In May 2025, the electric vehicle (EV) market displayed a complex mix of growth and challenges. While new EV sales experienced modest monthly gains, year-over-year declines indicated broader industry pressures. Meanwhile, the used EV market continued its upward trajectory, driven by affordability and consumer confidence. Inventory levels, pricing trends and incentive strategies all reflected a market in transition.

New and Used EV Sales – May

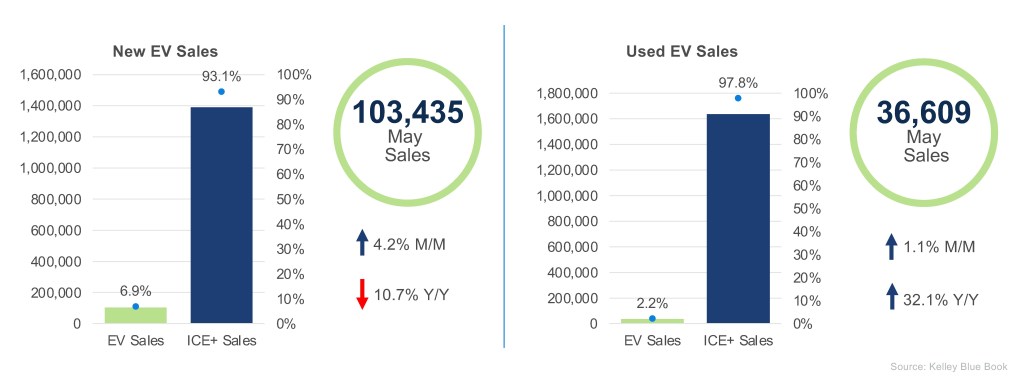

New EV Sales: New EV sales rose 4.2% month over month in May, reaching 103,435 units and maintaining a 6.9% market share. However, sales were down 10.7% year over year, reflecting ongoing industry challenges and the dynamic nature of an emerging market. May estimates suggest Tesla remained the market leader with 46,150 units sold, a 0.6% month-over-month increase, followed by General Motors, Hyundai Motor Group and Ford. Honda, which launched its first EV in the spring of last year, rounded out the top five.

Used EV Sales: The used EV market experienced modest growth in May, with sales increasing 1.1% month over month to 36,609 units, maintaining a 2.2% share of the overall used-vehicle market. Year over year, sales surged 32.1%, reflecting sustained momentum. Tesla led with a 49.6% share. According to our estimates, the best-selling used EVs last month were the Tesla Model 3, Model Y, Model S, Model X and Chevrolet Bolt EV. The used EV market continues to be dominated by Tesla-brand products, but we expect that to shift in the coming years.

New and Used EV Days’ Supply – May

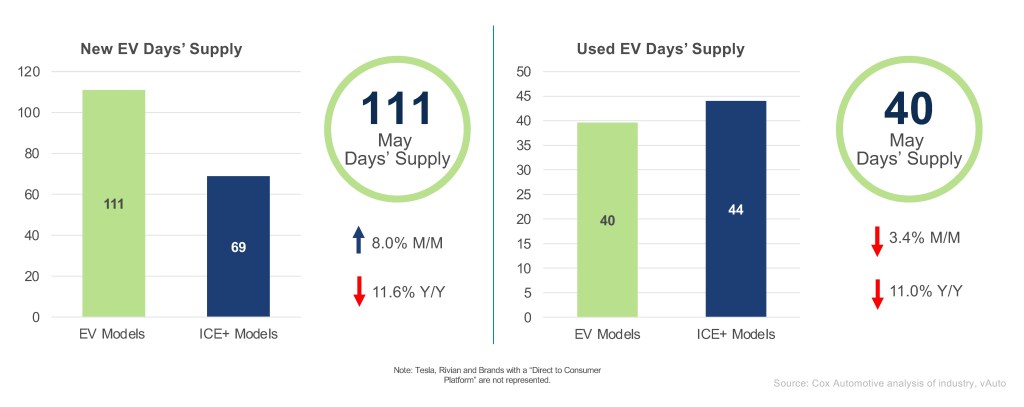

New EV Days’ Supply: In May, new EV days’ supply rose 8% month over month to 111 days, though it remains 11.6% lower than the same period last year. New EV days’ supply continues to exceed that of ICE+ models by more than a full month. Supply levels varied significantly by brand, reflecting the dynamic nature of the EV market, driven by production shifts, evolving consumer demand, and strategic inventory management. Most automotive brands saw an increase in EV days’ supply, signaling improved inventory availability.

