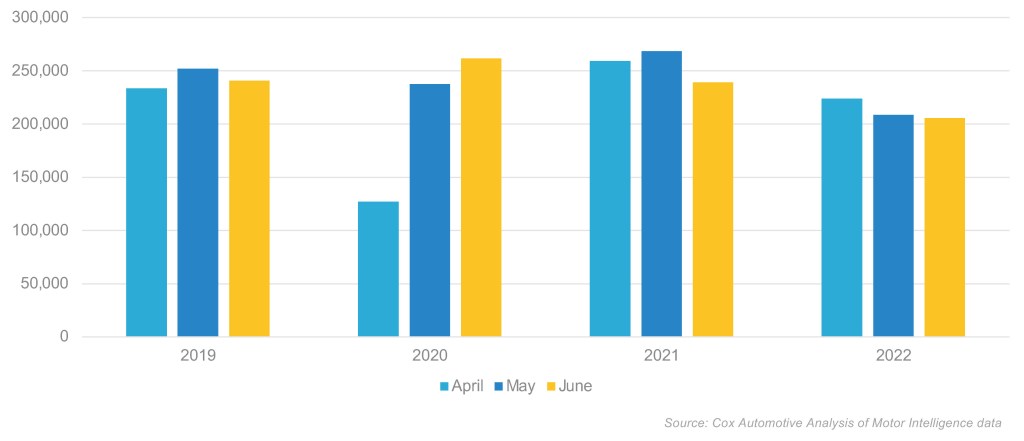

Certified pre-owned (CPO) sales in June fell to 205,924 units, down 1% from May’s 208,423 unit sales and down nearly 17% from June 2021. So far in 2022, CPO sales peaked in April but have fallen in both May and June.

June CPO Sales

Leveraging a same-store set of dealerships selected to represent the country from Dealertrack, we estimate that used retail sales increased 5% in June from May. However, the Dealertrack estimates indicate that used retail sales were down 13% year over year. Compared to 2019, sales were down 11%, which was the best comp against 2019 so far this year.

According to Chris Frey, senior manager of economic and industry insights at Cox Automotive: “With another slight decrease in June, CPO sales are down nearly 17% year to date, as we anticipated based on market dynamics. With six months to go, CPO sales remain on track to finish near 2.3 million in 2022, down nearly 18% from last year’s 2.7 million.”