According to the most recent analysis of vAuto Live Market View data, sales volume and days’ supply average have stabilized following two months of reporting volatility. An industry-wide disruption caused by a cyber breach at a widely used dealer management system (DMS) supplier created fluctuations in reporting across Cox Automotive’s data sets.

2.84M

Total Inventory

as of Sept. 5, 2024

77

Days’ Supply

$46,841

Average Listing Price

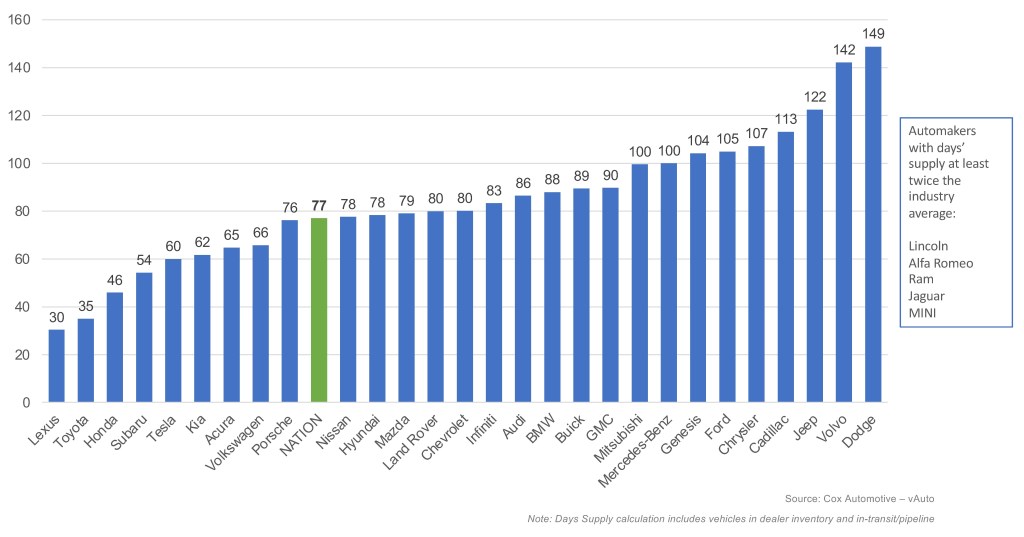

A new-vehicle days’ supply of 77 at the start of September aligns with the trend we last reported in early June, before the disruption. Current measures of days’ supply are below the average recorded in the first half of the year, at 83 days, but well above days’ supply recorded a year ago, which was below 60.

The Cox Automotive days’ supply is based on the daily sales rate for the most recent 30-day period, which ended Sept. 5.

The total U.S. supply of available unsold new vehicles opened September at 2.84 million units, only 6,073 units more than reported at the beginning of June. As new-model-year vehicles often hit dealer showrooms in the late summer months, this increase in inventory comes despite sales increasing 14% over last year. Approximately 25% of showroom inventory is now MY25 vehicles.

While Stellantis brands, in aggregate, lifted incentive spend to 7.8% of the average transaction price (ATP) in August from 5.7% in July, MY23 vehicles are still weighing down dealers in multiple markets. Dodge was most muted on incentives in August among the volume Stellantis brands at only 5.6% of ATP, and it shows in the 22.5% of inventory of prior year models still on the ground. At the end of August, Dodge days’ supply at 149 was nearly twice the national average days’ supply. Most brands were witnessing higher-than-average days’ supply at the start of September.

AUGUST DAYS’ SUPPLY OF INVENTORY BY BRAND

The average listing price for a new vehicle in the latest report was $46,841, down about 1% from a month earlier and down 0.7% compared to last year. However, when looking at the make model breakdown, there are still upwards of a third of the available models with average listing prices below $46,000. Best sellers include the Toyota RAV4, Chevrolet Trax and Honda CR-V, proving compact and subcompact SUVs are hot segments for consumers chasing affordability, form and function.

The average transaction price (ATP) of a new vehicle in the U.S. in August was $47,870, lower by 0.6% from the month prior, according to Kelley Blue Book. The average new-vehicle incentive package, which includes discounts and rebates, was 7.2% of ATP ($3,383) last month, up from 7% in July and higher than one year ago when incentives were 4.8% of ATP.