Press Releases

Cox Automotive Forecast: With New-Vehicle Inventory at a Two-Year High, August Auto Sales Expected to Increase Nearly 19% Year Over Year

Thursday August 24, 2023

Article Highlights

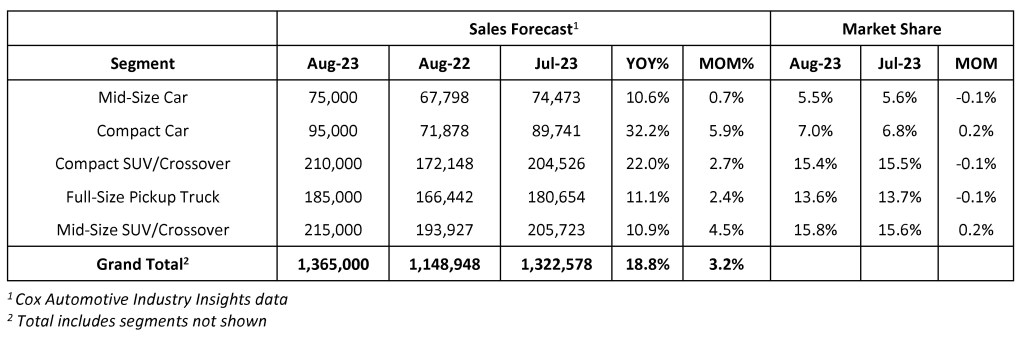

- August’s sales volume is expected to rise 18.8% from one year ago and reach 1.37 million units. This is a 3.2% increase from July, which had two fewer selling days than August’s 27 days.

- The annual new-vehicle sales pace in August is expected to finish near 15.4 million, up 2.2 million from last August’s 13.2 million pace but down slightly from July’s 15.7 million level.

- Economic headwinds from high interest rates and still-high prices are likely to slow the new-vehicle sales recovery in the back half of the year.

ATLANTA, Aug. 24, 2023 – New-vehicle sales, when announced next week by automakers, are expected to once again show big gains over last year but a slight decline in the sales pace from last month. A key reason for the volume gain is new-vehicle inventory hitting its highest level in more than two years. Stronger fleet sales are also expected to support higher sales volumes.

The August seasonally adjusted annual rate, or SAAR, is expected to finish near 15.4 million. This is a mild decrease in sales pace from July’s 15.7 million level. Although the pace is expected to dip slightly from last month, much of this decline can be attributed to statistical adjustments as this month has one more selling day than August 2022 and two more than last month.

Compared to August 2022, August’s sales volume is expected to show nearly a 19% gain over last year’s supply-limited market. In addition, new-vehicle sales are expected to rise more than 3% from last month. Pent-up demand from consumers and businesses – especially in the form of rental fleet sales – continues to be fulfilled as new-vehicle supply and pricing improves.

According to Charlie Chesbrough, senior economist at Cox Automotive: “The supply recovery continues to improve across the country, and this is leading to the market’s sales gains this year. In addition, the return of supply is also bringing back more discounting from manufacturers. But rising interest rates, and their impact on affordability, remain strong headwinds against a more robust vehicle market.”

August 2023 U.S New-Vehicle Sales Forecast

The new-vehicle market has seen improving or stable affordability and sales strength so far this year. However, economic headwinds from high interest rates and still-high prices will likely create some slowdown in the second half of the year. In addition, while some pent-up demand has been fulfilled, higher incentives and more fleet sales should continue to provide support.

About Cox Automotive

Cox Automotive is the world’s largest automotive services and technology provider. Fueled by the largest breadth of first-party data fed by 2.3 billion online interactions a year, Cox Automotive tailors leading solutions for car shoppers, automakers, dealers, retailers, lenders and fleet owners. The company has 25,000+ employees on five continents and a family of trusted brands that includes Autotrader®, Dealertrack®, Kelley Blue Book®, Manheim®, NextGear Capital™ and vAuto®. Cox Automotive is a subsidiary of Cox Enterprises Inc., a privately-owned, Atlanta-based company with $22 billion in annual revenue. Visit coxautoinc.com or connect via @CoxAutomotive on Twitter, CoxAutoInc on Facebook or Cox-Automotive-Inc on LinkedIn.

Media Contacts:

Mark Schirmer

734 883 6346

mark.schirmer@coxautoinc.com

Dara Hailes

470 658 0656

dara.hailes@coxautoinc.com