Data Point

Average New-Vehicle Transaction Prices Top $45,000 for First Time, According to Kelley Blue Book

Wednesday October 13, 2021

Article Highlights

- At $45,031, the average new-vehicle transaction price hit a record high in September 2021 for the sixth consecutive month, according to Kelley Blue Book.

- Vehicle mix shifted in September toward pickups and SUVs, and luxury share grew. The luxury segment hit a record price of $60,845.

- Average price paid for a new vehicle jumped 12.1% year over year in September, as tight inventory continued to hamper the sales pace.

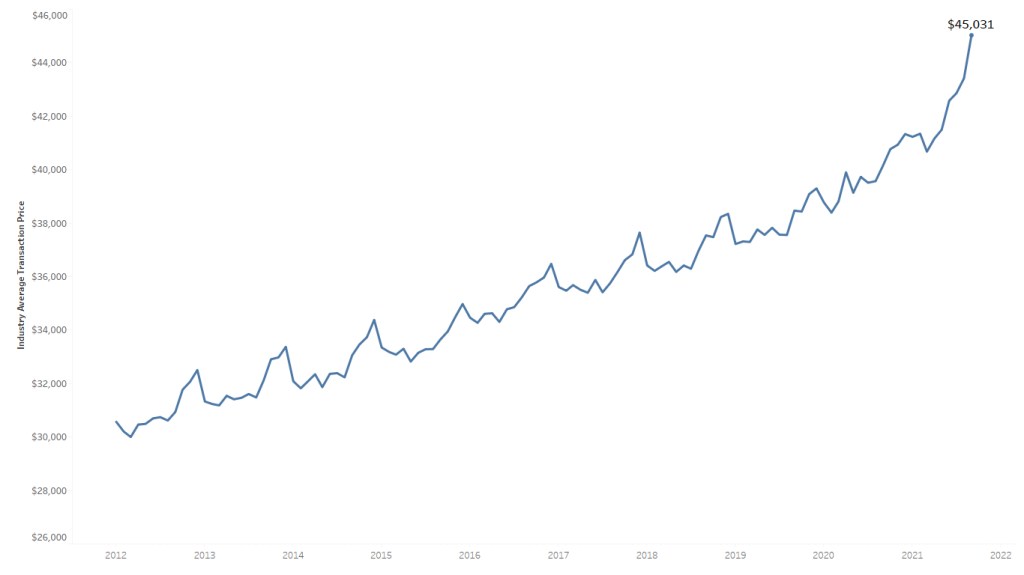

New-vehicle prices hit another all-time high in September 2021, marking the sixth straight record-setting month and surpassing $45,000 for the first time, according to a new report from Kelley Blue Book. At $45,031, the average transaction price (ATP) for a new vehicle was up 12.1% (or $4,872) from one year ago in September 2020 and up 3.7% (or $1,613) from August 2021.

NEW-VEHICLE AVERAGE TRANSACTION PRICE

The all-time-high prices accompanied the fifth straight month of a slowing sales pace. Total sales last month numbered just 1,012,797, a 7.3% month-over-month decrease and one of the lowest volumes in the past decade. On top of supply dynamics, the vehicle mix shifted in September away from lower-priced sedans, compacts and entry-level segments toward more-expensive pickups, SUVs and the luxury market.

“The record-high prices in September are mostly a result of the mix of vehicles sold,” said Kayla Reynolds, analyst for Cox Automotive. “Midsize SUV sales jumped in September compared to August and full-size pickup share moved up as well. Sales of lower-priced compact and midsize cars, which had been commanding more share during the summer, faded in September. As long as new-vehicle inventory remains tight, we believe prices will remain elevated.”

