The electric vehicle (EV) market gained strong momentum in July, with new and used EV sales rising sharply as consumers accelerated purchases ahead of the Inflation Reduction Act’s tax credit expiration. Inventory tightened, incentives climbed, and pricing adjusted – highlighting a market still heavily influenced by policy support but increasingly responsive to real-time demand.

New and Used EV Sales – July

New EV Sales: July new EV sales climbed to 130,082 units, up 26.4% month over month and 19.7% year over year, lifting market share to 9.1%. It was the second-highest monthly total on record, with 11 brands posting their best EV sales of the year. The top five by volume – Tesla (53,816 units), Chevrolet, Hyundai, Ford and Honda – all saw strong gains, while Volkswagen surged 454% to sixth place. Luxury brands also performed well, with Audi (+150.2%), Cadillac (+14.5%) and Mercedes-Benz (+6.4%) signaling continued strength in the premium segment.

Used EV Sales: Used EV sales rose to 36,670 units in July, up 23.2% month over month and 40.0% year over year, holding a 2.2% share of the overall used-vehicle market. The top five makes by volume were Tesla (15,903 units, +18.0%), Chevrolet (3,499 units, +28.6%), Ford (1,967 units, +25.7%), Mercedes-Benz (1,724 units, -12.3%) and Nissan (1,659 units, +19.9%). Tesla remained the clear leader, though its share dipped to 43.4%, down from 45.2% in June. Among luxury brands, BMW and Audi posted strong gains, up 43.8% and 38.0%, respectively. The largest month-over-month percentage increases came from Honda (+103.0%), Hyundai (+61.3%) and Rivian (+60.5%).

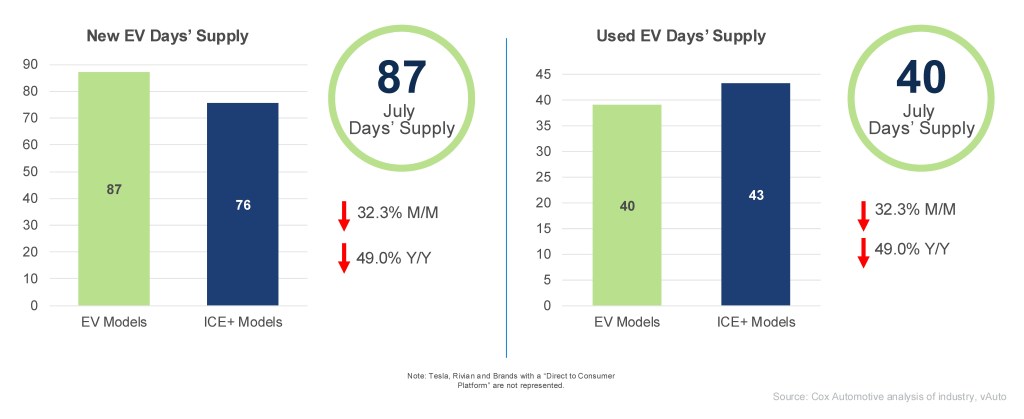

New and Used EV Days’ Supply – July

New EV Days’ Supply: In July, new EV days’ supply fell sharply to 87 days, down 32.3% month-over-month and 49.0% year over year. The gap between EVs and ICE+ vehicles narrowed by 75.9%, shrinking from 48.1 days in June to just 11.6 days in July – its smallest margin since February 2025. Supply levels varied by brand: Audi held the highest EV days’ supply at 168 days, despite a 115-day drop from June, while Toyota had the lowest at just 42 days after a 32-day decline. The steepest drop came from Volkswagen, which fell 153 days to 116.

Used EV Days’ Supply: The days’ supply of used electric vehicles declined to 40 days in July 2025, continuing a multi-month trend of tightening inventory and remaining below ICE+ vehicles for the fifth consecutive month. As with the new EV market, supply levels vary widely by make: Tesla had the lowest days’ supply at 29.4 days, followed closely by Chevrolet and Nissan, both under 40 days – highlighting strong demand and limited availability. In contrast, GMC, Ford and Rivian posted the highest supply levels, all above 64 days, suggesting slower turnover.

