Updated, Aug. 8, 2024 – In June, a cyber breach at a widely used dealer management system (DMS) supplier heavily impacted the automotive industry. This disruption clearly slowed sales and reporting in the second half of the month, pushing the new-vehicle days’ supply at the start of July to 120 days, according to Cox Automotive’s analysis of vAuto Live Market View data. Days’ supply of 120 is extremely abnormal and one of the highest measures on record, second only to April 2020.

2.89M

Total Inventory

as of July 8, 2024

120

Days’ Supply

$47,294

Average Listing Price

While inventory days’ supply is 110% higher year over year, it is expected to normalize over the next two months as DMS functionality is fully restored and reporting gets back on track for both sales and inventory. The late June disruption makes it difficult to portray what might be happening in the market accurately. Therefore, assessments of winners and losers should be held until July, or even August, when the 30-day sales pace – which drives the Cox Automotive days’ supply measure – begins to return to a more realistic measure.

In the meantime, preliminary data show a familiar story. Toyota, Lexus and Honda remain on the low end of the days’ supply spectrum. Meanwhile, Stellantis brands remain on the high end. Still, Stellantis shows some hope with its two top 30 sellers, the Jeep Wrangler and the Ram 1500. Recent incentives are likely helping to move that metal.

In addition to the DMS disruption, extreme weather and power outages may have impacted sales and inventory, especially in Houston – one of the nation’s largest auto markets – and areas under heat advisories, where buyers may have delayed purchases rather than forgo them.

The total U.S. supply of available unsold new vehicles opened July at 2.89 million units. Inventory volume has increased by more than 1 million units in the past year, up 52% compared to a year ago. However, inventory volume at the start of July was down from a revised 2.93 million at the beginning of June when days’ supply was 81.

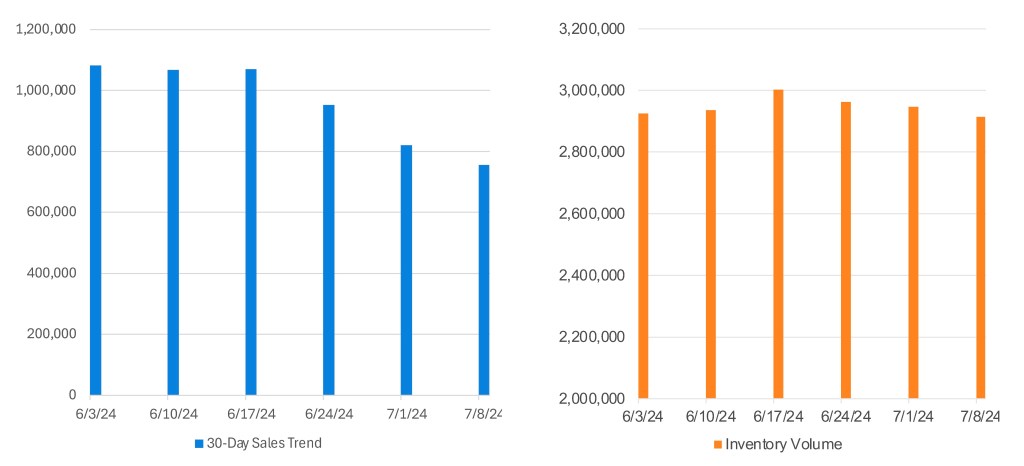

The chart below illustrates the impact of the market disruptions that started in mid-June. Inventory volume maintained a steady level. However, sales noticeably fell off after the mid-month point and continued falling into the start of July. The 30-day new-vehicle sales trend dropped 30% month over month in that timeframe, which can be largely attributed to the outage and indicates why inventory, as measured by days’ supply, is abnormally high at the start of July.

JUNE NEW-VEHICLE 30-DAY SALES TREND AND INVENTORY VOLUME BY WEEK

The average listing price for a new vehicle at the start of July was $47,384, lower by $109 compared to one year ago. Listing prices have seemingly stabilized, and while this is good for consumer expectations and planning, affordability remains an issue, with prices still well above 2019 levels.

The average transaction price (ATP) of a new vehicle in the U.S. in June was $48,644, statistically unchanged from a month prior, according to Kelley Blue Book. The average new-vehicle incentive package, which includes discounts and rebates, fell to 6.4% of ATP ($3,102) last month, down from 6.7% in May but higher than one year ago when incentives were 4.2% of ATP ($2,036). Many top sellers pulled back on incentives in June despite higher inventory levels. However, we expect incentives and discounts to stay and potentially increase, especially with the latest Fed decision, meaning there will be no near-term relief on interest rates.