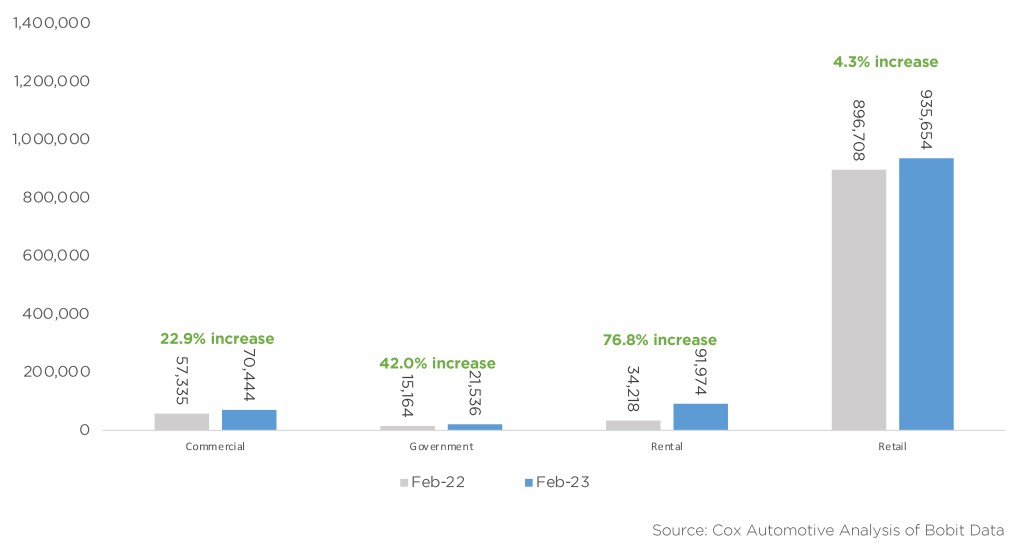

Sales into large fleets, not including sales into dealer and manufacturer fleets, increased 48% year over year in February to 183,954 units, according to an early estimate from Cox Automotive.

New-vehicle inventory is vastly better than year-ago levels, enabling automakers to be more aggressive with fleet sales. Combined sales into large rental, commercial, and government fleets have seen eight consecutive months of double-digit, year-over-year increases. Sales into rental fleets were up 77% year over year, sales into government fleets were up 42%, and sales into commercial fleets were up 23%.

February 2023 Fleet Sales

Fleet Share of Retail Sales Increases Again in February

As expected, strong fleet sales helped overall February U.S. auto sales pace, or seasonally adjusted annual rate (SAAR), likely reach 14.9 million units, above the Cox Automotive forecast of 14.4 million. Including an estimate for fleet deliveries into dealer and manufacturer channels, the remaining retail sales were estimated to be up 4.3%, leading to an estimated retail SAAR of 12.3 million, up 0.5 million from last year’s pace, but down 0.9 million from last month’s pace.

- Fleet market share of 17.7% was a 3.5% gain compared to last year’s share of 14.2% and was a 1.2% increase from last month’s estimated 16.5% market share.

- All large manufacturers had year-over-year fleet sales gains. Stellantis and Ford had the largest fleet volume gains – up more than 50% – in February compared to last year. Kia and Hyundai reported solid February retail sales results with only minor increases in fleet sales.

Charlie Chesbrough, senior economist at Cox Automotive, notes: “Fleet was a big part of the auto sales story in February. As inventory levels increase, some automakers are choosing to sell more units into the fleet channel to keep retail supply limited.”

Year-to-date fleet sales are up 52.3% compared to the same time in 2022 when fleet sales were down 30% year over year. The Cox Automotive fleet sales forecast for 2023 is 2.2 million units.