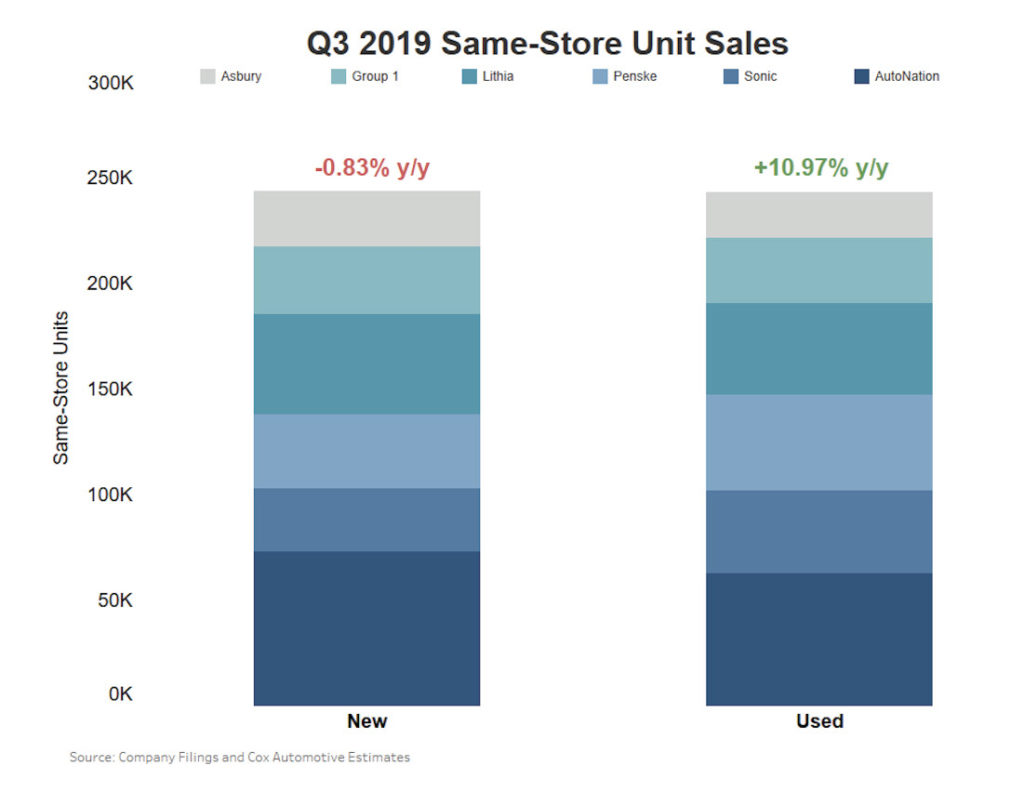

New-vehicles sales year over year remain weak and are down 1.2% year to date but are in a better position than last quarter. Fleet sales are up 4% this year, but retail sales are down 2%. The used-vehicle market, on the other hand, continues to see favorable performance. This shift in vehicle demand, away from new and toward used, can been seen more clearly in the Q3 financial results of the largest players in the auto industry: franchised dealer groups. Looking at the Q3 performance of these publicly traded dealer groups, which accounted for roughly 5% of new-vehicle sales in the U.S., the trend in our industry is crystal clear: New sales are down while used sales are significantly up.

This shift in vehicle demand, away from new and toward used, can been seen more clearly in the Q3 financial results of the largest players in the auto industry: franchised dealer groups. Looking at the Q3 performance of these publicly traded dealer groups, which accounted for roughly 5% of new-vehicle sales in the U.S., the trend in our industry is crystal clear: New sales are down while used sales are significantly up.

Looking at aggregate same-store sales, new-vehicle sales year over year almost broke even with being down .83% while used-vehicle sales were up nearly 11%. In total, the large dealer groups are selling more used units which follows general industry guidelines for dealer operations. How much they can skew to used-vehicle sales is still contingent on used-vehicle supply.