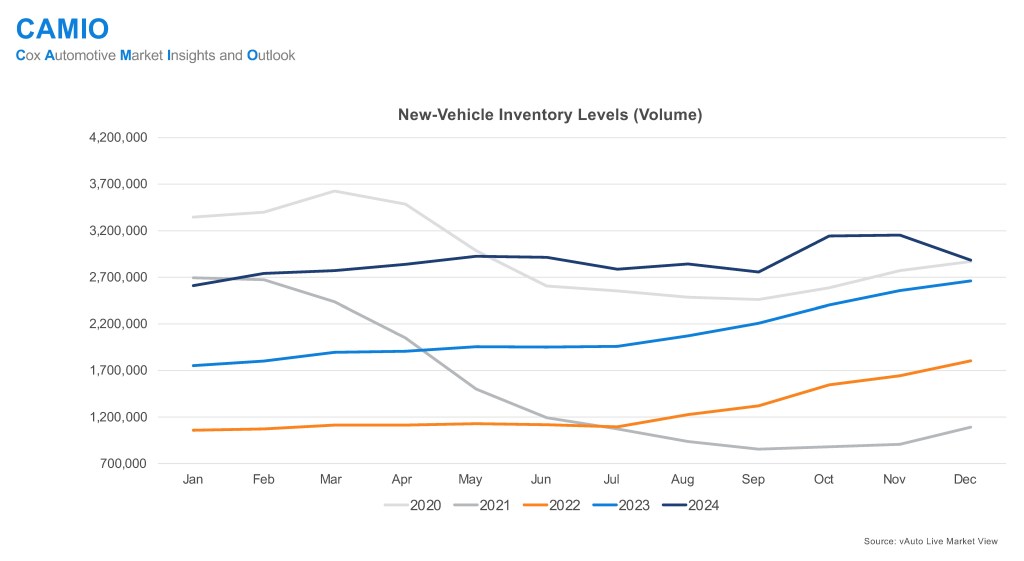

Takeaway: In 2024, new-vehicle inventory levels saw significant fluctuations. Early in the year, inventory stabilized despite disruptions from a cyber breach. By mid-year, the arrival of 2025 model year vehicles increased inventory levels, with older models finally moving off lots. By November, inventory topped 3 million units for the first time since the pandemic, reflecting a 29% year-over-year increase. Days’ supply also rose, reaching 85 days, indicating a balancing act for automakers between maintaining inventory and driving sales. As the year ended, new-vehicle inventory was down to 2.9 million vehicles available, up 200,000 units from where the market ended 2023.

What’s next: In 2025, Cox Automotive forecasts continued growth in new-vehicle sales, with an expected increase of 3% from 2024. Inventory levels are likely to hold steady near the 3 million-unit market. However, automakers are expected to offer higher incentives to keep sales momentum strong. Affordability will remain a challenge, but improving economic conditions and consumer sentiment may help balance the market. Overall, the industry is poised for a positive year, with increased inventory driving increased sales.