Used EV Days’ Supply: In May, the days’ supply of used electric vehicles declined by 3.4% month over month to 40, an 11% year-over-year decline, reaching its lowest level since June 2022. The gap between used EVs and ICE+ vehicles has narrowed to less than five days. As with the new EV market, days’ supply for used EVs varies significantly by make. Tesla recorded the lowest level at 28 days. This tightening supply landscape suggests growing consumer interest in used EVs, signaling a potential shift in demand dynamics that could reshape pricing and remarketing strategies in the months ahead.

New and Used EV Prices – May

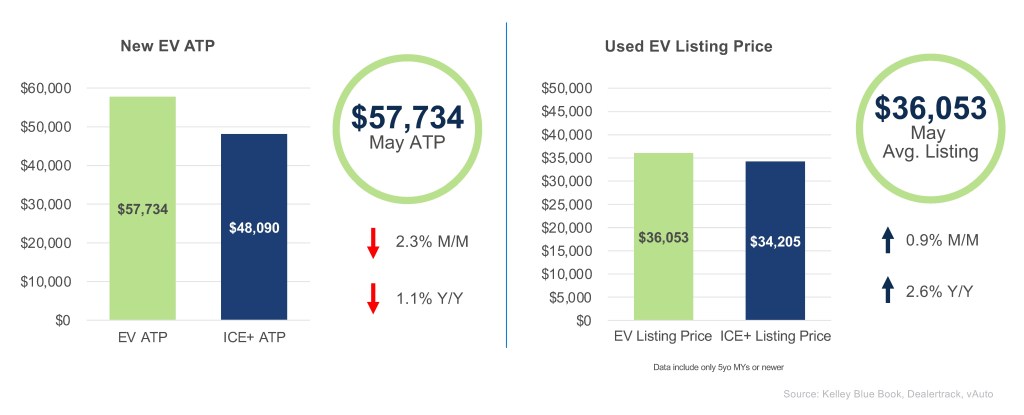

New EV Average Transaction Price: In May, the average transaction price (ATP) for new EVs fell to $57,734, marking a 2.3% decline from April and a 1.1% year-over-year decrease. The price gap between EVs and ICE+ vehicles narrowed to $9,644, down from $11,108 the previous month. At the same time, EV incentives increased by 19.4% to an average of $8,226, now accounting for 14.2% of ATP, the highest share in the post-2018, modern EV era. These incentives remain more than twice as high as those for ICE+ vehicles, underscoring the continued push to make EVs more accessible.

Among the most affordable options, the Nissan Leaf maintained its position with an ATP of $32,581. Additionally, a number of models – including the Acura ZDX, Ford Mustang Mach-E, Hyundai Ioniq 6, Kia EV6, Nissan Ariya, Toyota BZ4X, and VW ID.4 – had effective prices under $40,000, calculated by subtracting model-specific average incentives from their ATPs. The Chevrolet Equinox EV stood out by remaining under $40,000 even without incentives, reinforcing its strong value proposition in today’s competitive EV market. As EV adoption accelerates, ensuring a growing supply of affordable models is essential. For many consumers, price remains one of the most significant barriers to making the switch to electric.

Used EV Price Listings: In May, the used electric vehicle (EV) market saw a modest price increase, with the average price rising to $36,053, up 0.9% from the previous month and 2.6% year over year. The price gap between used EVs and ICE+ vehicles remained narrow, staying below $2,000. The Tesla Model 3 was the top-selling used EV in May, averaging $23,160, a 1.6% decrease from April. As the used EV market matures, price trends are increasingly shaped not only by brand dynamics but also by shifting consumer priorities around value, range, and long-term ownership costs.

The EV Market Monitor gauges the health of the new and used electric vehicle (EV) markets by monitoring sales volume, days’ supply and average pricing. Each metric will be measured month over month and year over year. For a detailed new-EV sales report, see the Q1 Electric Vehicle Report, the official quarterly report of EV data.