American Honda Motor, plagued with supply chain issues for most of 2022, is on the rebound with increased production and vehicle inventory on dealer lots leading to a significant leap in U.S. sales for the first quarter of its 2024 fiscal year.

Honda raised incentives by 67% to $1,393 per vehicle, the first bump since 2021. It also increased its average transaction price (ATP) by 2% to $38,765.

Here are some data points from Cox Automotive on Honda’s U.S. market performance in the latest quarter.

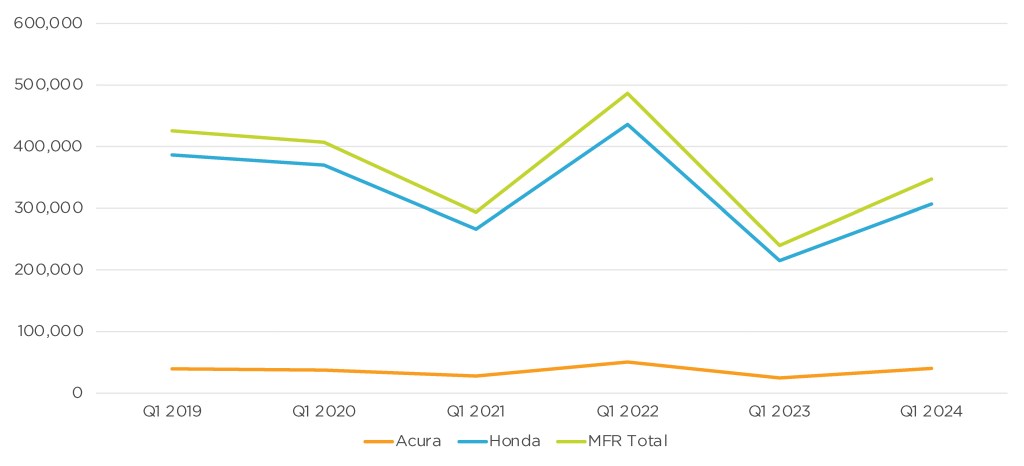

Sales and Market Share Up from Year-Ago Levels

American Honda’s U.S. sales totaled 347,025 in the quarter, up 45% from the same quarter a year ago. Though Honda’s total market share was up 1.6% to 8.4%, it remains below pre-pandemic numbers.

Honda U.S. SALES PERFORMANCE FOR Q1 FISCAL YEAR 2024

Honda brand sales totaled 306,848 vehicles, up 43%, beating the industry sales increase of 17% for the quarter. Honda brand’s market share increased incrementally to 7.4% in the most recent quarter from 6.1% in the 2022 quarter, a 1.3 percentage point increase. Most of Honda’s models jumped in quarterly sales – Accord 49%, Civic 52%, CR-V 66%, Odyssey 106%, Pilot 39% and Ridgeline 37%.

Acura’s U.S. sales soared by 63% to 40,177 units, beating the market. Its market share increased to 0.98%, a 0.28 percentage point gain.

Acura had four models to post sales gains – the TLX, the volume-leading MDX SUV, the new Integra and the RDX. Acura’s core model, the popular MDX, was up 67%, selling 16,741 units. Acura sold 8,808 units of the newly resurrected Integra, a 489% gain year over year. TLX sales were up 40% to 5,762 units, while the RDX was up 39%.

