Updated, May 2, 2025 – New-vehicle sales in April finished near 1.46 million according to initial estimates, above even Cox Automotive’s positive forecast below. Our Industry Insights team had been expecting solid sales in April, spurred on by concerns of higher prices on the horizon. As expected, though, sales in April were lower than in March, as the early-in-the-month frenzy cooled off some as the weeks passed.

While speaking to the Automotive Press Association earlier this week, Cox Automotive Chief Economist Jonathan Smoke noted, “We’ve seen sales increasing since the major tariff announcements, but the pace of increase has been slowing, especially in the back half of April. Yes, sales are strong. But the slowing pace of increase suggests that we may just be at the peak, and possibly even starting the other side of that peak.”

The seasonally adjusted annual rate of sales (SAAR) in March was a notable 17.8 million units, the hottest sales pace in nearly four years. The sales pace in April is now being initially estimated at 17.3 million, down from March as expected but higher than the Cox Automotive forecast. Records were set by several automakers in April, including Hyundai and Kia, and indications are that the market’s strength last month was driven mostly by retail sales, not fleet sales.

The healthy sales in April means that new-vehicle supply heading into May is now tighter, and much of the inventory arriving to replenish dealerships in the coming months will be vehicles (and will include parts) exposed to new tariffs at the border. As Smoke added, “The first phase of the frenzy in the retail vehicle market seems to have passed, as April is ending with a little less momentum than certainly it began. Meanwhile uncertainty remains acute, especially regarding what will happen next as many of these tariff-motivated buyers, we believe, have likely already acted. Supply has since tightened, and prices have trended higher.”

As May begins, many automakers are aggressively advertising a willingness to hold prices steady in the face of new tariffs on automobiles and parts, hoping to grab market share by encouraging consumers to act now. But with tighter supply and fewer discounts available — worth noting: The “holding prices steady” promise is very different than discounting — it is quite likely that May will look and feel a lot more like a seller’s market, not a buyer’s market.

ATLANTA, April 23, 2025 – Likely motivated by concerns about tariffs and future higher prices, new-vehicle shoppers were out in force early in April and, according to the Cox Automotive forecast released today, helped keep the new-vehicle sales pace relatively strong, although down from March’s surprising market surge.

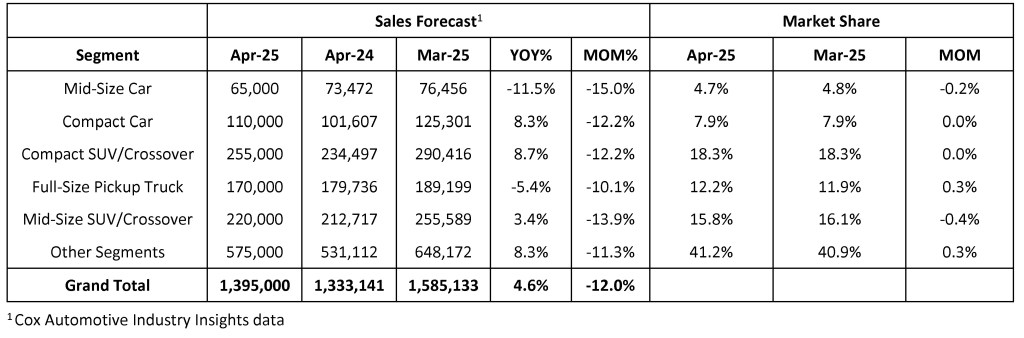

The April seasonally adjusted annual rate (SAAR), or sales pace, is forecasted by Cox Automotive to reach approximately 16.4 million. This result would be higher than April 2024’s 16 million pace and the best April since 2021. However, the sales pace in April is forecast to be far lower than March’s 17.8 million level, as the second half of the month showed signs of cooling after a very fast start. New-vehicle sales volume is expected to be higher by 4.6% year over year but lower by 12% from March’s total. April has 26 selling days, the same as last month and one more than last year.

“Forecasting sales in this volatile market is quite challenging, and that is what we have right now, a market being steered by headlines coming from the White House,” said Charlie Chesbrough, senior economist at Cox Automotive. “Concerns about potential future vehicle prices due to tariffs led to a surge in March sales, and April began with similar robustness. However, inventory levels have declined substantially over recent weeks, likely pushing vehicle prices higher, so the end of April may not be as strong. With economic concerns rising and consumer confidence declining, the outlook for new auto sales from here is more troubling. If current policy holds, prices in the new-vehicle market will be noticeably higher in the coming months as more costly products replace pre-tariff inventory.”

According to Cox Automotive’s vAuto Live Market View, new-vehicle inventory across the U.S. at the start of March was nearly 3 million units, with a measured days’ supply at 89. By the beginning of April, inventory had declined to 2.7 million units, and days’ supply was at 70, thanks partly to the hotter sales pace. And new-vehicle inventory continued to slip through early April, with days’ supply falling to near 60 at a mid-month measure. The official April inventory level will be released in the first part of May.

April 2025 New-Vehicle Sales Forecast

About Cox Automotive

Cox Automotive is the world’s largest automotive services and technology provider. Fueled by the largest breadth of first-party data fed by 2.3 billion online interactions a year, Cox Automotive tailors leading solutions for car shoppers, auto manufacturers, dealers, lenders and fleets. The company has 29,000+ employees on five continents and a portfolio of industry-leading brands that include Autotrader®, Kelley Blue Book®, Manheim®, vAuto®, Dealertrack®, NextGear Capital™, CentralDispatch® and FleetNet America®. Cox Automotive is a subsidiary of Cox Enterprises Inc., a privately owned, Atlanta-based company with $22 billion in annual revenue. Visit coxautoinc.com or connect via @CoxAutomotive on X, CoxAutoInc on Facebook or Cox-Automotive-Inc on LinkedIn.

Media Contacts:

Mark Schirmer

734 883 6346

mark.schirmer@coxautoinc.com

Dara Hailes

470 658 0656

dara.hailes@coxautoinc.com