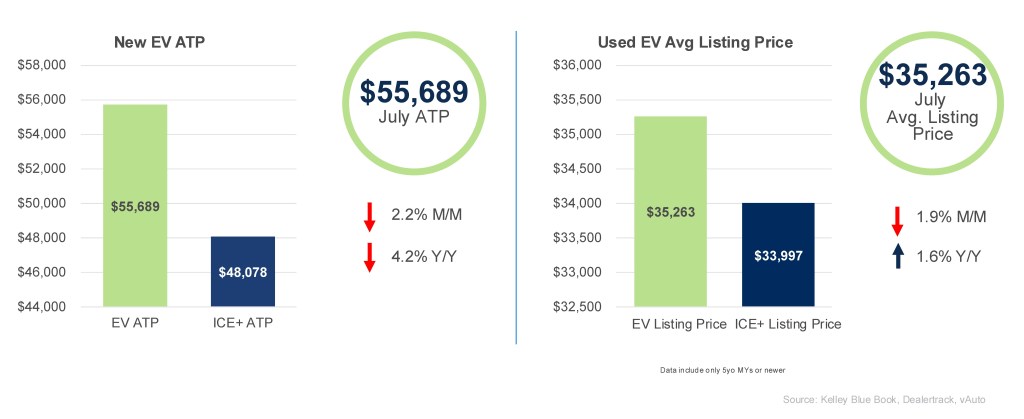

New and Used EV Prices – July

New EV ATP: In July, the average transaction price (ATP) for new electric vehicles declined to $55,689, reflecting a 2.2% decrease from June and a 4.2% decline year-over-year. The price gap with ICE+ vehicles narrowed to $7,611, the smallest since December 2024. EV incentives rose for the fourth consecutive month, reaching a record in the modern era of EV sales at 17.5% of ATP, or $9,768. Among brands, Volvo had the largest ATP decline at 17.1%, followed by Volkswagen at 12.2%, while Tesla dropped 2.4%, significantly influencing the overall average due to its volume. The top five selling EVs – Tesla Model Y, Tesla Model 3, Chevrolet Equinox EV, Honda Prologue and Hyundai Ioniq 5 – saw pricing and incentives play a pivotal role in driving volume. Incentives ranged from 14.5% to 27.7% of ATP, bringing effective prices for all five models below $40,000. The Chevrolet Equinox EV stood out with the lowest ATP at $38,477 and no reported incentives, reinforcing its strong value positioning.

Used EV Listing Price: The used electric vehicle market saw a price drop in June, with the average price declining to $35,263, down 1.9% from the previous month and up 1.6% year over year. The price gap between used EVs and ICE+ vehicles narrowed to a record low of just $1,266, signaling increased affordability and competitiveness. Tesla models continue to lead the segment in pricing dynamics: the Model 3, Model Y and Model S are all priced well below the market average, with a weighted average of $26,294. The Chevrolet Bolt EV, at $14,408, remains one of the most accessible options for budget-conscious buyers, while the Tesla Model X, priced at $39,656, stands out as a premium offering.

Looking Ahead

With the IRA tax credit set to expire at the end of September, urgency is likely to remain high, positioning the EV market for continued strength through the remainder of Q3. July’s performance sets a strong precedent, and as policy support winds down, the market’s ability to respond to real-time demand and brand-level dynamics will be critical in shaping the next phase of growth.

The EV Market Monitor gauges the health of the new and used electric vehicle (EV) markets by monitoring sales volume, days’ supply and average pricing. Each metric will be measured month over month and year over year. For a detailed new-EV sales report, see the Q2 Electric Vehicle Report, the official quarterly report of EV data.