Filter By:

Cox Automotive Unveils Cox Fleet, Setting a New Standard for Fleet Uptime Nationwide

ATLANTA, Jan. 7, 2026 – Cox Automotive today announced the launch of Cox Fleet, its new fleet brand, marking a significant milestone in the company’s long-term commitment to the trucking and fleet industry. More than a name change, Cox Fleet is designed to set a higher standard for uptime—aiming to keep vehicles moving, businesses running, …

Cox Automotive Forecasts New-Vehicle Sales at 15.8 Million, Down From 2025 as Market Fragmentation Slows Growth

ATLANTA, Jan. 6, 2026 – Cox Automotive, the world’s largest automotive services and technology provider, today released its 2026 automotive industry outlook, projecting new-vehicle sales in the U.S. to hit 15.8 million units in 2026, down 2.4% from 2025 levels. Most forecasted metrics for the automotive market, according to Cox Automotive, are expected to be …

Manheim Insights

Providing Data-Backed Insights on the Wholesale and Used-Vehicle Markets Manheim delivers the world’s largest wholesale marketplace through a network of physical, digital and mobile auction locations. Every year, Manheim handles more than 7 million vehicles, and more than 99% of used-vehicle listings are valued using the Manheim Market Report. For information on Manheim and its …

Auto Market Weekly Summary

Now that we’re officially into the new year, here’s a market update from the holiday-shortened week. The final week of 2025 brought limited economic data releases, but the updates we received were largely positive. We’ll cover December’s housing and labor market indicators, the growing disconnect between consumer sentiment and spending behavior, and how declining interest …

Auto Market Weekly Summary

Last week brought critical updates on the Fed’s dual mandate with November’s jobs report and CPI data. Both reports point toward a labor market under pressure while inflation looks to be cooling, although many economists are taking the report with a grain of salt. Additionally, the Economic and Industry Insights team hosted a webinar exploring key …

The AI Revolution Is Now: Agentic AI for End‑to‑End Automotive Workflow Automation

Artificial intelligence (AI) is no longer a future concept, it’s reshaping the automotive industry right now. In a recent webinar with Automotive News, Ben Flusberg, Chief Data Officer at Cox Automotive, explored how AI is transforming every corner of the ecosystem, from retail and wholesale to fleet and finance. The discussion covered the rapid evolution of AI …

Replay Available: Cox Automotive Q4 2025 Industry Insights and 2026 Forecast Call

A replay of the Cox Automotive Q4 2025 Industry Insights and 2026 Forecast Call held on Wednesday, Dec. 17, is available. The Cox Automotive Economic and Industry Insights team delivered a final update on the U.S. automotive market, focusing on the new, used and electric vehicle markets for 2025. This call also provided the team with an …

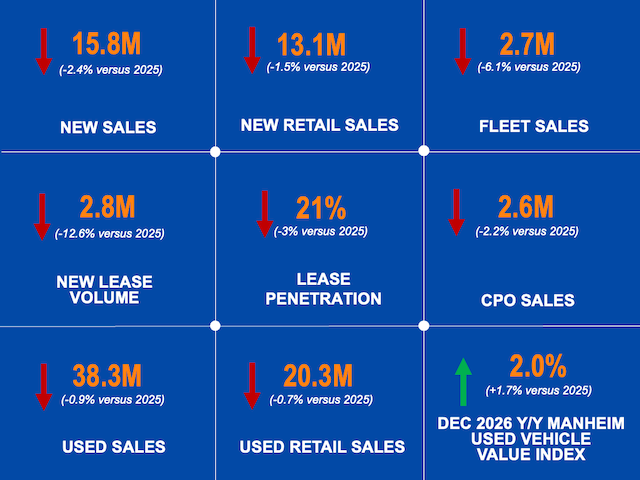

2026 Cox Automotive Forecasts

Cox Automotive provides forecasts on the new and used vehicle markets, leasing, fleet and CPO sales, and the Manheim Used Vehicle Value Index. Updates to the full-year 2026 forecasts were announced during the Industry Insights and 2026 Forecast Call on Dec. 17. The Economic and Industry Insights team reviews the full-year forecasts quarterly and updates …

Cox Automotive Forecast: Despite Q4 Slowdown, New-Vehicle Sales Forecast to Reach 16.3 Million in 2025, up Nearly 2% from 2024; Best Result Since 2019

Updated, Jan. 7, 2026 – New-vehicle sales finished December as forecast, down from year-ago levels but higher than November. Initial estimates suggest the Cox Automotive volume forecast of 1.46 million (see below) was spot on, pushing total 2025 sales to 16.3 million units, according to our Kelley Blue Book counts. The December SAAR, or seasonally …

Fragmented Reality: 5 Forces to Shape the Auto Industry in 2026

The U.S. auto industry is a trillion-dollar industry – an economic engine that is not a single business, but a collection of businesses touching nearly every household and community in the U.S. It’s also an industry deeply influenced by a massive web of economic, policy, social, and technological factors. Calendar year 2025 was a perfect …