Economic growth at the end of last year was much weaker than originally estimated. The economy decelerated to real GDP growth of 2.2%, setting up the first quarter to be much weaker as well.

Mixed bag for confidence: Consumer confidence data are sending mixed signals. Confidence was down in March, but sentiment was up. Part of what may be happening is a clear split in sentiment by demographics and region of the country.

Possible housing growth: Housing could see growth this year thanks to mortgage rates now lower than a year ago. The existing home market isn’t showing growth yet, but new home sales now point to a stronger spring.

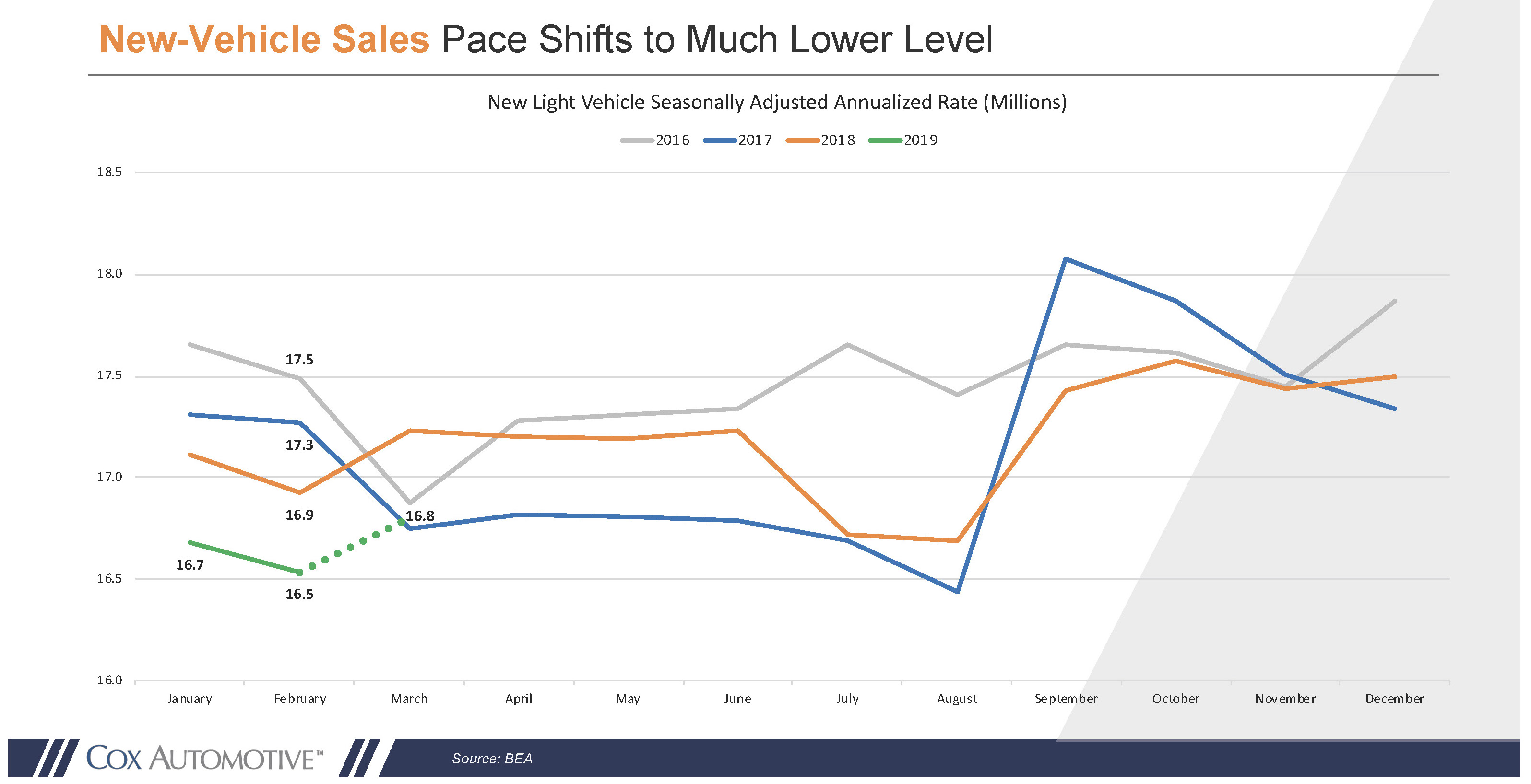

New-vehicle sales dip: The reverse is happening in the auto market, as new-vehicle sales are down relative to last year, but the used market continues to be strong. Unlike mortgage rates, auto loan rates have not declined.

Tax refunds fuel used sales: Tax refunds are powering a strong used car market, especially for affordable vehicles. We are forecasting the new vehicle SAAR to improve modestly in March to 16.8 million, but that would be a decline of 2% from last year’s 17.2 million pace. Lower tax refunds, high auto loan rates, record vehicle prices, weak incentives, and tighter credit are depressing new vehicle demand.

Looking ahead: This week we’ll get retail sales for February, new vehicle sales for March, employment data for March, updated tax refund data, and our report on the March Manheim Index.