Data Point

New-Vehicle Affordability Declined to New Low in 2022

Tuesday January 17, 2023

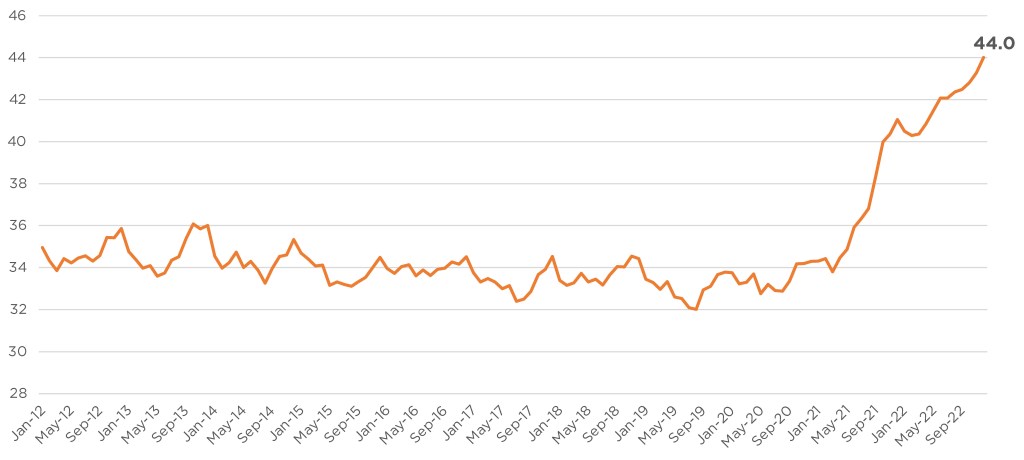

New-vehicle affordability declined again in December and reached a new low in 2022, according to the Cox Automotive/Moody’s Analytics Vehicle Affordability Index. Auto loan rates reached a new 20-year high and the average new-vehicle price increased to a record-high $49,507. The number of median weeks of income needed to purchase the average new vehicle in December increased to 44.0 weeks from 43.3 weeks in November.

Cox Automotive/Moody’s Analytics Vehicle Affordability Index

December 2022

Weeks of Income Needed to Purchase a New Light Vehicle

Average Monthly Payment for New Car Hits Another Record High

Supporting affordability, median income grew 0.4%, and incentives from manufacturers also increased in December. All other factors moved against affordability. The average price paid for a new vehicle increased by 1.9% to $49,507, according to Kelley Blue Book. The average interest rate increased another 53 basis points. As a result of these moves, the estimated typical monthly payment increased 2.1% to $777, which was a new record.

New-vehicle affordability in December was much worse than a year ago when prices were lower, incentives were higher, and rates were lower. The estimated number of weeks of median income need to purchase the average new vehicle in December was up 7% from last year.

“January has started with mixed trends,” said Cox Automotive Chief Economist Jonathan Smoke in the January 17 Auto Market Report video. “January is always a very light month for sales transactions, so I am not drawing any conclusions from the data we have seen so far other than to say the market’s biggest problem is affordability driven by the high level of interest rates.”

Click here for the full methodology for the Cox Automotive/Moody’s Analytics Vehicle Affordability Index.

The next update of the Cox Automotive/Moody’s Analytics Vehicle Affordability Index will be published on Feb. 15, 2023.

The Cox Automotive/Moody’s Analytics Vehicle Affordability Index (VAI) is updated monthly using the latest data from government and industry sources, including key pricing data from Kelley Blue Book, a Cox Automotive company. This important industry measure will be released at mid-month to indicate if the prices paid for new vehicles are moving out of consumers’ financial reach or becoming more affordable over time.