Ford reports third-quarter 2021 financial results after the stock market closes on Wednesday, Oct. 27. The results will show the continued impact of the production disruptions caused by the global computer chip shortage.

Ford was hit early by the chip crisis. The automaker had to partially build vehicles, including its all-important F-150 pickup truck, and park them as they waited for chip orders. Ford curtailed production altogether of some models, including the F-150 for some weeks. The company had to inform customers of its long-awaited electric Mustang Mach-E that their deliveries would be delayed for at least six weeks due to the chip shortage.

By the end of the third quarter, it appeared Ford was emerging from the situation, though it still trimmed production into the fourth quarter on some models – so far, not the F-150. Ford’s September sales beat analysts’ expectations. But Ford also has extended some production cuts already into the fourth quarter.

Ford’s third-quarter sales in the U.S., which represent the bulk of its sales, plummeted 28%, far underperforming the total market. Notably, Stellantis outsold Ford in the third quarter for the first time. The profit-generating F-Series had a second consecutive quarterly drop in sales. On the plus side, Ford was able to slash incentives by about 40% while its average transaction price rose 13% to above $50,000.

Here are key data points from Cox Automotive on Ford’s third-quarter performance in the U.S. market, where the company derives the bulk of its profits.

Sales and Market Share

Sales and market share figures for Ford and its Ford and Lincoln brands individually fell to their lowest levels in at least six years. In total Ford sold 397,644 vehicles, down 28% from the third quarter of 2020 and far underperforming the total market which was down 13%.

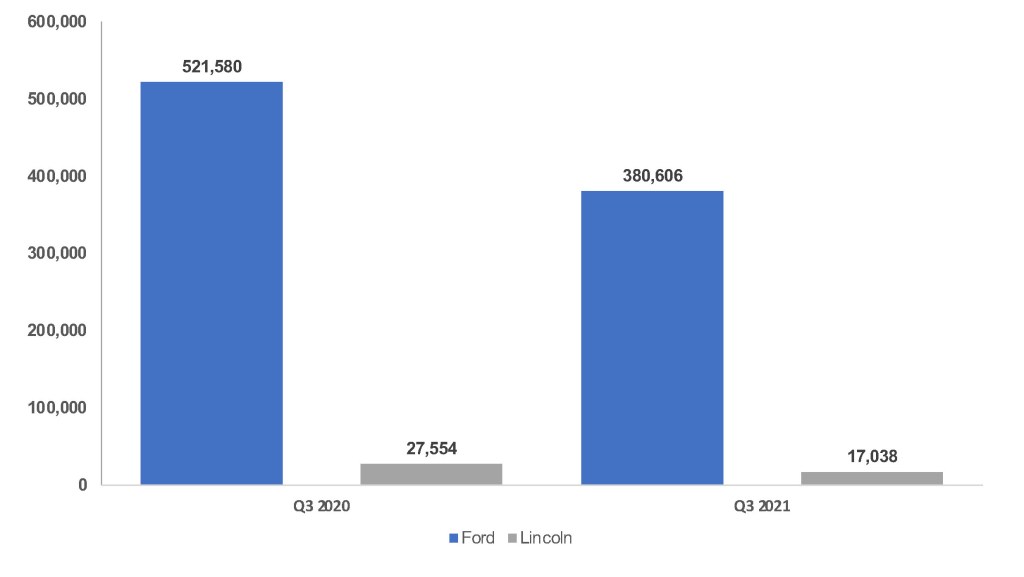

Sales Volume

The Ford brand sold 380,606 vehicles, down 27%. Every Ford-branded model had a double-digit decline in sales in the quarter, except for the E-Series commercial van that was only down 2%. The Ford Expedition had sales down only 14%. F-Series dropped 22%. The rest of the models declined by bigger percentages.

New models softened the blow by kicking in additional sales. The just-launched Bronco had sales of 9,403 units in the quarter. The Bronco Sport had 20,690 in sales. The electric Mustang Mach-E kicked in 5,880 units.

The Ford brand has been in the process of selling down discontinued models. The Fiesta, Focus and Flex were completely sold out for the quarter. The Fusion was almost sold out with only 225 units sold in the quarter.

Lincoln sold 17,038 vehicles, down 38%. Every model but one had a double-digit decline except for the Nautilus, which was up 17%.

Ford’s lower-than-industry sales pushed its overall market share to 11.7%, down 2.3 percentage points from the year-ago quarter. Ford brand share was 11.2%, down 2.1 percentage points. Lincoln share came in at .5%, down from .7%.

