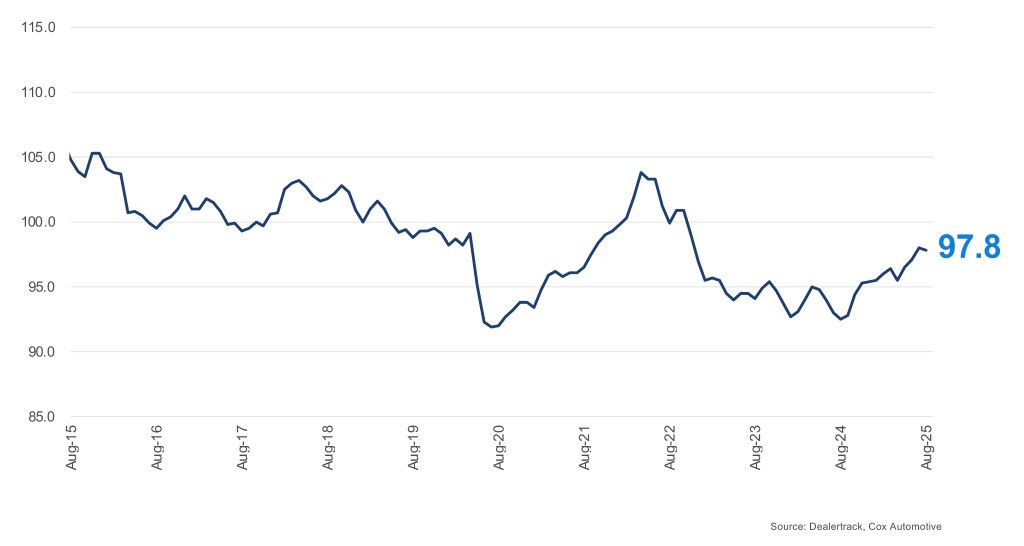

In August 2025, the Dealertrack Credit Availability Index signaled a modest tightening in auto credit conditions after several months of improvement. The All-Loans Index edged down to 97.8 from 98.0 in July, indicating that while credit remains broadly accessible, lenders showed slightly more caution compared to the prior month. Despite this, credit access remains significantly looser than a year ago, with the index up more than 5 points from August 2024.

Dealertrack Credit Availability Index

Auto loan access was down slightly in August but up year over year

All Auto Loans Index (Jan 2019 = 100)

Key Metrics

- Approval Rates: The approval rate for auto loans rose by 100 basis points (BPs) to 105.4 in August, a new high for the year and a sign that lenders are still approving more loans overall. However, this was offset by tightening in other areas.

- Subprime Share: The share of loans to subprime borrowers was unchanged at 13.6%, suggesting no further expansion into higher-risk lending.

- Yield Spread: The yield spread narrowed slightly by 2 BPs, driven by an 18 BPs drop in the average contract rate (from 10.87% to 10.69%) and a decline of 16 BPs in the 5-year Treasury yield (from 3.95% to 3.79%). This indicates lenders are offering competitive rates amid easing rate pressure.

- Loan Term Length: The share of loans with terms greater than 72 months decreased by 80 BPs to 25.4%, reflecting a shift toward shorter-term financing and a more conservative approach by lenders.

- Negative Equity Share: The proportion of borrowers with negative equity fell by 60 BPs to 53.5%, a positive sign for borrower health, but also a signal that lenders may be tightening standards for higher-risk profiles.

- Down Payment Percentage: The average down payment percentage increased by 1 basis point to 13.7%, suggesting lenders are requiring slightly more upfront from borrowers.

Channel and Lender Trends

- Channels: Credit access was mixed for sales channels in August. The only improvements were seen in the franchised used segment. Certified pre-owned (CPO) saw the largest decline, which could be driven by tight supply.

- Lender Types: Lender performance was mixed. Captives showed the most significant tightening, followed by banks and auto-focused finance companies. In contrast, credit unions loosened credit access.

Year-Over-Year Comparison

Compared to August 2024, credit access was looser across channels and lender types:

- Channels: The most notable year-over-year improvements were in franchise used loans and non-captive new loans, indicating stronger credit availability in both new and used vehicle segments.

- Lender Types: Banks and auto-focused finance companies led the year-over-year loosening, while credit unions and captives also improved.

Implications for Consumers and Lenders

- Consumers: While approval rates are at their highest, borrowers may encounter slightly shorter loan terms and marginally higher down payment requirements. Lower contract rates continue to support affordability.

- Lenders: The data suggests a cautious recalibration, with lenders balancing growth and risk as market conditions evolve. The slight tightening in August may reflect a response to macroeconomic signals or portfolio management priorities.

Overall, the August Dealertrack Credit Availability Index reflected a pause in the recent run of loosening credit, with lenders showing slightly more caution even as approval rates reached new highs. Credit access remains robust by historical standards, but the data signals that lenders are keeping a closer eye on risk as the market moves into late summer. Looking ahead, the Federal Reserve meets next week. While a rate cut is widely anticipated, auto loan rates won’t immediately follow, however, as they are tied to longer-term Treasury yields that remain elevated.

The Dealertrack Credit Availability Index tracks six factors that affect auto credit access: loan approval rates, subprime share, yield spreads, loan term length, negative equity and down payments. Reported monthly, the index indicates whether access to auto credit is improving or declining. This typically means that it is cheaper and easier for consumers to obtain a loan or more expensive and harder. The index is published around the 10th of each month.