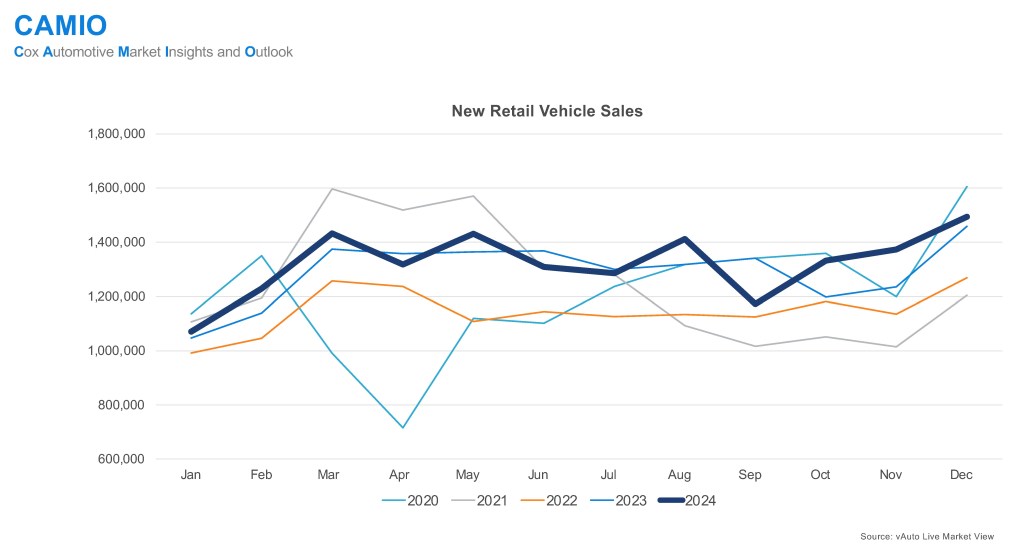

Takeaway: 2024 was a volatile year for the new-vehicle market but ended on a high note. Strong sales can be attributed to a resilient consumer base, improved inventory levels, and higher incentive spending. New-vehicle sales in 2024, according to estimates from Kelley Blue Book, finished at just over 16 million sales, an increase of just over 2.5% from 2023 and the best year for volume since the pandemic. Total new-vehicle sales ended the year strong, with the December SAAR at 16.8 million, higher than the Cox Automotive new-vehicle sales forecast for that month. Retail new-vehicle sales were particularly strong at year-end and finished 2024 at 13.1 million units. Sales into rental fleets also contributed to the gain, although overall fleet sales retreated slightly year over year.

What’s next: The new-vehicle sales outlook for 2025 is positive, with Cox Automotive forecasting sales to reach approximately 16.3 million units, a 2% increase from 2024. This growth is supported by positive economic conditions, lower interest rates, and increased OEM discounting. Sales of electrified vehicles are expected to rise, making up one out of every four vehicles sold. However, potential policy changes regarding tariffs and battery electric vehicle credits by the Trump administration could pose challenges.