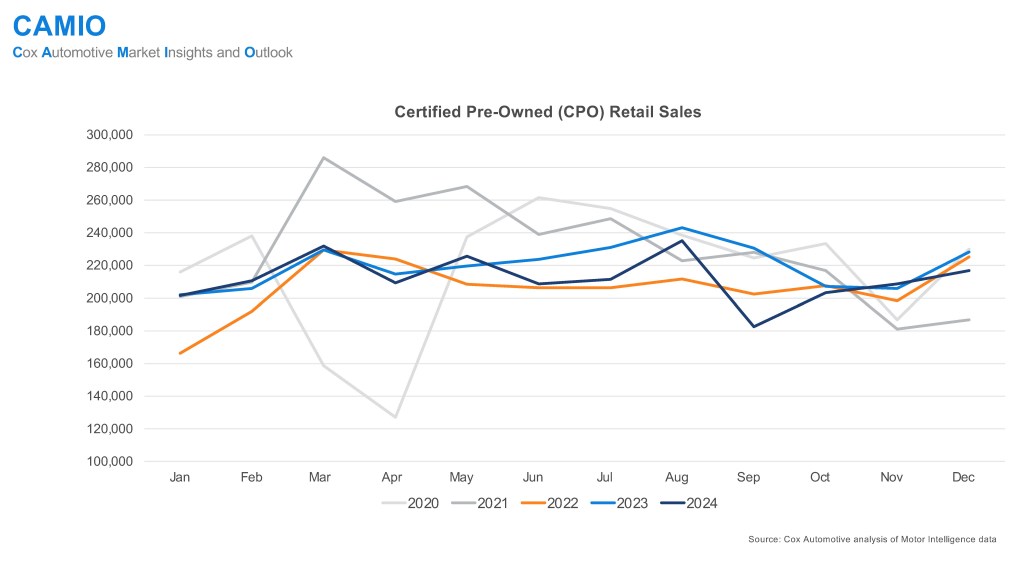

Takeaway: Certified pre-owned (CPO) underperformed the overall used-vehicle market in 2024. Full-year CPO sales in 2024 were 2.5 million units, down 3.6% compared to 2023. The used-vehicle market is in a multi-year recovery from low new-vehicle sales following the pandemic. CPO sales are being held back by limited supply of nearly new units and affordability issues.

What’s next: For 2025, Cox Automotive forecasts growth in every sales metric except certified pre-owned sales. CPO sales are anticipated to be flat in 2025 at 2.5 million. Fewer lease maturities from limited production between 2020 and 2022 have led to a scarcity of prime, available CPO products despite relatively strong CPO demand. Also, high used-vehicle auto loan rates are likely to impact CPO sales.