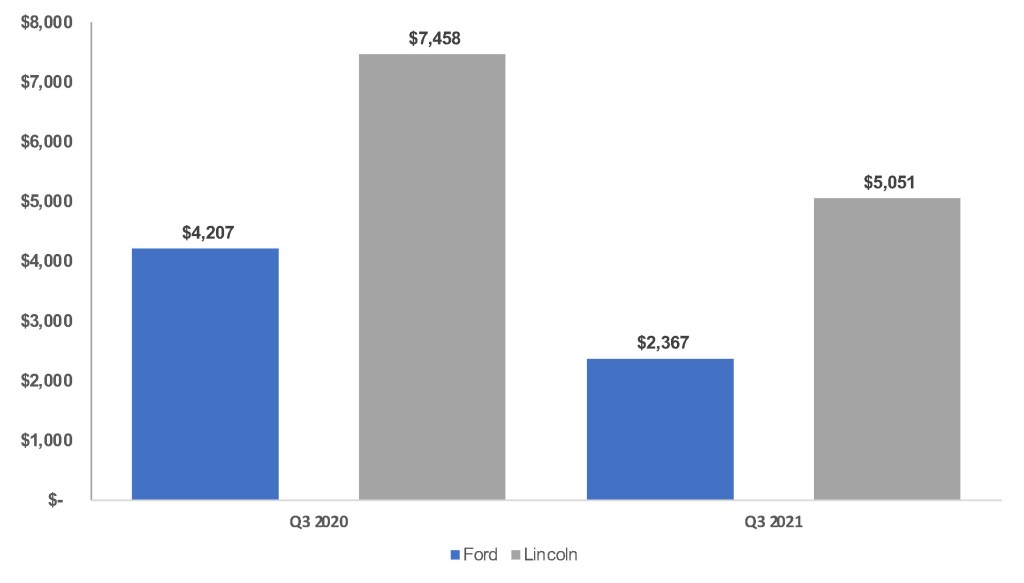

Incentives

On the plus side, incentives plummeted to their lowest levels in at least six years. In total, Ford spent on average $2,482 per vehicle in incentives, down 43% from a year ago, according to Cox Automotive calculations. Ford brand spent $2,367 per vehicle. Lincoln spent $5,051.

Sales Incentives

Average Transaction prices

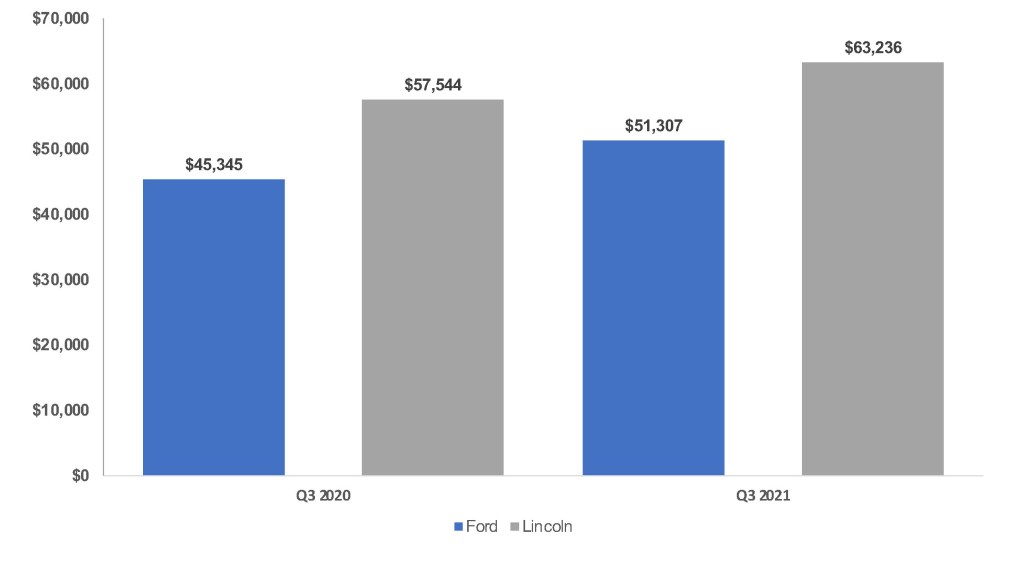

High demand, low inventory and little discounting resulted in big hikes in average transaction prices (ATP). Overall, Ford’s ATP rose 13% from a year ago to a record-high $51,818.

The Ford brand also saw a 13% gain, putting its ATP at $51,307. Nearly every model saw a hike. The brand got a big boost from its volume-leading F-Series, which had a 13% increase in its ATP to just shy of $60,000. The Expedition, the brand’s most expensive model, got a 4% bump to $68,257.

Average Transaction Prices

Ford’s new models kicked in some hefty prices as well. The ATP on the Bronco Sport was $34,269, about $2,000 more than the Escape upon which it is based. The bigger Bronco’s ATP hit nearly $50,000. The ATP on the Mustang Mach-E was nearly $55,000.

With Ford announcing in the quarter that it would discontinue the subcompact EcoSport SUV, the Ford Maverick, fully launching by year-end or early next year, is intended to be the brand’s entry-level model with a starting price of about $20,000. However, its ATP in the quarter was close to $30,000. The small Transit Connect van was in the same ballpark.

Lincoln’s average transaction price was 10% higher at $63,236. Lincoln’s most expensive model, the Navigator SUV, got a 4% gain in its ATP, putting it close to $95,000. The smaller Aviator now has an ATP over $70,000.