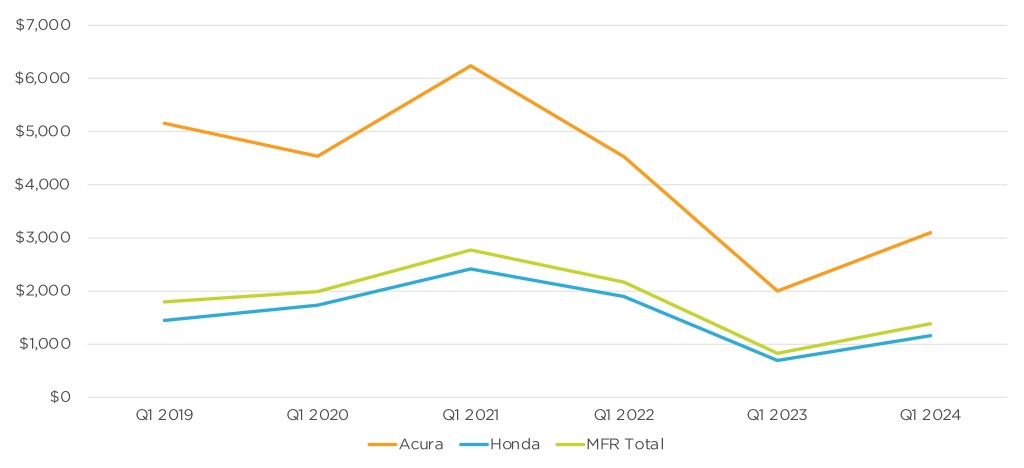

Honda Raised Incentives for First Time Since 2021

Always among the lowest for incentive spending, Honda Motor boosted incentives in the latest quarter. In total, Honda raised incentives by 67% to an average of $1,383 per vehicle, according to Cox Automotive calculations. Incentives averaged only $828 in 2022.

Honda U.S. INCENTIVE SPENDING FOR Q1 FISCAL YEAR 2024

Honda brand incentives were also up 67% to an average of $1,158 per vehicle. This was the first time since 2021 that incentives were above $1,000 per vehicle in a first quarter. Acura incentives increased by 55% to an average of $3,098 per vehicle after hitting a record high of $6,240 per vehicle in 2020 during the pandemic.

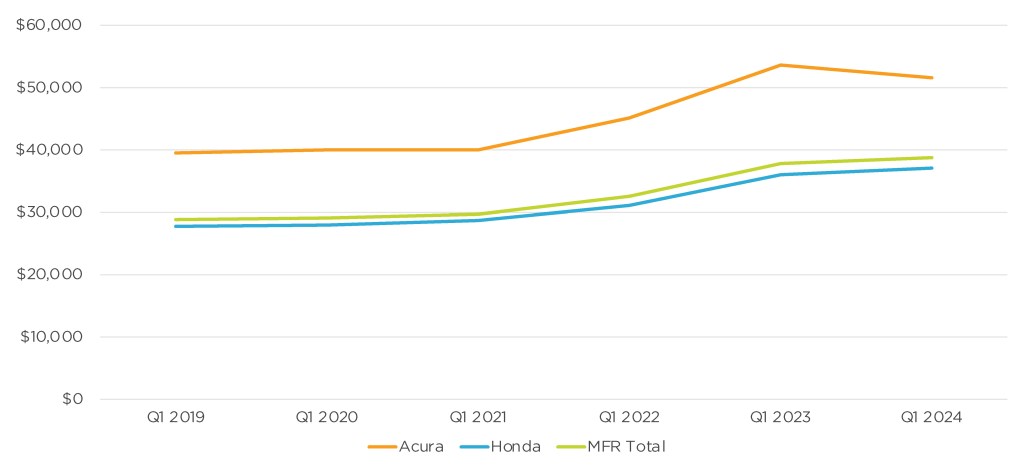

Honda’s Average Transaction Price Hits All-Time High

The Honda brand’s overall ATP rose 3% to $37,087 compared to the same quarter in 2022, according to Cox Automotive calculations. Popular models such as the Civic and CR-V rose 1% and 3%, respectively. The newly redesigned HR-V was up 3% to $28,736, and the Pilot was up 7% to $49,689.

Honda U.S. AVERAGE TRANSACTION PRICE FOR Q1 FISCAL YEAR 2024

The TLX was the only Acura model that had an ATP increase, up 6% to $51,905. The rest of the Acura lineup saw price decreases between 2% and 5%.