Despite news headlines suggesting the auto market would see more tariff-price increases by now, the new-vehicle market has largely remained stable. After hitting a peak in sales pace in April, the new-vehicle market has continued to slow from there. The market has returned to seasonal norms, including a typical bump in sales over the Memorial Day weekend. New-vehicle inventory has continued to decline as well, albeit at a slower pace compared to April, according to the Cox Automotive analysis of vAuto Live Market View data.

2.47M

Total Inventory

as of June 2, 2025

70

Days’ Supply

$48,883

Average Listing Price

June opened with 2.47 million new vehicles on dealer lots across the U.S., down 0.6% from the 2.49 million units at the start of May and down 12.2% from a year ago. Inventory volume continues to decline, as sales hold steady and automakers and dealers are seemingly in no hurry to restock as they wait out the tariff discussions.

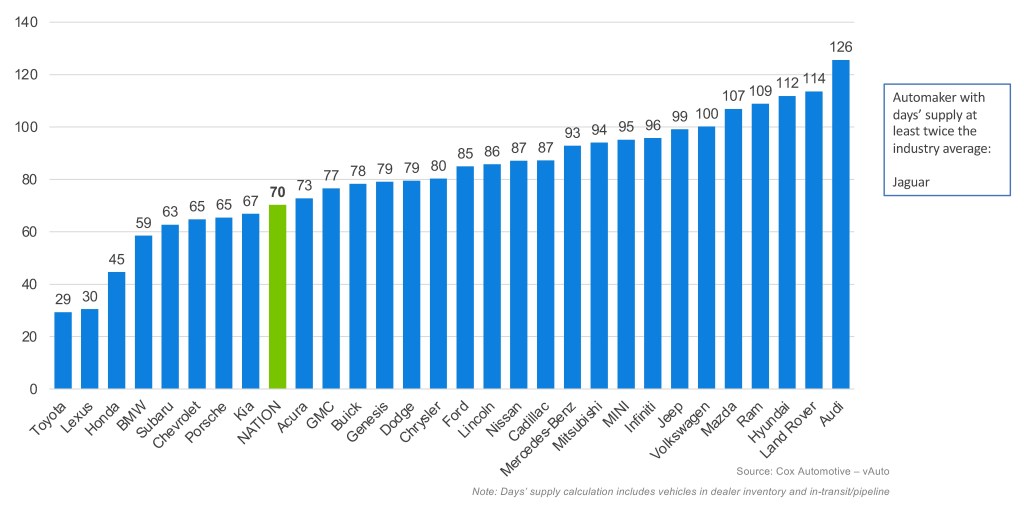

New-vehicle days’ supply in the latest measure was 70, up three days from the upwardly revised 67 at the end of April, but down 9 days compared to last year. The 30-day sales pace began to decline in early May and continued downward, ending the month lower by 5.3%. That decline feels significant due to the frenzy of demand hitting the showroom in March and April, but in reality, the sales pace at the end of May was only down 1.5% from May 2024 and feels normal for this time of year. Cox Automotive’s vAuto Live Market View days’ supply is based on the estimated daily retail sales pace for the most recent 30-day period.

May Days’ Supply of Inventory by Brand

As inventory volume declines, auto dealers are likely enjoying some pricing power and, arguably, the balance of having enough options on the showroom floor for customers while containing floorplan expenses on excess volume, which was lower at the end of May compared to the end of April.

Notably, next-model-year vehicles (MY2026, in this case) begin to show up in the market this time of year: In 2023 and 2024, nearly 7% of the available inventory consisted of next-model-year units. However, end-of-May data shows that the current inventory of next-model-year vehicles makes up only about 3% of available units.

With uncertainty around where tariffs will land, the lack of next-model-year vehicles is likely because automakers are buying time as they carefully consider cost increases, as model year changeover is an opportune time to adjust pricing. Interestingly, BMW and Genesis dealers have a larger portion of 2026 models, with nearly a third of available vehicles being next-model-year units. BMW shows a 2% month-over-month increase in new-vehicle listing price, while Genesis remains flat. Mitsubishi, on the other hand, has 40% of their inventory tied up in prior-model-year vehicles. Mitsubishi listing prices are mostly unchanged from a month earlier.

New-Vehicle Listing Prices Increase in May

The average new-vehicle listing price at the end of May increased by 0.5% to $48,883. This is 3.2% higher than the same period last year. It may seem counterintuitive given the impact of tariffs, but the truth is that most automakers are keeping a steady eye on market share and holding off on portfolio-wide price increases. In the meantime, some are pulling back on incentives and/or increasing delivery fees. There were no real standouts in May for price increases or decreases, reinforcing the message that whoever blinks first will be the guinea pig on how much the market will bear in increased pricing. It is also a reminder that shifts in the auto market are slow-moving.

As reported earlier, according to our Kelley Blue Book team, the average transaction price (ATP) of a new vehicle was $48,799 in May, virtually unchanged month over month and up only 1% year over year. In May, new-vehicle sales incentives also remained relatively unchanged, increasing by just 0.1 percentage points month over month and year over year to 6.8% of ATP.

Looking ahead, consumers may find it challenging to secure significant deals in the automotive market. With inventory levels remaining tight and automakers carefully managing pricing amidst tariff uncertainties and model year transitions, the market is leaning toward stability. While new models will gradually make their way into showrooms, the relative balance of supply (declining) and demand (slowing) means shoppers should temper their expectations for substantial savings, but not fear significant price increases. Patience and close monitoring of incentives might still yield some opportunities, but deep bargains are unlikely in the current environment.