In a notable development, new-vehicle inventory has declined by 1% over the last month, yet it has returned to levels comparable to those before the tariff announcements on March 26. This indicates that automakers are exercising discipline in production, while electric vehicle (EV) sales are thriving as buyers respond to EV tax credits set to expire on Sept. 30, according to Cox Automotive’s analysis of vAuto Live Market View data.

2.68M

Total Inventory

as of July 31, 2025

73

Days’ Supply

$48,480

Average Listing Price

August opened with total new-vehicle inventory at 2.68 million vehicles, with a days’ supply of 73 and an average listing price of $48,480. July began with 2.83 million new vehicles available on dealer lots across the U.S. The sales pace picked up, leading to an 8.7% month-over-month increase in new-vehicle sales, which further drew down inventory by 25,840, or 1%, at the end of July. Compared to a year ago, inventory has dropped by 4.7%, while sales have increased by 10.1%. This sustained demand continues to support the market, even as automakers hold pricing steady despite significant losses due to tariff impacts.

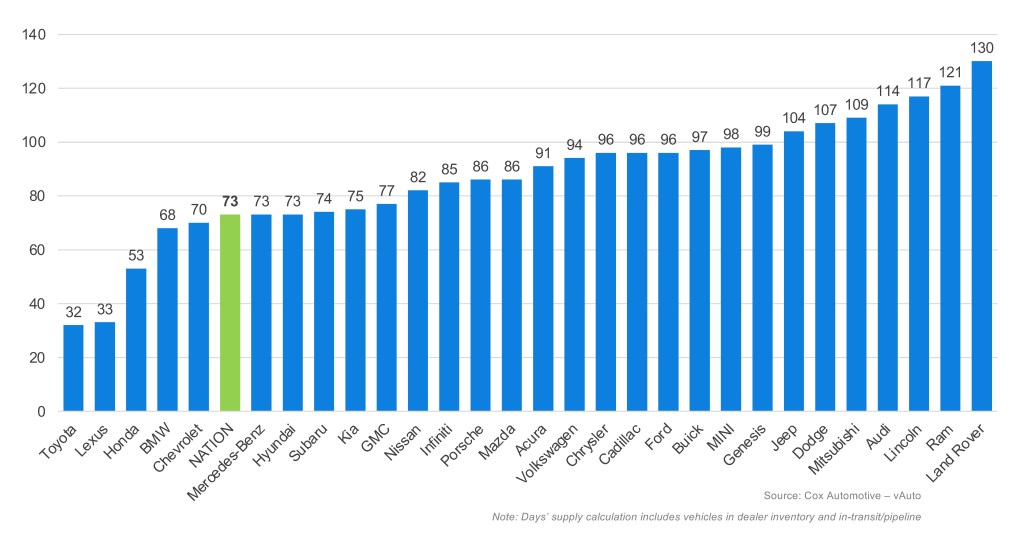

Cox Automotive’s vAuto Live Market View days’ supply is based on the estimated daily retail sales pace for the most recent 30-day period. Given the robust sales pace, days’ supply has declined to 73 days, down seven days month over month. Through the first seven months of 2025, average new-vehicle days’ supply was six days lower than in 2024, reflecting the volatility of tariff announcements and automakers’ cautious approach to production.

July Days’ Supply of Inventory by Brand

July Days’ Supply of Inventory by Brand

Momentum across the market is unfolding unevenly, with brands navigating inventory and incentives in distinct ways. Brands like Kia, Hyundai and Mercedes are experiencing an uptick in EV sales but are not replenishing stock at the same rate. Meanwhile, brands such as Mazda and Mitsubishi are benefiting from increased incentives on key models, and Nissan is seeing a boost from the new Armada while pushing incentives for the redesigned Murano. Subcompact, compact, and mid-size crossovers and SUVs continue to drive sales growth, as do pickups like the Toyota Tacoma and Tundra.

Strategic incentives and model refreshes help maintain a competitive advantage. As we continue to see MY26 vehicles, especially brand-new models rather than simple facelifts, we expect prices to rise.

New-Vehicle Listing Prices Continue a Remarkable Decrease

The average new-vehicle listing price at the end of July decreased by 0.3% month over month, down by $154 to $48,480, the lowest since late April. Compared to last year, average listing prices were 2.8% higher. Despite tariffs impacting automakers’ bottom lines, consumer prices have not seen significant increases. Yes, some brands have experienced price rises of over 10% from a year ago, but most have seen shifts of 2% or less.

According to Kelley Blue Book, the average transaction price (ATP) of a new vehicle in July was $48,841, representing a month-over-month decrease of $59, leaving prices essentially flat. New-vehicle sales incentives increased by 0.3 percentage points to 7.3% of ATP, the highest level year to date.

As we wrap up July’s market review, it’s clear that the U.S. auto industry continues to navigate shifting tides with resilience. Inventory is tightening just as sales momentum grows, and while tariffs remain a thorn in automakers’ sides, smart incentives and fresh models are keeping buyers engaged. Price trends have stabilized despite underlying volatility, proof that both dealers and consumers are adapting quickly. As we look ahead to upcoming Model Year 2026 launches and the evolving EV landscape, expect the market to stay dynamic and competitive, with savvy shoppers ready to seize the next opportunity.