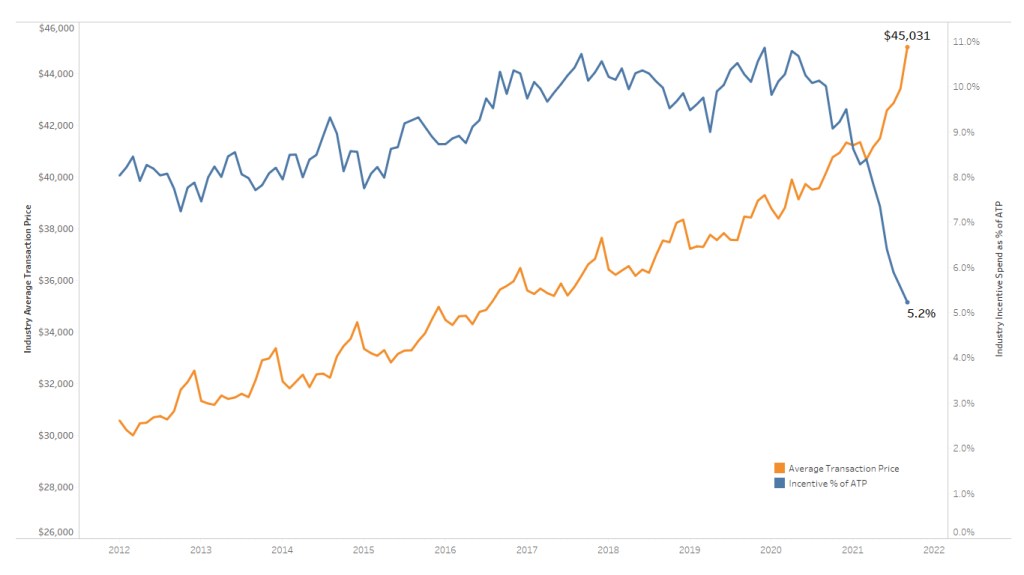

Incentive spending fell in September to another record low, dropping to 5.2% of ATP last month, a decrease from 5.6% in August 2021 and well below the 10.0% of ATP recorded in September 2020. Porsche, Land Rover, Genesis, Subaru and Toyota had among the lowest incentive spend last month, all 3% of ATP or lower. On the other hand, Alfa Romeo, Buick, Fiat and Infiniti each had incentive levels above 10% of ATP.

INDUSTRY AVERAGE TRANSACTION PRICE VERSUS

INDUSTRY AVERAGE INCENTIVE SPEND AS % OF ATP

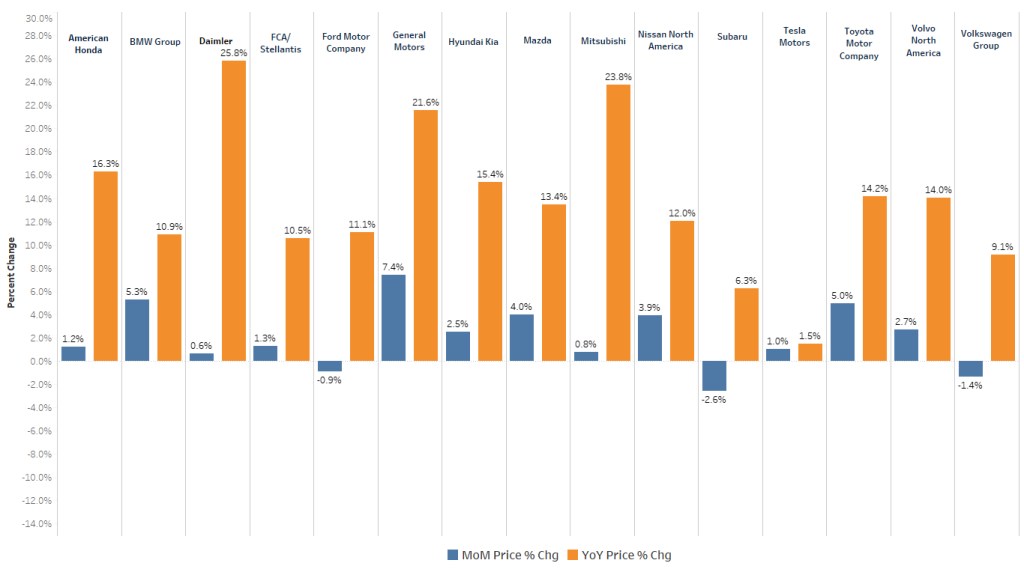

ATPs in September continued to be driven higher by strong luxury vehicle sales. Luxury sales accounted for 16.6% of total market sales, up from 15.1% in September 2020. Luxury share in September was among the highest in the past decade, and luxury buyers paid an average of $60,845 for a new vehicle last month. Further, many luxury brands, notably Acura, Cadillac, Genesis and Mercedes-Benz, achieved year-over-year ATP gains in excess of 20%. Cadillac, for example, saw ATPs jump up more than 32% last month, reaching $81,939. Consumers continue to pay near $100,000 for a new Cadillac Escalade. More than 3,500 were sold in September 2021, a jump of more than 50% from August 2021.